General maintenance and improvements.

For Ireland, we've added new two-digit Nature of Transaction Codes (NOTC) for Intrastat entries. The Irish Revenue extended the codes in April 2023.

Web screens can be customised by using a JSON schema file, without having to write complex JavaScript.

General maintenance and improvements.

Update 22/08/2022 - 2022 R2

New features in the Sage 200 desktop

Sales orders

New features in the Web Portal

Sales orders

-

Confirm despatch of sales order goods and services.

-

Add tracking and shipping information to a despatch, such as courier details, the Incoterm, and a reason for export.

Other changes

Intrastat

You must now specify the Country of origin for Intrastat entries, otherwise they will be listed as invalid.

Businesses in the Northern Ireland and the Republic of Ireland with exports above the dispatch threshold must include certain details to their Intrastat dispatch reports from 1 January 2022. For more information, see these articles:

Watch a video: Video: New features in Sage 200 2022 R2. (opens in a new tab)

Update 07/03/2022

General maintenance

We've resolved an issue that caused a loss of functionality when using the Data to Excel option from a report preview.

For more information, see this article: Sage 200: Essential Software Maintenance and updates (opens in a new tab)

Update 28/02/2022- 2022 R1

New features in the Sage 200 desktop

Sales orders and quotations

-

Add cross-selling items to quotations.

-

Add suggested items to quotations.

-

Add alternative items to quotations.

-

Add an expiry date to quotations, so you know how long it's valid for.

-

Set a quotation status of Lost, if a customer doesn't want to proceed with a quotation.

Changes to VAT submissions

Making Tax Digital will become mandatory for all VAT registered businesses from April 2022.

XML VAT submissions will no longer be accepted. To support this change, we've deactivated the XML VAT submission feature in the 2022 R1 update. If you previously used the XML VAT submission feature, you can either move over to MTD for VAT, or opt to use the HMRC portal to submit VAT returns manually.

For details of the HMRC changes in April 2022, see Voluntary VAT: Here's what HMRC's April 2022 mandatory Making Tax Digital requirements mean (opens in a new tab).

Changes to system requirements

-

Added support for:

-

Microsoft Windows 11.

-

Microsoft Office 2021.

-

Removed support for:

See System requirements for Sage 200 Standard.

New features in the Web Portal

We're pleased to announce these features have been added to the Web Portal.

Sales orders and quotations

-

Add memos to sales orders and quotations.

-

Enter a payment with a sales order.

-

Add an expiry date to quotations, so you know how long it's valid for.

-

Set a quotation status of Lost, if a customer doesn't want to proceed with a quotation.

General

-

Changes that you make to lists, such as adding columns, will be remembered for the next time you use the list.

-

Documents that you've printed can be viewed from the Spooler in PDF format.

Watch a video: Video: New features in Sage 200 2022 R1. (opens in a new tab)

Update 08/11/2021- 2021 R3

New features in the Web Portal

We're pleased to announce these features have been added to the Web Portal.

Sales orders

-

Create, amend and view sales orders.

-

Create, amend and view quotations.

-

Sales Order List.

Watch a video: Video: New features in the Web Portal for Sage 200 Standard 2021 R3. (opens in a new tab)

New features in the desktop

Sales orders

-

Discount information is now saved with items that you add to a new sales order, quotation and pro forma. When you edit or view an item on an order, select Discounts to view the original source of the discount.

Update 27/07/2021 - 2021 R2

New features in the desktop

Excel Reporting

-

We're providing all of our Excel reports for free. These reports were previously only available with .

For the list of reports, See Excel Reporting - list of reports.

After the update, you won't see these reports until you first Restore Default Excel Reports. See Can't see these reports?

New features in the Web Portal

We're pleased to announce these features have been added to the Web Portal.

Stock Control

Nominal

Cash Book

-

Bank Account List.

-

Inter Account Transfer.

Watch a video: Video: New features in the Web Portal for Sage 200 Standard 2021 R2. (opens in a new tab)

Update 18/03/2021 - 2021 R1

New features in the desktop

Stock control

New features in the Web Portal

We're pleased to announce these features have been added to the Web Portal.

Stock Control

Nominal

Customers

Suppliers

Watch a video: Video: New features in Stock Control for Sage 200 Standard 2021 R1. (opens in a new tab)

Watch a video: Video: Nominal Ledger and additional features in Sage 200 Standard 2021 R1. (opens in a new tab)

Update 11/01/2021

Brexit transition - Republic of Ireland

We've made some changes for Irish businesses to use after the Brexit transition.

-

New VAT term for postponed VAT accounting, and two new default VAT rates.

-

The VAT return and file for online submissions have been updated to include box PA1 for postponed accounting.

See Brexit transition (UK and Ireland).

Other improvements

We've fixed the following issues:

Update 14/12/2020 - 2020 R4

Brexit transition

We've made some changes for businesses to use after the Brexit transition from 1 January 2021.

-

New VAT term for postponed VAT accounting, and two new default VAT rates.

-

New country codes for Northern Ireland (XI) and Great Britain (XU) for use by Republic of Ireland only.

See Brexit transition (UK and Ireland).

New features in the Web Portal

We're pleased to announce these features have been added to the Web Portal.

Cash book

Nominal

Stock control

Watch a video: Video: New features in the Web Portal for Sage 200 Standard 2020 R4. (opens in a new tab)

Sage Pay is now Opayo

Opayo is the new name for Sage Pay. If you use online card payments, we've changed some of the feature names as follows:

-

Sage Pay Settings is now Online Card Settings.

-

Import Sage Pay Transactions is now Import Online Card Transactions.

-

Default report layout names have changed from "Sage Pay" to "Payment Service Provider", for example SOP Invoice Sage Pay (E-Mail) is now SOP Invoice Payment Service Provider (E-Mail).

Update 02/11/2020 - 2020 R3

New features in the Web Portal

We're pleased to announce these features have been added to the Web Portal.

Customers

Suppliers

Stock control

Watch a video: Video: New features in the Web Portal for Sage 200 Standard 2020 R3. (opens in a new tab)

Improvements that you've suggested

Following feedback we received from you, we are pleased to announce these improvements:

-

Customer Transaction Enquiry and Supplier Transaction Enquiry - The transaction list now includes the Outstanding amount for transactions.

-

Manage Stocktake - Approve & Complete stocktake now shows the variance value for stock items.

Update 15/09/2020 - 2020 R2

Try our new Web Portal

You can now use some Sage 200 features using a web browser. It's great for when you're on the move, or away from your desktop PC. The Web Portal is designed for use on computers and tablets, and you can use it straight away without installing an app.

Watch a video: Video: Accessing new features in the Web Portal (opens in a new tab)

What can I do in the Web Portal?

We've included the following features in the Web Portal. This is just the first release, and there will be more features to come!

Customers

-

Create, amend and view customer accounts.

-

Change account status (hide or put on hold).

-

Enter customer payments (refunds) and receipts.

-

Customer transaction enquiry.

