Whatever kind of business you run, you'll be dealing with customers. This can be regular customers that have an account with you or cash customers who you don't hold records for.

Customers

-

Cash customers.

If you make one-off sales to customers, you can record transaction for these that post directly to your nominal accounts but are not connected to a customer account. For these you can use the nominal receipt options (with or without VAT).

-

Customer accounts.

For your regular customers, you can create an account in Sage 200. Each customer accounts contains:

- Name, address and contact details.

- Trading information such as the currency they use and VAT details.

- Payment terms and early settlement discounts you offer them.

- Credit terms you allow them.

- Prices and discount options if you're using the sales orders features.

If you tend to agree standard payment and credit terms with all your customers you can define these once in the Customer settings and defaults and have them automatically applied to new customer accounts. With common terms and values preset, you reduce errors and speed up the customer account creation process. These values can be amended as individual customer records are set up or as a later amendment.

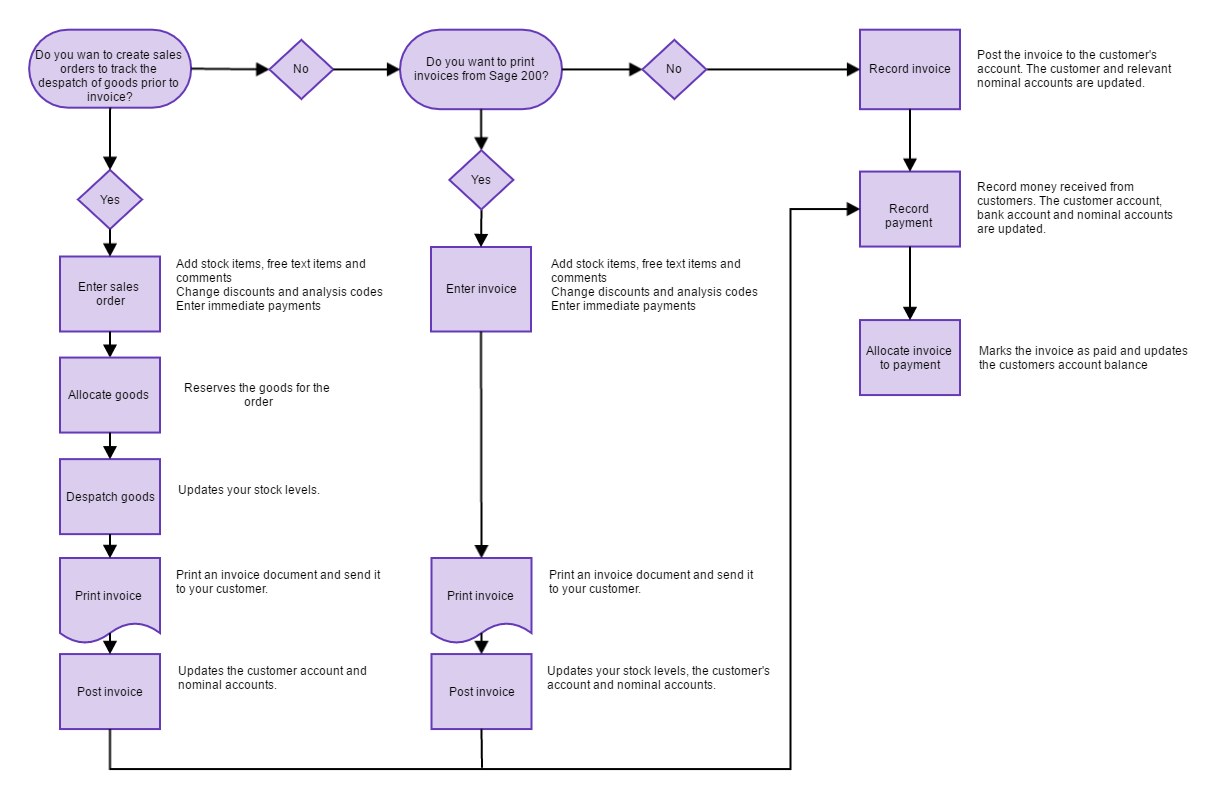

How do you sell

Every sale you make goes on a journey through your business and through Sage 200. There are several ways to process and record your sales in Sage 200. You do not have to exclusively use a single method, but can choose depending on your business processes and the information you need to add to Sage 200.