Pay your VAT bill online to HMRC

This topic is not applicable to Sage 200 Standard for Education.

How to

Pay your VAT bill online

Open: Cash Book > Enter Transactions > VAT Return Payment

-

Select the VAT Return you want to pay from the list.

You can only select a VAT Return that was submitted online and has a submission status of Success.

-

Select the cash book account that you want to use to pay your VAT Return.

This defaults to the account set for HMRC payments in Nominal Ledger Settings.

Note: If you are using Supplier Payments, the cash book account is linked to Supplier Payments and cannot be changed unless it has funds of £0.00.

- Select the nominal account to post the VAT payment to. This defaults to the VAT Liability Account selected in the Nominal Ledger Settings.

- The HMRC VAT Return reference Number and the Amount to Pay are taken from the submitted VAT Return and can't be changed.

- Click Pay Now.

- Click Yes to process the payment.

- If you use e-Banking, save the e-Banking file, then use your bank's software to import the file and pay HMRC.

- If you use Supplier Payments, the payment will be immediately submitted to Supplier Payments for approval by your Supplier Payments account approver.

Useful info

Paying your VAT bill online

If you submit your VAT Return online you must also pay your VAT bill online.

There are a few ways you can do this:

- Pay using the HMRC website.

-

Pay from Sage 200 using the Sage e-Banking service.

When you pay your VAT with Sage e-Banking a file is created containing the payment which you process using your bank's software.

-

Pay directly from Sage 200 using Supplier Payments.

What happens when

What happens when I pay using e-Banking?

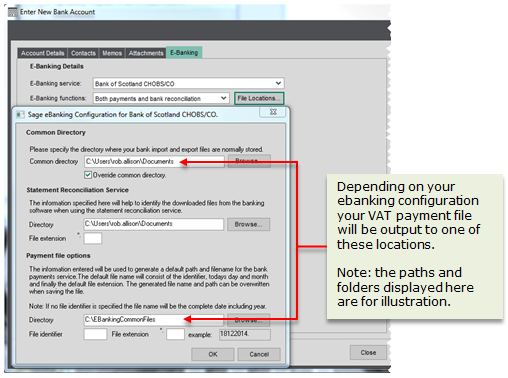

Sage 200 generates a payment and saves it in the folder specified for the bank account you used for the VAT payment.

You must upload this file to your bank's e-Banking tool to send the payment to HMRC.

What happens when I pay using Supplier Payments?

Sage 200 will send the payment for the payee HM Revenue and Customs to Supplier Payments for approval. Once this payment has been approved by your Supplier Payments account approver, the payment will be made to HMRC.

To check the status of the payment, see View the Supplier Payments dashboard.

Sage is providing this article for organisations to use for general guidance. Sage works hard to ensure the information is correct at the time of publication and strives to keep all supplied information up-to-date and accurate, but makes no representations or warranties of any kind—express or implied—about the ongoing accuracy, reliability, suitability, or completeness of the information provided.

The information contained within this article is not intended to be a substitute for professional advice. Sage assumes no responsibility for any action taken on the basis of the article. Any reliance you place on the information contained within the article is at your own risk. In using the article, you agree that Sage is not liable for any loss or damage whatsoever, including without limitation, any direct, indirect, consequential or incidental loss or damage, arising out of, or in connection with, the use of this information.