-

Customer List.

Suppliers

-

Create, amend and view supplier accounts.

-

Change account status (hide or put on hold).

-

Enter supplier payments and receipts (refunds).

-

Supplier transaction enquiry.

-

Authorise purchase invoices and credit notes.

-

Supplier List.

Sales orders

Stock control

Watch a video: Video: Stock control new features (opens in a new tab)

Update 17/03/2020

General maintenance

General maintenance and improvements.

Update 02/03/2020 - 2020 R1

-

We've updated the custom connector that's used for creating flows with Power Automate. To download the new custom connector, see Set up Microsoft Power Automate with Sage 200.

-

For VAT submissions to HMRC using MTD, the submissions now include additional information to help troubleshoot problems and prevent fraudulent submissions.

-

For VAT submissions using the HMRC gateway (not MTD), you can now use a longer account password, as it was previously restricted to 12 characters.

-

Improvements to support updated version of Sage Bank Feeds.

Update 16/12/2019

General maintenance

Some issues were reported following the update on 12 December 2019.

-

An issue with BOM / Record built item was resolved on 13 December 2019, and did not require an update.

-

An issue with Importing customer and supplier transactions has been fixed in this update.

Please accept our apologies for the inconvenience caused.

Update 12/12/2019

General maintenance

General maintenance and improvements.

Update 23/11/2019

General maintenance

General maintenance and improvements.

Update 09/10/2019

General maintenance

General maintenance and improvements.

Update 11/09/2019

General maintenance

General maintenance and improvements.

Update 21/08/2019 - Summer 2019

Power Automate flows - Email notifications for purchase requisitions and supplier bank details

You can now send email notifications by using these new flows that we've provided. Microsoft Power Automate is a cloud-based service that makes it practical and simple for people to build workflows that automate business tasks and processes across applications and services.

Note - information

To use this feature, you'll need to use Microsoft Power Automate with a Microsoft 365 subscription.

-

The purchase requisitions flow automatically sends emails to people to notify them during the authorisation process.

-

Authorisers will receive email notifications when they have new purchase requisitions that require authorisation.

-

The person who submitted the purchase requisition will receive an email notification when it is authorised or rejected.

-

The supplier bank details flow automatically sends emails to people to notify them of any changes to the bank details for supplier accounts.

To set up these flows for email notifications, see Set up Microsoft Power Automate with Sage 200.

Bank reconciliation improvements

Following feedback we received from you, we are pleased to announce these improvements for bank reconciliation:

-

If you don't want to reconcile the full amount of the transaction, you can part reconcile the transaction by entering the Amount to Reconcile for the transaction, before you match it.

The remaining amount of the transaction can be reconciled the next time you do your bank reconciliation.

The transaction will be marked with a status of Part, to indicate it has been part reconciled.

-

You can now see the URN of a transaction when you reconcile or unreconcile.

See Reconcile manually using a bank statement.

See Reconcile using bank feeds.

Scan and attach documents for sales invoices and credit notes, and goods received

Now you can attach files and scanned documents when you view sales invoices and credit notes, confirm receipt of goods received (GRNs), and view the delivery history of a purchase order or return.

-

When you use the Customer Transaction Enquiry, select a sales invoice or credit note, then select Attached Documents.

-

When you use the Nominal Transaction Enquiry, view the transaction detail for a sales invoice or credit note, then select Attached Documents.

-

When you Confirm Receipt (confirm goods received), select the Attach Documents check box before you select Save.

-

When you view the Delivery history for purchase orders and returns, select Despatches or Deliveries , then select Attached Documents.

See Scan and attach documents.

Other improvements

-

You can now set your EORI number in company details. This is required by UK companies trading in the EU, and Irish companies trading outside the EU.

Open: Settings > Organisational and Financial > Company Details.

-

You can now set the Country of Origin for a stock item when using a UK company. This feature was previously only available for Irish companies.

Open: Stock Control > Stock Records > Amend Stock Item Details and select the Analysis tab.

-

If you can't open a feature because other people are using a related feature, such as changing settings, you can now see a list of who is preventing access. See Unable to access feature error message.

-

Based on your feedback, you can now show the default contact's email address on the Customer List and Supplier List.

To add the column, right-click inside the list, then select Columns > Contact Email.

-

We've changed the calculations for the totals on invoices and orders when notional VAT rates are used. See Notional VAT effects on order and invoice totals.

Update 07/05/2019

General maintenance

General maintenance and improvements.

Update 16/04/2019 - Spring 2019

Export and update nominal accounts, customers, suppliers, and stock items

You can now export and update information for nominal accounts, customer and supplier accounts, and stock items.

This makes updating the information easier if you need to make a lot of changes.

The information is exported to a file in the same format used for an import. This means you can export information and make changes to it using an external tool (such as Excel), and then import your updated information back into Sage 200.

Power BI

Microsoft Power BI (Business Intelligence) is a collection of software services, apps, and connectors that work together to turn your data into immersive and interactive insights. Power BI lets you easily connect to your data sources, discover what's important, and share that with anyone you want.

You can connect Power BI to Sage 200 to analyse your company data. Sage 200 includes some example reports to get you started, but you can also build your own reports to share with other people inside your organisation.

See Power BI.

Control access to supplier bank details

You can control who can view and amend supplier bank details by setting access to the feature Bank Details. This feature allows you to show or hide the Bank tab for all supplier accounts.

See Control access to supplier bank details.

Open or close all modules in an accounting period

You can now open or close an accounting period for all modules at once, rather than having to open them individually.

Open: Settings > Organisation and Financial > Accounting Periods.

See View and manage accounting periods.

Save remittances to cloud document storage

You can now save supplier remittances to cloud document storage, so that you can view or print them at a later date.

See Save printed documents to cloud document storage.

Update 25/02/2019

General maintenance

General maintenance and improvements.

Update 04/02/2019 - Winter 2018

Purchase requisition enhancements

Following feedback we received from you, we are pleased to announce these improvements for purchase requisitions:

-

You can choose whether supplier and nominal accounts are required for purchase requisitions.

-

The combined budget can be set for each individual line in the requisition, rather than apply to all lines in the requisition.

-

You can restrict the nominal code in a requisition to be linked to the combined budget.

-

You can now amend rejected requisitions, so you can make changes and submit them again.

-

Authorisers can amend purchase requisitions submitted by other people.

-

If you select a warehouse on a free text item in a requisition, the warehouse will be applied to the purchase order line.

-

When you make changes to a purchase order that's linked to a requisition, you can choose what happens to the requisition lines.

-

If you cancel an order or delete lines in an order, you can choose whether the linked requisition lines are cancelled or can be re-ordered.

-

If you reduce the quantity of an item in an order that's linked to multiple requisitions, you can allocate the remaining quantity to the requisition lines.

-

If you write off an order, the requisition lines are cancelled.

-

You can now set access permissions to control separately who can authorise requisitions, and who can authorise and generate orders.

See Purchase requisitions.

See Set user access to purchase requisition features.

