Do you want Sage 200 to take the strain out of bank statement reconciliation or generate payments for your suppliers that you send straight to your bank?

Use your bank's e-Banking service with Sage 200 to take some of the pressure off you.

How e-Banking can help you

With e-Banking you can:

-

Automatically reconcile your bank statement.

To do this you download a file containing a list of the receipt and payments on your account from your bank. You can then check these against the transactions entered into Sage 200 and automatically reconcile.

-

Pay your suppliers electronically.

This creates a file with the details of all the payments you want to make to your suppliers. You send this file to your bank to process the payments.

Note: You cannot pay foreign suppliers through e-Banking.

-

Pay your VAT Return electronically (UK only).

If you submit your VAT Return online through Sage 200, you can also pay your VAT electronically. This creates a file which you send to bank to process the payment.

What banks are supported?

There are e-Banking plug-ins available for the majority of banks in the UK and Ireland.

Download and install the required plug-in for your bank from the Sage website: Sage e-Banking compatible banks (opens in a new tab).

How to set up e-Banking

Set up your bank accounts

-

Install the Sage 200 e-Banking component. This sets up Sage 200 to send the required files to your bank.

Open:

Tools > Installers > Install eBanking components.

Tools > Installers > Install eBanking components. -

Download and install the required plug-in for your bank from the Sage website: Sage e-Banking compatible banks (opens in a new tab).

-

Go to the Online Banking tab for the bank account in Sage 200.

-

Select the E-Banking service you will be using.

Note: You will only see your bank listed here if you have downloaded and installed the plug-in for your bank.

-

Choose the tasks you will be using with e-Banking from the E-Banking functions list.

-

Payments if you want to pay your suppliers via e-banking.

-

Bank reconciliation only.

-

Both payments and bank reconciliation if you want to make the most of it and do both.

Note: Not all banks support all functions. If you can't see a function in the list, it's not supported by your bank.

-

-

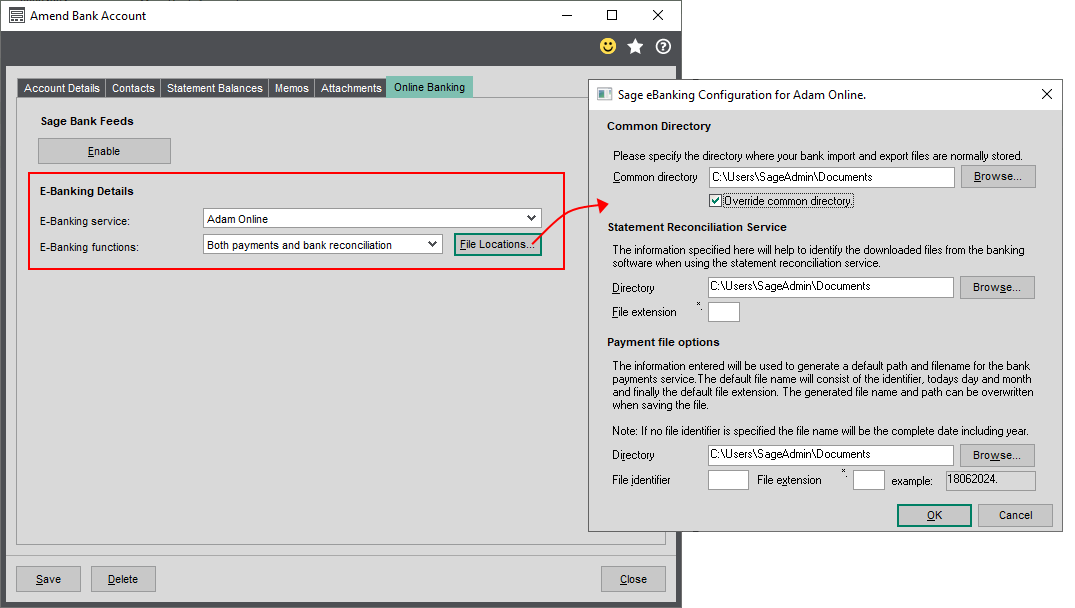

Files for e-Banking are saved to your user Documents folder by default. To change this click File Locations.

Set e-Banking file locations-

Click File Locations.

-

To choose the folder for your e-Banking files, select your Common directory.

-

To specify separate locations for statement reconciliation (that come from your bank) and payment files (that you will send to your bank), select Override Common Directory.

-

In the Statement Reconciliation Service section, click Browse to select the folder where Sage 200 will look for statement files for reconciliation.

If your incoming bank statement files will have a specific file extension, enter it in the File extension field.

-

In the Payment file options section, click Browse to select the folder where Sage 200 will save the payment files for you to send to your bank.

Output payment files are named according to the date they are produced. You can add a prefix to the file name by entering a File identifier field. You can add a file extension in the File extension field. The example field shows what the file name will look like.

-

Set up your supplier accounts to use e-banking

If you want to pay your suppliers via e -banking, each supplier account must belong to an EPayment payment group and your must use the Generate payments feature to pay your suppliers.

You can create a single payment group for all suppliers that you pay via e-banking or you can use separate groups. You might want separate groups if you do your payment runs at different times, or want to use a mixture of printed or emailed remittances.

To set a supplier to use an EPayment payment group:

Open: Suppliers > Create & Amend Accounts > Amend Supplier Details

-

Select the supplier to amend.

-

Go to the Payment tab.

-

Choose the relevant Payment group for the supplier account. Choose from:

-

3 - Epayment

-

4 - Epayment Remittance

-

5 - Epayment Email Remittance

Tip: You can change the labels for the payment groups to make them more meaningful for your business in the Supplier settings.

-

Set up your VAT Return to pay via e-banking (UK only)

Open: Settings > Cash Book / Nominal Ledger > Nominal Ledger settings | VAT submissions

-

Select Enable online VAT payments (UK only).

-

The bank details for the HMRC are entered automatically. Do not change these unless you have received notification from HMRC.

-

Select the bank account to pay the VAT from. The VAT payment defaults to this bank account.

-

Choose a nominal account to post the VAT payment to.

What's Next?

-

Generate payments for your suppliers that are transferred through your e-Banking service

These payments are generated when you use the automatic supplier payment feature.

Sage is providing this article for organisations to use for general guidance. Sage works hard to ensure the information is correct at the time of publication and strives to keep all supplied information up-to-date and accurate, but makes no representations or warranties of any kind—express or implied—about the ongoing accuracy, reliability, suitability, or completeness of the information provided.

The information contained within this article is not intended to be a substitute for professional advice. Sage assumes no responsibility for any action taken on the basis of the article. Any reliance you place on the information contained within the article is at your own risk. In using the article, you agree that Sage is not liable for any loss or damage whatsoever, including without limitation, any direct, indirect, consequential or incidental loss or damage, arising out of, or in connection with, the use of this information.