Purchase Order Settings (Configuration Assistant)

Find this screen

Open: Configuration Assistant > Purchase Order Settings.

How to

Enter the settings for your purchase orders

These settings are applied to your purchase orders. You can change them at any time. Once you have completed the Configuration Assistant, you can change them from Settings > Purchase Orders > POP Settings.

Once the settings are changed they are applied to subsequent purchase orders. Existing purchase orders are not affected.

Choose options for:

- Cost Price Differences nominal Account - records the difference between the purchase order price and actual price charged by the supplier.

- Standard Cost Variances nominal account - records the difference between the standard cost price of stock items and actual price charged by the supplier. If you don't intend to use standard cost pricing for any of your stock items, this account is not required.

- Generate purchase orders for back to back orders - choose whether to include back to back orders by default when you generate purchase orders.

- Use the user's name as the order originator - choose whether to use the logged on user by default.

Useful info

Cost price differences

The cost price of stock items in Sage 200 is always updated when you record that you've received the goods. This nominal account is used to record any difference between the cost price on the purchase order and the actual cost price on the supplier's invoice.

Set the nominal account to use as the default here. This should be a Profit and Loss account. If you have used our default set of accounts, this account is 5020.

When you record the purchase invoice, this price difference is posted the nominal account entered here by default. You can change this, if required.

You enter a purchase order for 10 widgets. The cost price of the widgets is £1 each, so the order value is £10. You receive the widgets from your supplier and record this in Sage 200.

When you receive the invoice for the widgets, the price charged by the supplier has changed to £3.

The value of the invoice is therefore £30. When you record the invoice, the values are posted to the following nominal accounts by default:

| Account | Value |

|---|---|

| Stock account | 10 |

| PO Cost Difference Account | 20 |

Standard cost variances

If you intend to use the Standard costing method for any of your stock items, you need to specify a nominal account for your cost variances if:

- You use the Standard costing method for any of your stock items, and

- You want Sage 200 to post a transaction to account for any price differences.

Standard cost variances happen when the actual price paid for an item is different to the standard cost price that is stored on the stock record. When you enter the details of the invoice received from your supplier into Sage 200, the actual cost price paid is posted the nominal account specified on the invoice. Sage 200 uses the cost price set on the stock record to calculate the value of your stock on the valuation report.

When the cost prices are different, the value on your stock, on the valuation report, will be different to the balance of your stock nominal account. So you'll need to make adjustments to your nominal account values.

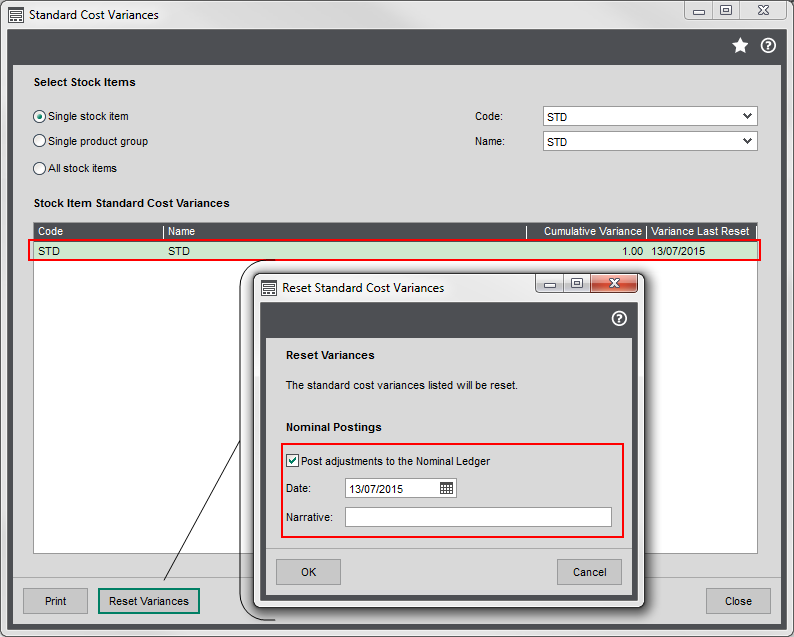

The standard cost variances screen shows the cumulative value of all the occasions when the purchase price for a stock item has been different to the standard cost price stored on the stock record. You can use this value to update your accounts manually, or you can choose to post this value to the standard cost variances nominal account.

You have a stock item which has a standard cost price of £10. You buy the item from your supplier who charges you £11.

When you record the invoice for the purchase, £11 is posted to the nominal account specified on the invoice. This defaults to the account set on the stock item. The balance of this account is now £11.

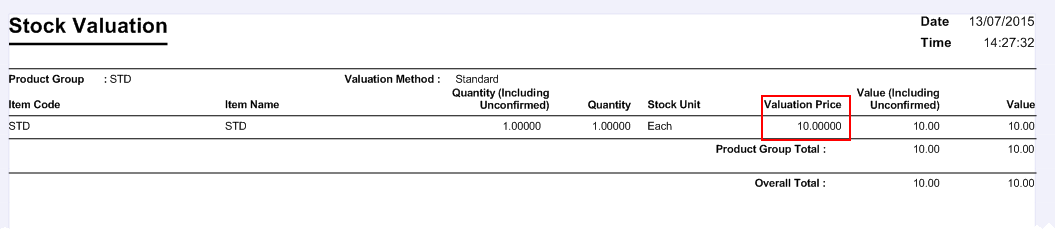

The stock valuation report shows the item value as £10, making a variance of £1.

This is shown on the standard cost variances screen.

If you choose to post this to your nominal accounts, the following values are posted:

| Nominal account | Debit | Credit |

|---|---|---|

| Specified on the stock item | 1.00 | |

| Standard cost variances | 1.00 |

Back to back sales orders

A back to back sales order is used when you want to order goods directly from a supplier to fulfil a sales order, rather than keep items in stock.

Once you have set this up, a purchase order is generated automatically by Sage 200 to fulfil sales orders for specific items. There are two ways you can create the purchase order:

- When you save the sales order.

-

Using the Generate Orders option.

Selecting the Generate purchase orders for back to back orders option here create these orders by default.

If you want to use back to back sales orders, additional configuration will be required

- Choose to use the From supplier via stock fulfilment method in Settings > Stock Control > Stock Control Settings.

- Set the a preferred supplier for the relevant stock items.

- Set the Stock Fulfilment method to From Supplier for the relevant stock items.

Generate purchase orders for back to back orders

You can automatically produce purchase orders based on your current stock levels, by using the Generate Orders for back to back orders option. This produces a list of purchase orders that you may want to create, so that you can:

- Replenish stock which has fallen below the re-order level.

- Order stock to fulfil back-to-back sales orders.

- Order stock to fulfil any outstanding sales orders for an item.

What happens when

What happens when I save and mark this panel as complete?

- When you finish adding information and click Save and Mark as Complete, the panel is marked with a tick

to indicate that you have completed this step.

to indicate that you have completed this step. - While you remain on the Configuration Assistant, you can return to this panel to add or amend any of the details you have entered.

- Once you have finished the Configuration Assistant, you can change these options from Settings > Purchase Orders > POP settings.