Invoice Payments enhancements

-

You can now view customers, invoices and payments in the Invoice Payments Portal.

See Use the Invoice Payments Portal.

-

We've changed the Pay Now button so it's easier to add the button to your custom invoice layouts.

See Add a Pay Now button to custom invoices.

-

You can now customise the payment message displayed on invoice layouts.

See Change the text displayed on invoices.

-

You can record invoices as paid offline, if your customer pays the invoice using an alternative method to Invoice Payments.

See Record an invoice that has been paid offline.

-

If you cancel an invoice, it'll be removed from the Invoice Payments service, so your customer cannot pay the invoice by mistake. If your customer does click the Pay Now button on their invoice, they'll see a message to say that you have cancelled the invoice and no payment is due.

-

You can check which customers have been uploaded in the Customers List, by displaying the Invoice Payments column.

See Upload customers to Invoice Payments (GoCardless).

-

You'll be notified if payments are outside the range permitted by GoCardless of 1-5000 GBP / EUR.

Set delivery locations for free text items in purchase orders

Following feedback we received from you, we are pleased to announce these improvements for purchase orders:

-

When you enter a purchase order or return, you can select a warehouse when you add a free text item.

The warehouse address will be included on printed orders and returns, so this means that your items are delivered to (or collected from) the right location.

-

If you select a warehouse on a free text item in a purchase requisition, the warehouse will be applied to the purchase order line.

-

You can use configurable names to make the names used in Stock Control more meaningful for your organisation.

You can enter your own labels for:

-

Locations. These labels are used when you enter stock item locations. The default labels are Warehouse and Bin.

-

References. These labels are used when you add a reference to a stock movement transaction. The default labels are Reference and Second ref.

See Enter or amend a purchase order.

See Configurable names.

Scan and attach documents to nominal journals and VAT Returns

Now you can attach files and scanned documents when you enter nominal journals and VAT Returns. You can scan images directly using a scanner connected to your PC or your network.

-

When you enter a nominal journal, select Save and Attach.

-

When you produce a VAT Return, you'll be able to add attachments to the return.

The attachments can also be viewed and amended:

-

When you use the nominal transaction enquiry, select Attached Documents.

-

When you view Completed Period Totals for a VAT Return, select Attached Documents.

See Scan and attach documents.

Audit log

Use the audit log to check for any changes that have been made in key areas of Sage 200, such as:

See Audit log.

Other improvements

-

You can now delete the predefined report or SOFA categories.

-

We've changed how features are categorised in User Access.

-

We've changed the name of Sage Payments to Supplier Payments.

-

We've added a welcome page and a new Sage 200 Home desktop home page, so it's easier to find out what's new in Sage 200.

Update 05/10/2018

General maintenance

General maintenance and improvements.

Update 07/09/2018 - Summer 2018

Faster online payments with Stripe, PayPal, and GoCardless

Sage Invoice Payments is a great way for your customers to pay you online, quickly and easily.

Use Sage Invoice Payments to request payments from your customers, using the payment providers Stripe, PayPal, or GoCardless.

You generate invoices with a Pay Now button, then email the invoices to your customers. Your customers then select the Pay Now button to pay the invoice using the payment provider that you've chosen.

After your customer pays the invoice, the transactions can be downloaded and posted in Sage 200.

Invoice Payments integrates seamlessly with Sage 200, making it easier for your customers to pay you, and easier for you to process those payments.

See Take payments using Invoice Payments.

Cross-selling items

You can use cross-selling items to help speed up entering a full sales order or quotation. Cross-selling items are complimentary items which are often sold together with another stock item. For example, if you sell a printer, you might want to show print cartridges or cables for that printer.

Set up cross-selling items if you want to display and add these items when you enter a sales order or quotation.

-

To set up cross-selling items for a stock item, amend the stock item and use the Cross-selling tab.

-

Once you've finished setting up all your cross-selling items for your stock items, enable the option to Allow users to select items for cross-selling.

- When you add a standard stock item to a sales order or quotation, click Save and Cross-sell to add a cross-selling item.

See Cross-selling stock items.

Suggested and preferred items for customers

Suggested items can help you speed up entering a sales order or quotation, as you can quickly add items that the customer has previously bought from you.

When you enter a full sales order or quotation, select Suggested items to see items that are specific to the customer.

Suggested items include:

- The customer's preferred items (you can think of these as 'favourites').

- Items that the customer has recently ordered.

- Items that the customer has frequently ordered, for example you can see items they've ordered at least 3 times in the last 6 months.

See Suggested items for customers.

Customer alerts

You can set up alerts on a customer account, to show messages whenever you deal with that customer. For example, if a customer has specific requirements, you can set up a reminder message that will be displayed whenever you enter an order for that customer.

When you set up an alert on the customer account, you can choose to show the alert for particular activities.

You can choose to show alerts when entering invoices or credit notes, sales orders and returns, quotations and pro forma invoices, and for customer price enquiries.

Alerts are specific to an individual customer, and you can have multiple alerts for each customer.

See Customer alerts.

Purchase invoice authorisation

You can use authorisation for supplier invoices and credit notes that are entered directly to the Purchase Ledger (and not from a purchase order).

You can set up authorisation to be automatically selected if the purchase invoice or credit notes is above a specified value.

For all other invoices or credit notes below this value, you can choose whether they requires authorisation by selecting Requires Authorisation when the transaction is entered.

To set up purchase invoice authorisation, see Set up authorisation for invoices and credit notes.

Scan and attach documents to purchase invoices and credit notes

Now you can attach files and scanned documents when you enter purchase invoices and credit notes. You can scan images directly using a scanner connected to your PC or your network.

The attachments can also be viewed and amended when you authorise transactions, and when you view transactions in the supplier and nominal transaction enquiries.

See Scan and attach documents.

View addresses in Google maps

Now you can view a customer or supplier address using Google Maps.

When you're viewing a customer or supplier account, just click the  Google Maps icon next to the address.

Google Maps icon next to the address.

Spooler list filters

You can now use filters on the print  Spooler list, to only show the reports you're interested in. You can filter the spooler list by report name, the user who produced the document, the company, the date of the report, or the status of the report.

Spooler list, to only show the reports you're interested in. You can filter the spooler list by report name, the user who produced the document, the company, the date of the report, or the status of the report.

See Print reports and documents from the spooler.

Reducing balance depreciation for fixed assets

If you set up depreciation for a fixed asset using the reducing period balance method, it could be difficult to calculate the period depreciation rate to use. Now you can click the % button to calculate the percentage rate to use, when you want to depreciate an asset by a total percentage over a set number of periods.

See Add a fixed asset record with depreciation details.

Improved VAT Transaction (Education) report

The VAT Transaction (Education) report has been improved to help you with your VAT126 return.

The report shows transaction details for your supplier invoices and credit notes, showing the transaction date, supplier's VAT registration, to whom addressed, VAT paid, and the transaction URN.

See Review and finalise your VAT Return and reports.

