Budgets are one of the most important things you need to track. Budgets are set against your nominal accounts so once you've recorded your budget, you can compare the totals of the actual nominal transactions posted to a nominal account against the budget for that account.

Budget values can be both positive and negative. Negative values apply to accounts whose balances are normally a credit. This applies to revenue accounts but may also feature elsewhere in your own account structure.

All budgets can be set for your current year and for up to five years in the future.

Nominal account budgets

Your actual income and expenditure is only tracked against the budget set on your nominal accounts. Nominal account budgets can be set as:

- An annual total - specify a single budget amount and Sage 200 divides it equally across your accounting periods. Any odd amounts that are left over are added to the last period's budget

- Per month - specify a separate budget amount for accounting period.

-

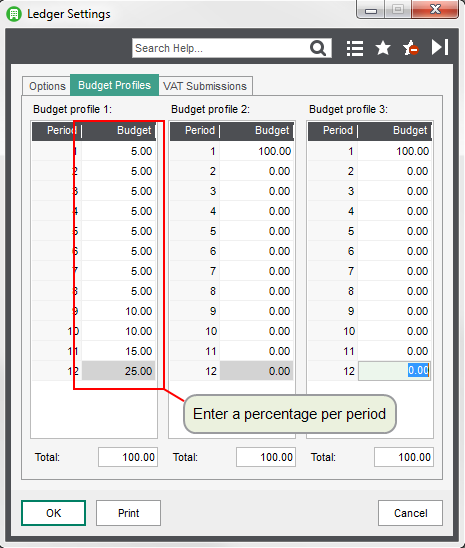

Per budget profile - create a template where you specify a percentage budget per period.

These are useful if you need to weight certain periods more than others to account for seasonal or market trends.

Note: You can also enter an Original Budget figure for the budget this year, if you want to keep a record of the initial budget amount so that you can compare it against any changes to the budget.

How to set up budget profiles

How to enter budgets on your nominal accounts

Check budgets when entering purchase orders

Group account budgets

If you use Group accounts, you can associate budgets to these accounts for budget comparison reporting purposes. Transactions are not posted to Group accounts When you use group account budgets you only assign the budget to the group account. Budgets are not assigned to the nominal accounts within the group.

The nominal account number is used to associate group accounts and posting accounts. Group accounts can be a parent (higher in the hierarchy) and/or a child (lower in the hierarchy) of other group accounts. For example, these accounts are associated with each other using the 08 account code.

| Account number | Account type |

|---|---|

|

08 |

Group |

|

081 |

Group |

|

08101 |

Posting |

|

08102 |

Posting |

|

08103 |

Posting |

|

08104 |

Posting |

If you're not using Group nominal accounts, and want to set a budget for a selection of nominal accounts or assign a budget owner, use a Combined nominal budget. See Budget owners and combined nominal budgets.

How to set up group budgets

How to import budgets

You can import budgets set at nominal account level (but not combined nominal budgets). This is useful if you want to maintain your budgets in an Excel spreadsheet and makes the process of entering and updating your budgets much quicker.

All information is imported via a CSV Comma Separated Value (CSV) file format. Sage 200 can import and export data in the CSV file format. file, so once your information is in an Excel spreadsheet it's pretty straightforward to import from there. To make sure Sage 200 can read the data for all the different records, the information in your CSV file will need to conform to certain rules.

You can import nominal budget values using either a CSV Comma Separated Value (CSV) file format. Sage 200 can import and export data in the CSV file format. or XML Extensible Markup Language (XML) file format. Sage 200 can import and export data in the XML file format. file.

-

Download the import information and example file:

- Nominal Budgets import format (XLS): Details of the information you need to include in the file.

- Nominal Budgets example CSV file: Use this to import from CSV format.

- Nominal Budgets example XML file (opens in a new tab): Use this to import from XML format.

- Create your import file in the format of the CSV or XML example file.

-

Read the information in the import format file (XLS), and make sure your information is correct and all mandatory fields are included.

Note: You must enter budgets as a negative amount for all accounts where you're expecting the account balance to be a Credit. This normally applies to all Income type accounts on the Profit and Loss and Liability accounts on the Balance Sheet.

- Save your import file.

- When you import, the Budget this year values are updated, and you can also choose whether you also want to Update original budgets to make the amounts the same.

- The number of budgets you import must match the number of accounting periods configured in the system.

- If you have different numbers of accounting periods defined for different years in Accounting System Manager then you must import these separately.

Open: Nominal Ledger > Utilities > Import and Export > Import Ledger File

You can import budgets set at nominal account level, but not combined nominal budgets. This is useful if you want to maintain your budgets in an Excel spreadsheet and makes the process of entering and updating your budgets much quicker.

- You can import the current year's budgets for existing nominal accounts, and budgets for up to five future years.

- You can't import combined budgets, group budgets, budgets for previous years, or budget profiles for future years.

To import budgets:

- In the Data to import list, select Budget values.

- Select Validate and import records.

-

Choose whether you want to Update original budgets.

- If you only want to update the Budget this year values and not the Original budget values, don't select Update original budgets.

- To update both the Original budget values and Budget this year values (to be the same), select Update original budgets.

-

Click OK.

