Create sales orders

Sales orders are a contractual agreement between you and the customer for the provision of goods and services for a price.

Lifecycle of a sales order

Customer orders are central to your business as a supplier. These are contractual agreements between you, the supplier, and the customer. They define the terms (prices, quantities and times) by which you will deliver products or provide services.

Strong order management allows you to maintain order visibility throughout the life cycle of an order, from demand creation to supply fulfilment. Orders may be set up individually, or as a repeat requirement for a customer so that it is produced automatically in Sage 200 on a regular basis.

|

Quotation

An order may begin life as a quotation. You can track and maintain quotations and upgrade these to genuine orders. Pro forma

Where a customer requires a quotation to look like an invoice or if you require the customer to make payment before goods are despatched use the pro forma invoice. Pro forma invoice customers may become regular customers and you can upgrade the pro forma invoices to orders if this happens. Create order

Orders may be taken and created in a number of ways:

Allocate stock

Stock can be allocated during the order lifecycle. This reserves the stock held on your system, so that you can keep track of the stock levels. Once order despatch takes place, these reserved stock items are removed from the system. Print order documentation

Printing order documentation, such as picking lists, order acknowledgements and invoices, is part of the order lifecycle. Whether you choose to allow printing of these is dependent upon the settings in your system. Despatch order

Order despatch may take place immediately as in over the counter sales, or it may need to wait on stock allocation. Invoice customer

Invoices are generated to send to your customers and the invoice values are then available for posting to other modules in Sage 200 such as customers records in the Sales Ledger. If payments have been received at the point of sale, as in over the counter sales, then the payment values are posted at the same time. Handle returns

Sometimes orders are returned, and dealing with returns is another stage in the order life cycle. Report on order progress

Keeping a record of your Sales Order Processing system is important at all stages of the order life cycle. Depending on how you set up your system you might not have to complete all of the stages. For example, a quotation might never progress to a sales order. You might not need to print picking lists. You might not want order acknowledgement documentation. You might receive payment with the order (most often the case in trade counter sales). |

Contents of a sales order

Sales orders are created using customer details and the goods and services you supply held on your Sage 200 system.

Customer details

Customer details are managed in the header section of the sales order. These details include information such as the customer's name and the invoice and delivery addresses. Often these addresses are the same. When entering an order, Sage 200 displays the invoice address stored in the customer's record held in the Sales Ledger. When goods are to be delivered to a different address, additional delivery addresses for the customer can be included on the order.