Improved default nominal accounts

When you create a new company in Sage 200 using the Configuration Assistant, you can choose to use our sample nominal accounts to get you started. We've improved these sample nominal accounts to more closely reflect what our customers use in their schools and academies.

For information on setting up nominal accounts in the Configuration Assistant, see Nominal Accounts (Configuration Assistant).

Improvements that you've suggested

Following feedback we received from you on the  Ideas Hub, we are pleased to announce these improvements:

Ideas Hub, we are pleased to announce these improvements:

Purchase requisitions

When you enter a purchase requisition, you can now search for nominal codes with a particular cost centre (fund) or department. To do this, enter a slash / between the code, cost centre (fund) and department (nominal code / cost centre (fund) / department).

For example:

Import remembers last file location

When you import information, Sage 200 will now remember the last folder that you used for an import.

Sort columns on bank reconciliation

Now when you use bank reconciliation, you can sort the lists of matched and unmatched transactions. Just click on a column heading to sort a list.

Update 20/04/2018 - Spring 2018

Quotations and pro formas

Following feedback we received from you on the  Ideas Hub, we are pleased to announce these improvements to quotes and pro formas.

Ideas Hub, we are pleased to announce these improvements to quotes and pro formas.

You can now:

-

Enter pro forma invoices for prospect customers.

Using a prospect account means you don't have to create new customer accounts that you might never use.

Open: Sales Orders > Proformas > Enter New Pro Forma for Prospect.

-

Convert quotations to pro forma invoices.

This is useful if a customer wants an invoice following receipt of a quotation. The pro forma can then be converted to a sales order, and processed in the usual way.

Open: Sales Orders > Quotations > Convert Quotation to Pro Forma.

-

Check the progress of quotations with new quotation reports.

You can see quotations that have converted to sales orders, and quotations that have been converted to pro formas, but have not yet been completed.

Open: Sales Orders > Reports > Status > Converted Quotations.

Open: Sales Orders > Reports > Status > Quotations with Outstanding Pro Formas.

See Quotations or Pro forma invoices.

Hide nominal accounts, bank accounts, and combined budgets

Do you have nominal accounts, bank accounts, or combined budgets that you're no longer using, or don't want to use just yet?

You can hide the account or budget from lists, so it can't be selected by mistake.

Just edit the account or budget, and set the Active Status to Hidden.

See Hide or show a nominal account.

See Hide or show a bank account.

See Hide or show a combined nominal budget.

This feature was added following feedback we received from you on the  Ideas Hub.

Ideas Hub.

Restrict nominal account selection

You can now restrict how you select nominal accounts, to ensure that you can only select accounts with a valid nominal account code, cost centre, and department.

See Restrict account selection to existing and active accounts.

Find contact information (GDPR)

The EU's General Data Protection Regulation (GDPR) will come into force on 25 May 2018, and this will affect how you should collect and process data that you collect about an individual.

To help you get ready for the GDPR, we've added some new reports that will help you find information in Sage 200.

-

Find contact details for an individual.

Open: Settings > Organisational and Financial > General Data Protection Regulation > GDPR Contact Check.

-

Find old customer or supplier accounts.

Open: Customers > Customer Reports > Account Analysis > Customers With No Transactions From.

Open: Suppliers > Supplier Reports > Account Analysis > Suppliers With No Transactions From.

See Managing your contact information (GDPR).

Create a demonstration company

If you want to try out Sage 200 before you use it with your real company data, you can create a company with demonstration data.

Open: Settings > Organisational and Financial > Company Management.

Note: Creating a company with demonstration data does not count towards the number of company databases in your subscription.

See Create a company with demonstration data.

Automatic list refresh

The following lists will now refresh automatically when you add or edit an item in the list:

-

Sales Order List.

-

Invoicing List.

-

Purchase Order List.

-

Stock List.

-

Price Book List.

This feature was added following feedback we received from you on the  Ideas Hub.

Ideas Hub.

Making Tax Digital

As part of their plans to modernise the tax system, the Government is changing the way VAT registered businesses create and submit VAT Returns.

From April 2018, HMRC are running a pilot scheme, giving businesses the opportunity to submit VAT Returns via the new system and help shape the new digital process.

Note: Available to UK customers only.

Update 23/02/2018

General maintenance

General maintenance and improvements.

Update 27/01/2018

Budget v Actuals standard reports

Use these reports to see how much you've spent from your budgets and how much remains, so you can check if you're under or over budget.

Open: Nominal > Nominal Reports > Budget Comparisons.

-

Budget v Actuals By Cost Centre, to group by cost centre (fund).

-

Budget v Actuals By Cost Department, to group by department.

-

Budget v Actuals By Nominal Type, to group by nominal account type (expense, income, asset, liability).

See How to report on your budgets.

Bug fixes

General improvements and bug fixes.

Update 06/01/2018 - Winter 2017

Bank feeds rules

Bank feeds rules help make data entry and bank reconciliation even easier.

You can use bank feeds rules to automatically create transactions in Sage 200 for your bank transactions that you download from Sage bank feeds. This saves you time entering transactions, and helps you reconcile your bank accounts more efficiently and reduce errors.

Bank feeds rules can be set up to create customer receipts and payments, supplier payments and receipts, and nominal transactions.

See Bank feeds rules.

Watch Bank Feeds Rules (video).

Sage Contact app in Microsoft 365

The Sage Contact app for Sage 200 has now been withdrawn.

Save documents to cloud document storage

Save printed documents to cloud document storage in PDF format, so that they can be viewed with everyone in your companyschool.

You can save customer invoices, credit notes, statements and debtor letters, despatch notes, and purchase orders.

Documents are saved to your server, and can then be synchronised to the cloud using OneDrive for Business or Dropbox.

See Save printed documents to cloud document storage.

Watch Save printed documents to cloud document storage (video).

Multiple contacts for customer and supplier accounts

You can now add details for more than one contact to customer and supplier accounts. To do this, use the new Contacts tab on the account.

See Customer contacts or Supplier contacts.

Update 18/11/2017

Bug fixes

General improvements and bug fixes.

