Make supplier payments with payment processing

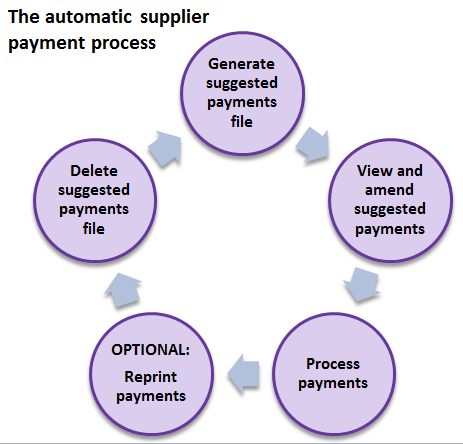

The automatic supplier payments process is a cyclical process which works like this:

Before you automatically pay suppliers

We advise that you perform these tasks before you generate supplier payments:

-

Allocate all outstanding payments to invoices.

Invoices that have been allocated are marked as paid and so won't be selected by this process. Making sure that payments you have made are allocated helps to prevent payments being created more than once and your suppliers being overpaid.

Remember - if the calculated payment is more than balance of the supplier's account, Sage 200 won't generate the payment.

-

Delete any previously generated suggested payments file.

You can create the suggested payments file as many times as you want. If one has already been created and not processed, you'll be asked if you want to delete it first.

Generate the suggested payments file

You can control over what invoices are selected for the file. You can include:

- Invoices that are due up to a specific date.

- Invoices that are more than a specific number of days overdue.

- Invoices that would earn early settlement discounts if paid.

The suggested payment file is stored by Sage 200. You can review and amend the invoices, or go straight to paying your suppliers.

Review and amend the invoices included in the file

Before generating payments for the suppliers and the invoices detailed in the suggested payment file we suggest that you review the suggested payments for each of the suppliers in the file.

Why review the file?

This enables you to control which suppliers and invoices are paid.

The suggested payments file could include invoices that you don't want to pay yet - maybe you've returned goods or haven't yet received them. Reviewing the file allows you to remove those payments and make sure suppliers are not paid in error.

Process supplier payments

This is the stage at which you generate the payment or payments to suppliers listed in the suggested payments file. You can make a payment to an individual supplier or to all suppliers that are linked to a specific payment group.

When the automatic process will omit invoices or not post payments

In certain circumstances the automatic process will not include invoices in the file. If you discover expected invoices or payments are missing it may be because:

-

The supplier has been put on hold.

The on hold status must be removed from the supplier record before any of its invoices will be included in a payments file.

-

An invoice is under query or dated after the payment date.

Invoices and payments are placed under query on the Supplier Allocations screen.

-

If a payment would exceed the maximum payment allowed.

If the total of all selected invoices for an individual supplier exceeds the maximum single payment amount your company is willing to pay any one supplier then Sage 200 will ignore all invoices for that supplier. To prevent this happening:

- Allocate all payments to invoices before you generate the suggested payment file to ensure invoices that have already been paid are not selected.

- Review the suggested payments file and remove some of the invoices or reduce the amount being paid from invoices until the total amount is less than your company's maximum allowed payment.

- Increase the maximum amount your company is willing to pay.

What do you want to do?

Prepare for making automatic supplier payments:

- Remove the On Hold status from a supplier account

- Allocate outstanding payments to invoices

- Delete a previously generated suggested payment file

Make automatic supplier payments:

- Generate the suggested payment file

- Review and amend the payments in the suggested payment file

- Pay one of the suppliers in the suggested payment file

- Pay all, or a group, of the suppliers in the suggested payment file

- Pay suppliers using e-Banking

- Pay suppliers with Supplier Payments

- Reprint the remittances and cheques from the last suggested payment file

Next steps

After posting payments to your supplier accounts, the next steps might include:

-

If you subsequently return any of the goods or services and your supplier provides you with a credit note:

- Record the credit note.

- If you were also given a refund, record it and allocate it to the appropriate credit note.

- Reconcile the payment, and the refund if required, when they are detailed on your bank statement.