-

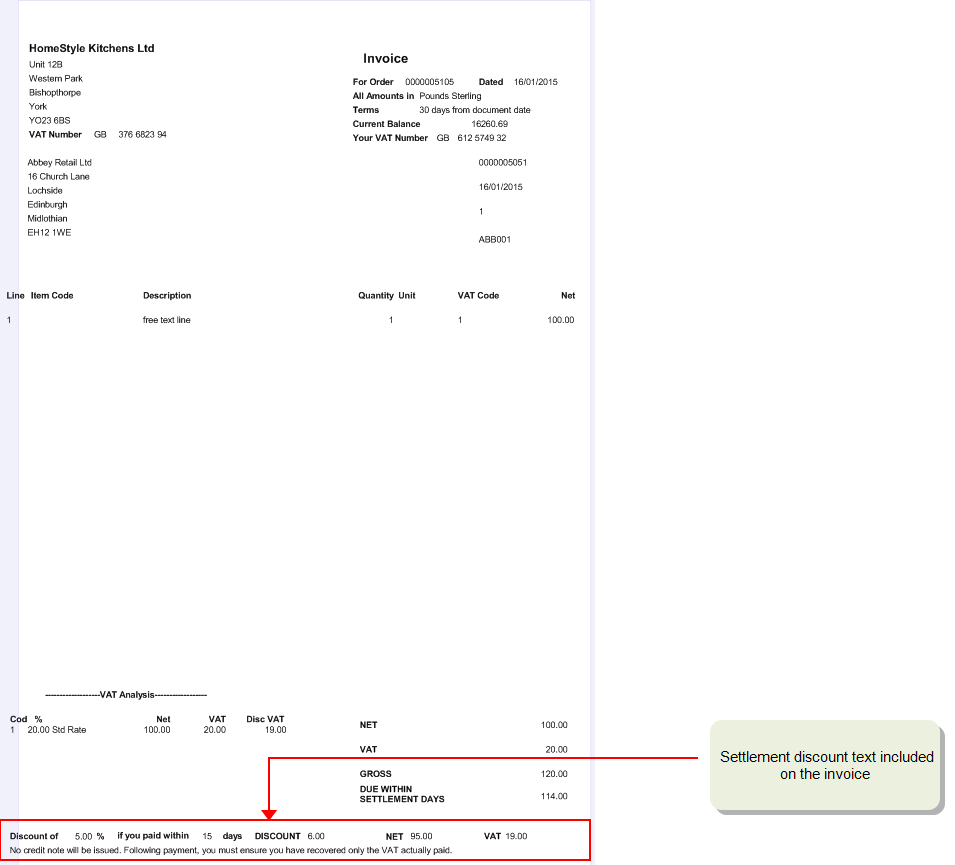

In the UK, VAT on an invoice is only discounted when it is paid within the settlement discount period.

On each invoice, VAT is calculated by default on the full invoice value. If the invoice is paid within the settlement discount period, a VAT adjustment is required, to account for the discounted VAT.

-

In Ireland, VAT is calculated on the full value of the invoice regardless of any settlement discount.

When invoices are produced from Sage 200, if you're using sales orders or project bills, each invoice states the amount of discount (net and VAT) that can be claimed if the invoice is paid early, as well as the full amount (net and VAT) due after the settlement discount period. This means that there is no need to issue an additional VAT only invoice, if the customer pays within the discount period. However, internal VAT adjustments will be required.

When creating sales order and project bills, you enter the amount of settlement discount on the Delivery and Invoicing tab of the order or bill. When the invoice is printed, Sage 200 calculates the VAT for the full amount before settlement discount is applied, and adds the required text to the invoice.

Goods, services and charges

The detail section of the sales order consists of lines. These lines itemise the goods and services requested, including any additional charges incurred and are categorised by line type. The line types cover:

|

Standard item |

Standard items are:

|

|

Free text item |

Free text items have no stored item records. You can choose to process a free text item in the same way as other standard items. Use free text items for:

|

|

Additional charges |

Additional charges are added to an order to cover costs such as delivery, or insurance. Each additional charge has its own record. Add the additional charge to the order by selecting it from a list. |

|

Comment lines |

Use a comment line to add information to an order. The comment is generally printed on the order documentation. You can choose to prevent the comment printing, if you want to keep it private. |

To create sales orders

You can create orders in the following ways provided the customer's account is not on hold The 'on hold' status indicates that an account or an order has been queried. It is suspended to prevent any processing until the on hold status is removed ('off hold').:

-

Goods ordered in this way are despatched from the warehouse with a despatch note. An invoice for payment is generated separately.

-

Enter payments with order.

You can choose to enter a payment when the order is processed. This can be for the full invoice amount or for a part payment. You can also choose to create an invoice immediately, showing payment has been received. This is useful when handling deposits. You can use online payments.

-

Use this to enter orders quickly. Orders entered this way use the default prices and discounts for the customer. You can change these if you have the appropriate user permissions.

This type of order entry is typically used when you are entering data from a batch of completed order forms.

-

Use this to enter over-the-counter sales. For this type of order the customer collects the goods and pays immediately.

-

Copy an existing (not archived) order.

You can copy an existing order and amend the information to suit. This method does not copy payment details, order number or dates.

- By converting a quotation into an order.

- By converting a pro forma invoice into an order.

- Using a repeat order template.

Once created, sales orders can have the following status:

- Live. The order has been generated and is in the process of being fulfilled.

- On hold. The order has been put on hold, e.g. because the customer has exceeded their credit limit.

- Completed. The order has been fully despatched and invoiced, or has been cancelled.

What do you want to do?

Create a new sales order (full order entry)

Enter the payment with sales order details

Create a rapid entry sales order

Convert quotations to sales orders

Convert pro forma invoices to sales orders

Converting repeat order templates into orders

Other tasks

Reference

Set up customer delivery addresses

Create invoice and order items

Additional charges for invoices and sales orders