Update 03/11/2017

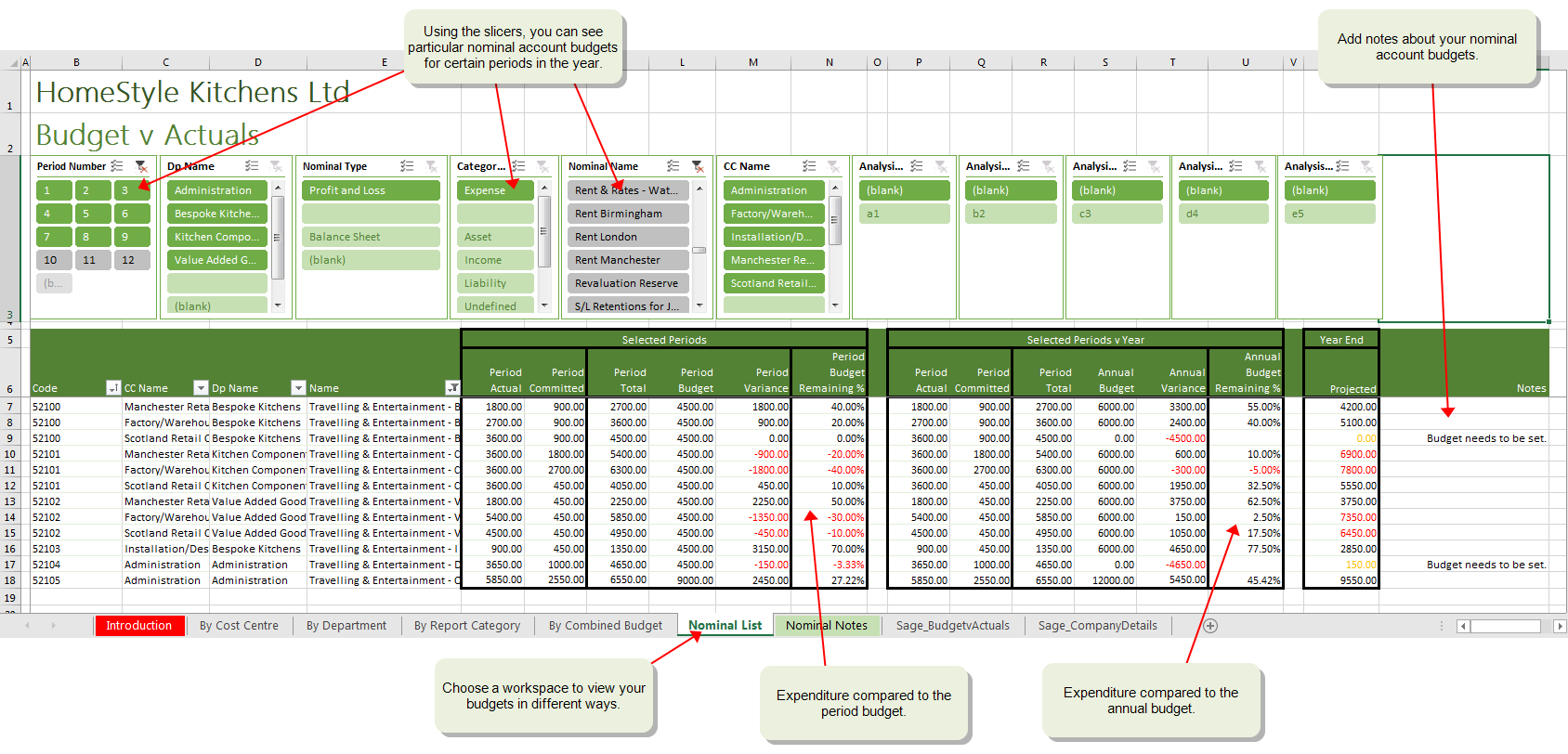

Budget vs Actuals Excel report

If you couldn't find the Budget vs Actuals Excel report in the last release, then follow the steps below to restore the report:

Open: Excel Reporting > Restore Default Excel Reports.

-

Tick the box next to the Budget vs Actuals report, and click Restore.

-

The report will now be displayed in the Excel Reports list.

Note: This report is only available if you subscribe to .

For help on using the report, see How to report on your budgets.

Update 28/10/2017

Budget vs Actuals Excel report

Use this report to see how much you've spent from your budgets and how much remains, so you can check if you're under or over budget.

You can compare your nominal account budget figures against your actual and committed expenditure, and view figures for selected periods or an annual budget. Use the slicers to view details by cost centre, department, report category, individual nominal accounts or a combined nominal budget.

Note: This report is only available if you subscribe to .

Open: Excel Reporting > Excel Reports.

See How to report on your budgets.

Period Budgets report

Use this report to check the budget figures per period that you have set for your nominal accounts. For example, you might want to compare past, current and future budget figures for a selection of nominal accounts.

Open: Nominal > Reports > Budget Comparisons > Period Budgets.

Update 23/09/2017

New budget features

Check budgets

If you use purchase authorisation, you can check that purchase orders you are about to authorise will not exceed the budgets set on your nominal accounts.

If you enable Check budgets when authorising purchase orders, Sage 200 will check your nominal account budgets each time you authorise a purchase order. A warning is displayed when you try to authorise the order if the value of any item on the purchase order will exceed the nominal budget linked to that item, or any item on the purchase order contains a blank or invalid nominal account code.

See Setting up purchase orders.

Original budget values

When you enter your nominal account budgets, or import budgets, you can now set an Original Budget figure. This is useful if you want to keep a record of the initial budget amount so that you can compare it against any changes to the budget.

See How to set up and enter budgets.

Update 19/08/2017

Improvements and bug fixes

Update 29/07/2017 - Summer 2017

Sage Bank Feeds

Sage bank feeds is a free secure service that you can use to download your bank transactions to Sage 200, to help you reconcile your bank account.

This reduces the time that you spend reconciling your bank transactions, and ensures your accounts are up to date and accurate.

Once you download your bank transactions, you can match them to the existing transactions in Sage 200, or create new transactions if something is missing. This means that transactions in your live bank account are reflected in Sage 200. Sage 200 will remember which transactions you have matched, ready for your next bank reconciliation.

See Sage bank feeds.

Access reports from the Self Service web app

Web users can now also view and run reports from the Self Service web app.

Simply open the Self Service web app and select the Reports tab.

See Access reports from the Self Service web app.

Excel reports

We now include more Excel reports for free as part of Sage 200 Services, and additional reports are available with .

See Excel Reporting - list of reports.

Send report data to Excel from Report Designer

You can now send any Sage 200 report data to Excel. This allows you to analyse data from your reports in a table format in Excel. You can then work with the data in Excel, such as filtering the information, or using pivot tables.

This is different to the existing functionality to Export data to Excel.

Just click Data to Excel from the report preview.

Note: You can't do this when the report is sent to the spooler first.

For more information, see Send report data to Excel with Report Designer.

Update 13/05/2017

Rapid invoice entry

Want a new, faster way to enter your supplier invoices?

You can now enter these on a single screen using a grid entry form. We've also added function keys so invoice entry can be totally driven from the keyboard for even faster data entry.

See Rapid supplier purchase invoice entry.

Watch Rapid supplier purchase invoices (video).

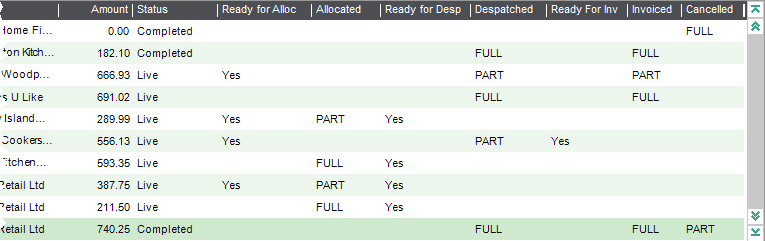

Sales order progress

You can now track the progress of orders in the Sales Order List to see when an order is:

-

Ready for allocation, and allocated.

-

Ready for despatch, and part or fully despatched.

-

Ready for invoice printing, and part or fully invoiced.

-

Part or fully cancelled.

How do I show these columns in the Sales Order List?

To show a column in the list, right-click anywhere in the list and select Columns, then choose the column to display.

-

Ready for allocation: Columns > Delivery > Ready for Alloc.

-

Allocated: Columns > Allocated.

-

Ready for despatch: Columns > Delivery > Ready for Desp.

-

Despatched: Columns > Despatched.

-

Ready for invoice (printing): Columns > Delivery > Ready for Inv.

-

Invoiced: Columns > Invoiced.

-

Status: Columns > Document Status.

-

Cancelled: Columns > Cancelled.

Watch Check sales order progress (video).

See Check the progress of sales orders.

Update 01/04/2017

Improved error corrections

You can now make corrections to customer and supplier transactions from a single screen. Correcting and reversing transactions has been combined into a single option on the menu.

You can now:

-

Change all the information on a transaction including the date, nominal account and amount.

-

Correct foreign currency invoices and credit notes.

Watch Correcting customer and supplier transactions (video).

See Correct posted customer transactions and Correct posted supplier transactions.

Enhancement to purchase requisitions

You can now generate purchase orders from authorised requisitions via the Self Service web app. Previously this was only available in the desktop app. This means that users who create purchase orders from requisitions don't have to be full Sage 200 users or logged into the desktop app.

Watch Authorise purchase requisitions and generate orders (video).

See My Authorised Purchase Requisitions workspace.

Update 25/02/2017

Improved budget reporting

Budget reporting has been enhanced and improved:

-

Business managers can now track the budget for the whole organisation, using the new Budget Overview Excel report.

-

Budget holders can see their budgets in real time using the My Budget Overview workspace. This can be accessed via a browser so budget holders don't have to be full Sage 200 users.

-

Managers and finance officers can report on and distribute budgets by cost centre and department using the new Budget Statement Breakdown reports.

See How to report on your budgets.

Direct debits and standing orders due report

Use this new report to find the outstanding value of SO and DD (Cash Book > Reports). Useful for working out your committed costs.

Do you use the help?

When you use the help, there are feedback buttons at the bottom of the page so you can tell us how we're doing.

Update 20/01/2017

New feature - Purchase requisitions

The new purchase requisitions feature provides an easy way to enter requisitions, authorise them, and generate orders.

You can enter and authorise requisitions when you're on the move using the Self Service web app. This means that you only need a web user licence, and don't need access to the full desktop app.

Authorisation rules let you control who can authorise the requisitions, for example a budget owner can authorise any requisitions made against their budget. Budget owners can be set against a combined nominal budget. See Enter or amend a combined nominal budget.

You generate purchase orders from authorised requisitions in the Sage 200 desktop app, and choose how they are fulfilled. Orders are generated efficiently, so multiple requisitions for an item from the same supplier can combined into a single order.

See Purchase requisitions.

Watch a video:

Hide customer and supplier accounts

Got a list of supplier or customer accounts that you're no longer trading with? Have to add 'Do Not Use' as the customer or supplier name?

Following feedback received from you, via the ideas hub  , you can now hide these accounts so they're not displayed on the Customer or Supplier list and not shown on lookup lists.

, you can now hide these accounts so they're not displayed on the Customer or Supplier list and not shown on lookup lists.

This helps to prevent transactions being entered for these accounts in error and makes your lookups smaller and more efficient.

Just choose the new Hidden status from the Amend status form.

See Change customer account status (hide or put on hold) and Change supplier account status (hide or put on hold).

Watch Hide customer or supplier accounts (video).

Portrait versions of the Aged Debtor and Aged Creditor reports

Want to see your debtors or creditors reports printed portrait rather than landscape?

Following feedback from you, the portrait versions of these reports are now available 'out the box' rather than as an extra downloaded report.

You can access the reports from the Customers or Suppliers sections of the menu:

Open: Customers > Customer Reports > Credit Control > Aged Debtors Report (Detailed) Portrait or Aged Debtors Report (Summary) Portrait.

Open: Suppliers > Supplier Reports > Payments Control > Aged Creditors Report (Detailed) Portrait or Aged Creditors Report (Summary) Portrait.

Other improvements from the Ideas hub

-

2nd Reference onTransaction Enquiry forms.

The 2nd ref. field has been added to customer and supplier transaction enquiry forms, allowing you to sort and find transactions by their 2nd ref.

-

Additional new transaction types onBank Reconciliation.

You can now enter the following transactions whilst reconciling your bank account:

-

Transfers between bank accounts.

-

Customer refunds (customer payments).

-

Supplier refunds (supplier receipts).

Update 09/12/2016

General improvements and bug fixes.

Update 19/11/2016

New Invoicing module - our most requested feature

Following feedback received from you, we are pleased to announce our new Invoicing module is available with this update. This is the most requested feature on our Ideas hub  .

.

Invoicing introduces a new, easy and quick way for you to create invoices to send to your customers. This is great for creating invoices and credit notes with no despatch process.

This is ideal for:

-

Any facilities and services your school offers.

-

School uniform and equipment sales.

-

After school and breakfast club fees.

This is ideal if:

-

You're a service business and don't want to keep records of stock.

-

You don't have a despatch process.

-

You don't have any lead time between orders placed and invoices sent out.

-

Your despatch process has already occurred and you don't want to record it Sage 200.

Why use Invoicing?

-

Use our new grid entry form for easy and rapid data entry.

-

Add stock items or free text (plus charges and comments) depending on your organisation's processes.

-

As there's no despatch process, you can print or email your invoices straight away.

-

Print or email your invoices straight away.

-

See all your invoices and credit notes together in one list for easy management.

-

You can also report on the profitability and use analysis codes for more in depth reporting.

-

Report on income and use analysis codes for in depth reporting.

Just open the Invoicing section from the menu and choose the Invoicing List.

Already using Sales Orders?

That's no problem. If you want to use Invoicing in preference to Sales Orders, just start creating invoices and credit notes in the Invoicing module. All your invoices and credit notes, from both Invoicing and Sales Orders, are shown on the Invoicing list, so you can easily manage both together. All your settings are shared between both modules, so there's no need to make any changes.

Can't see the Invoicing section on the menu?

This is because you don't have access to the Invoicing screens. To fix this, just get your Administrator to give you access using the User Access screen.

See Getting started with Invoicing.

Watch Introduction to Invoicing (video).

Analysis codes for nominal accounts

Following feedback from you, we have extended analysis codes to include your nominal accounts.

Analysis codes allow you to add information unique to your business to your accounts for more in depth reporting.

Analysis codes have always been available to add to your customers, suppliers, stock items, sales and purchase orders. You can now set them up and add them to your nominal accounts as well.

See Using analysis codes to customise and analyse your business.

Other improvements and bug fixes

-

You can now add the account code to the sales order and purchase order lists.

-

The sales order, purchase order and invoice lists now default to showing orders and invoices in descending number order.

Note: This will only be applied to an existing site if you reset the desktop settings. Doing this also removes any other changes you've made to lists.

Update 29/10/2016

General improvements and bug fixes including:

Update 18/10/2016

Improvements to Excel Reporting subscriptions

has been improved to give even more reporting power. If you subscribe to you will now receive the Stock reporting pack and Finance reporting pack as part of your subscription. Previously these were only available at additional cost.

For details of which reports are included, see Excel Reporting - list of reports.

For more information about setting up your layouts for the Finance reports, see How to design layouts for financial data reports (Excel Reporting).

Update 02/09/2016

General improvements and bug fixes including:

Update 25/07/2016

Improvements and bug fixes including general improvements to performance.

Update 11/07/2016

New features for Sage for Education

Sage 200 has been specifically tailored for the education sector. It been designed to help schools manage their income and expenditure, track budgets and produce reports for your stakeholders such as your LEA and the Department for Education.

This release includes the following additional new feature specifically for the Education sector.

Statement of Financial Activities (SOFA) report

If you're set up as an academy, you can now produce a report from Sage 200, giving you all the figures required for you to complete a SOFA report.

We've provided some 'out the box' SOFA categories that you add to your nominal accounts. If you use our defaults, then you can print the SOFA report straight away.

We've also provided a sample layout, allowing you to easily amend the report if you want to add more SOFA categories, add or change text etc. This layout works in the same way as the layouts for the income and expense and balance sheet reports.

See About the SOFA report.

Fund Management

Improvements have been made to how the year end process handles any remaining balances in your funds at the end of the year, to make sure brought forward funds are included on the SOFA report.

You now need to specify an additional default nominal account for Accumulated Fund Profit. At the end of the year, the remaining balance in each fund is transferred to the Accumulated Fund account for each of your cost centres. Any accounts that don't exist are created by Sage 200 as part of this process.

See Year End.

Other new features

Combined budgets and budget owners

Report category budgets have been extended to allow you to create a budget for any subset of nominal accounts. Previously you could only do this for accounts with the same report category.

In addition, you can now specify a budget holder for your combined budget.

See How to set up and enter budgets.

Nominal consolidation

If you're a multi- academy trust or your organisation is made up of several subsidiary companies, you can now produce consolidated reports for your parent reporting company.

To do this you just need to add a parent company to your site, link it to your subsidiary companies and link the nominal accounts in each subsidiary to your parent company nominal accounts.

Once linked up, you can transfer your trial balance from each subsidiary to your parent.

See Consolidated reporting.

Update 20/06/2016

Bank feeds

You can now use our new secure bank feeds service to download transactions from an online bank account, and then reconcile your downloaded transactions against your transactions in Sage 200.

This reduces the time that you spend reconciling your bank transactions, and ensures your accounts are up to date and accurate.

Purchase order authorisation

You can now use purchase order authorisation to make sure that your orders are checked and approved before being processed.

You can set up authorisation rules that control which orders require authorisation and who can authorise them. For example, you may want to have authorisation for orders over a certain value, or for when orders are requested by certain people.

See Purchase order authorisation.

Web based sales orders

This web based sales order feature has now been removed, but you can now enter sales orders using our Web Portal.

Other improvements and bug fixes

We have implemented various performance improvements and bug fixes. These include:

-

Exporting from workspaces - improvements to performance when exporting large numbers of transactions from a workspace to Excel.

-

Create a return from an order - returns are now created correctly for 'back to back' order lines.

-

Running reports from lists and workspaces now correctly only includes the selected records.

Update 09/05/2016

Improvements and bug fixes

These include:

-

Custom reports: You can now run customised reports from the menu. Previously this generated an error.

-

Excel reporting: Improvements to Excel reporting to ensure reports are company specific.

-

Performance: General improvements to the performance of the desktop app.

Update 19/03/2016

Improvements and bug fixes

These include:

Update 05/03/2016

Sage for Education

Sage 200 has been specifically tailored for the education sector. It been designed to help schools manage their income and expenditure, track budgets and produce reports for your stakeholders such as your LEA.

See Education.

Commitment reports

You can now track your committed expenditure against your budgets using these new Excel reports for Nominal Budgets, Nominal Outturn, and Nominal Outturn by Report Category.

You can run these Excel reports from Excel Reporting > Excel Reports.

See Commitments.

New report

Following feedback we have received from you, we have introduced a new Nominal Ledger Trial Balance Consolidated report. This report is available in both landscape and portrait versions.

You can install this reports using Settings > Organisational and Financial > Custom Report Manager.

See Install additional reports with the Custom Report Manager.

Other improvements and bug fixes

These include:

-

The create company screen no longer appears when accessing Report Designer.

-

Improved tab sequence on the Sales order entry form.

-

The settlement discount field is now available when entering sales receipts.

Update 20/02/2016

Multi-company support for Sage Pay

The Sage Pay settings have been extended to allow you to link more than one Sage Pay account with Sage 200.

If you have more than one Sage Pay account, you can set up a separate configuration for each one and choose which Sage 200 companies to link it to. Card payments are then processed for the Sage Pay account the company is linked to.

See Configure Sage 200 to use Opayo (formerly Sage Pay).

Update 12/02/2016

Supplier Payments

Supplier Payments introduces a new, easy and secure way to pay your suppliers or HMRC (for VAT) directly from Sage 200.

A Supplier Payments account is a secure virtual wallet (also known as an e-wallet). You add funds to your Supplier Payments account, which has an e-money balance, and then use this to make approved payments directly from Sage 200.

Before you can use Supplier Payments with Sage 200, you must first apply for a Supplier Payments account.

See Salary and Supplier Payments.

Update 05/02/2016

Sage Pay enhancements

You can now get paid faster using the Pay Now feature with Sage Pay.

Sage Pay is an online card service provider similar to PayPal. Sage Pay integrates seamlessly with Sage 200 making it easier for your customers to pay you.

Pay Now enables your customers to pay you directly on receiving an invoice, statement or chase letter.

How does it work?

-

A Pay Now button is added invoices, statements and chase letters.

-

When your customer receives your invoice, statement or letter, they can pay you straight away by clicking the Pay Now button. The Pay Now button contains a link that takes the customer to your Sage Pay account. The customer simply chooses how much they want to pay and enters their card details.

-

To make processing these payments even easier, once your customers have paid you using the Pay Now button, you can import these transactions directly into Sage 200. Where possible Sage 200 will also automatically allocate them to the invoices they are paying.

See Use Pay Now with Opayo (formerly Sage Pay).

See Import online card transactions from Opayo (formerly Sage Pay).

Tip: Only an Administrator can open the new screens straight away. If you can't open a screen, your Administrator will need to give you access (Settings > Organisational and Financial > User Access).

New reports

Following feedback we have received from you, we have introduced some new reports. These are re-styled versions of existing reports made to look similar to Sage 50 Accounts. If you've recently moved from Sage 50 Accounts, then check these out.

The new reports include portrait versions of the Profit and Loss, Balance Sheet and Trial Balance.

You can install these reports using Settings > Organisational and Financial > Custom Report Manager.

See Install additional reports with the Custom Report Manager.

Update 18/12/2015

Print sales orders

Following feedback received from you, we have added an option to print sales orders from Sage 200. You can print orders as your enter them, or in batches by customer, order number range, etc.

See Print sales orders, returns, invoices and credit notes.

We have also made a number of other improvements and bug fixes in this release.

Update 04/12/2015

User Access

Following feedback we've received from you, we've changed how you control user access in Sage 200. Previously access to screens was provided via roles. Now you can choose per screen what users can access, making it easier for you to set Sage 200 to suit your business.

If you're already using Sage 200, the screens that your users can currently access won't change, however you'll now be able to add and remove access to individual screens.

See Assign feature access to users.

Import BOM records

You can now import Bill of Materials records into Sage 200. This is an easy way to create your BOM records. You just add the list of components and quantities to a CSV file, and this creates a BOM record.

The components and the built items must already exist in Sage 200.

See Import Bill of Materials.

Other improvements and bug fixes

These include:

-

The Financial Statement Designer for Excel Reporting is now within the Excel Reporting section of the menu so it's easier to find and less likely to be confused with the Financial Statement Layouts Designer for Report Designer.

-

There is a new report for VAT Transactions (by period) within the Revenue and Submissions section of the menu. Use this report to help you reconcile your VAT Return.

Update 13/11/2015

Give us your feedback

As part of our drive to constantly improve our products, we want to give you the opportunity to tell us what you think about individual forms and processes in Sage 200.

At the top of each form you'll see a smiley face  . Just click here and us what you think!

. Just click here and us what you think!

New reports

Following feedback we have received from you, we have introduced some new reports. Some of these are re-styled versions of existing reports made to look similar to Sage 50 Accounts. If you've recently moved from Sage 50 Accounts, then check these out.

The new reports include customer credit limit and balance, customer receipts and supplier payments.

You can install these reports using Settings > Organisational and Financial > Custom Report Manager.

See Install additional reports with the Custom Report Manager.

Update 30/10/2015

Bill Of Materials

We have introduced a Bill of Materials record for your stock items. If you have stock items that are assembled from other items, you can now create a Bill of Materials (BOM) to record required components.

You can also check whether you have enough stock to build your assembled items, order items when they're out of stock, and record when an item's been built to update your stock levels.

See Bill of Materials (BOM).

New reports

Following feedback we have received from you, we have introduced some new reports. Some of these are re-styled versions of existing reports made to look similar to Sage 50 Accounts. If you've recently moved from Sage 50 Accounts, then check these out.

The new reports include summary versions of the Aged Creditors and Aged Debtors reports, top customer and supplier lists, and a monthly breakdown of your nominal account balances.

You can install these reports using Settings > Organisational and Financial > Custom Report Manager.

See Install additional reports with the Custom Report Manager.

Other improvements and bug fixes

These include

-

Drill down on summary pages - you can select a section of the chart on the Customers summary page and see a list of the transactions that make up the total.

-

Improvements to memos - memos now have a created and an updated date.

Update 09/10/2015

Importing data

We have improved the processes for importing data and the import routines have been extended to include:

-

Customer delivery addresses.

-

Memos (up to 1000 characters) linked to customer accounts, supplier accounts, stock items and nominal accounts.

See Import, export and update information.

We have also made a number of other improvements and bug fixes in this release.

Update 02/10/2015

Unreconcile bank transactions

The bank reconciliation changes have been extended. You can now unreconcile your bank transactions if you've made an error. This removes the reconciliation flag from the transaction and makes it available to reconcile again.

See Unreconcile transactions.

Create a return from a sales order

This functionality has been extended. There is now a Copy Order button on the Create New Return form.

Other improvements and bug fixes

These include:

-

Improvements to allocating receipts and payments. The focus now remains on the selected transaction.

-

Bank reconciliation via e-Banking. Transactions are now correctly filtered by date.

-

Importing stock items has been extended to include the new bar code field.

Update 18/09/2015

Bank reconciliation

The bank reconciliation screen has been redesigned based on your feedback. This screen is now split into two sections, reconciled and unreconciled transactions. When you match transactions to your bank statement, you move them to a lower list so you can easily see what's been reconciled and what's still to do.

Additional improvements include:

-

A running total of selected transactions making to easier to reconcile when one transaction is shown on you bank statement for several entered in Sage 200.

-

The ability to change the size of the two sections making it easier to see long lists of transactions.

-

Additional Matched Balance, End Balance and Difference fields that are updated as you reconcile, making it easier to check your progress.

See Reconcile manually using a bank statement.

Create a sales return from a sales order

We've introduced a new quick way to create sales returns, by copying all items (lines) from existing sales orders.

You simply select a sales order from the sales order list and click Create return from order from the menu at the top of the list. This copies all the items (lines) and original prices from the sales order and adds them to a return. You can then add and remove items from the return, or change quantities and prices.

See Enter sales returns.

Other improvements and bug fixes

These include:

Update 08/09/2015

Bar codes on stock items

You can now store bar code information against each stock item record (Details tab) and produce bar code labels to make stock identification and inventory easier. Bar codes are printed in Code 39 format by default. If you use a different bar code format, you can change this using Report Designer.

Bar code labels can be printed using the Stock Control > Reports > Stock Bar Code Labels report.

See Stock items.

Performance improvements

We have made a number of changes to improve the performance of various screens and make data entry more efficient. This includes the Amend Customer Account, Customer Transaction Enquiry, Enter New Order and Enter New Order - Rapid screens.

We have also made a number of other improvements and bug fixes in this release.

Update 20/08/2015

Stock sales reports

We have created a set of new reports to enhance how your report your product sales. You can now report on your sales by combinations of product, product group and customer. You can find these new reports on the menu in the Stock Control > Reports > Stock Sales section.

Other improvements and bug fixes

Journal templates

All lines on a journal template can now be amended.

Workspace performance

Changes have been made to workspaces to improve performance and reduce errors. This includes improvements to filters to remove scripting errors and indicators to show when the workspace is loading

We have also made a number of other improvements and bug fixes in this release.

Ideas Portal.

Ideas Portal. Ideas Portal.

Ideas Portal. Ideas Portal.

Ideas Portal. Ideas Portal.

Ideas Portal. Ideas Portal.

Ideas Portal.

Google Maps icon next to the address.

Google Maps icon next to the address. Spooler list, to only show the reports you're interested in. You can filter the spooler list by report name, the user who produced the document, the company, the date of the report, or the status of the report.

Spooler list, to only show the reports you're interested in. You can filter the spooler list by report name, the user who produced the document, the company, the date of the report, or the status of the report.