-

Browse to your import file, select it and click Open.

The validation checks are repeated and reports are produced showing the records that have been imported and second report (if required) showing those that can't.

Note: The reports are displayed as a preview, printed, or sent to the spooler. This depends on the Output mode you have set.

Note: If you get a message that the process cannot access the file, make sure your import file is closed and isn't open in any other applications.

-

Check both reports to ensure that your records are complete and correct.

-

Make any required corrections to the records in your import file.

As part of this update remove the details of records that were successfully imported.

- Repeat this process to import those corrected records.

Budget owners and combined nominal budgets

In addition to the budgets set at a nominal account level, you can also create combined nominal budgets. You can use these to:

-

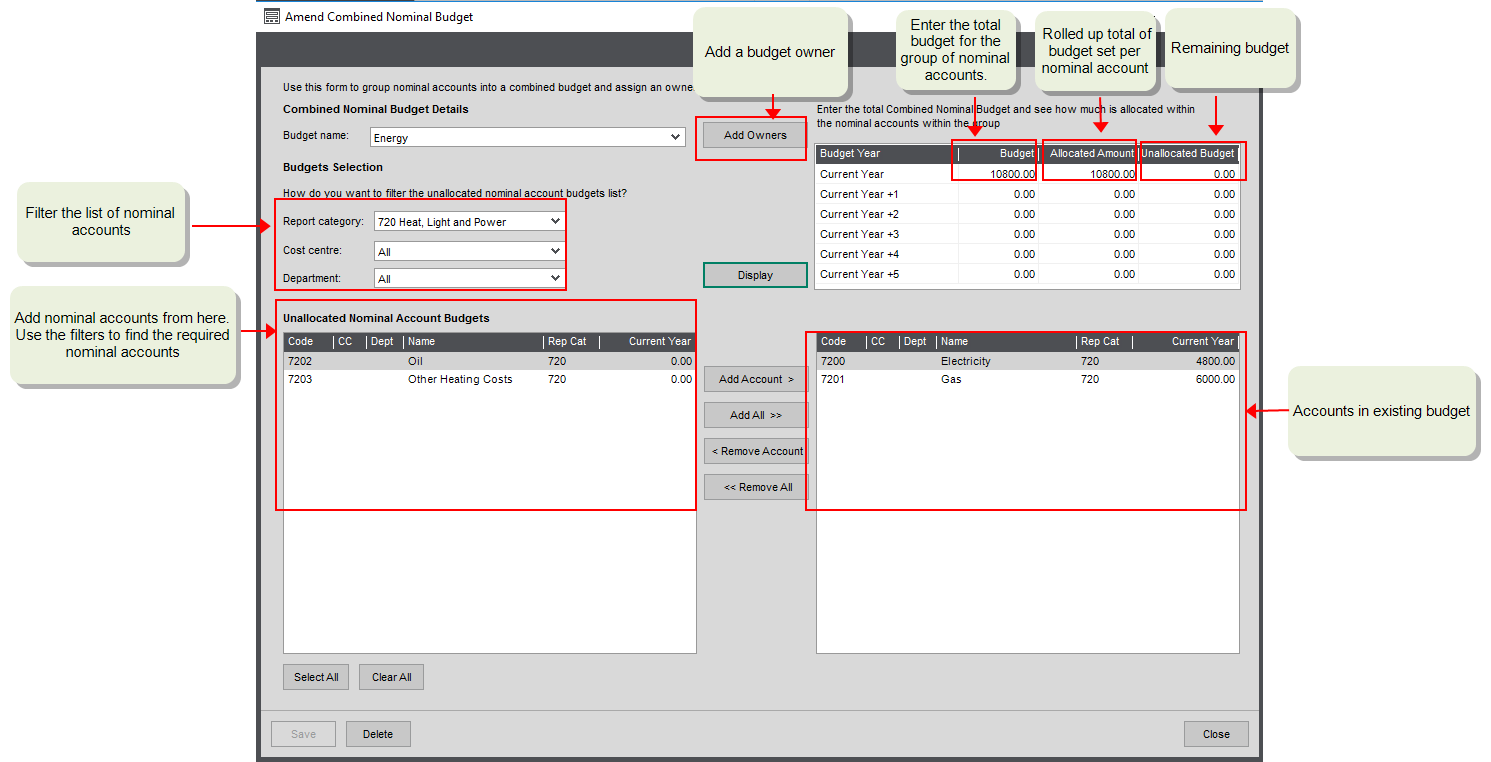

Group nominal accounts together to report on the rolled up totals.

A combined budget allows you to group together any combination of nominal accounts and report on the rolled up total budget of all these accounts against the rolled up actual total balance (and any committed costs). This also helps you check that the budget figures you've set for each nominal account are correct, by showing you how much of the overall combined budget has been allocated to the nominal accounts.

-

Set a Budget Owner.

Budget holders can then use the My budgets overview workspace to check actual spend against the budgets where they are set as the Budget Owner.

Finance managers can track the actual spend against budget using Excel reports such as the Nominal Budget Overview and printed reports such as Budget Statement Breakdown by Department report.

Purchase requisitions can also be entered against combined budgets, with the budget owner as the authoriser. See how to set this up.

-

Set an anticipated budget for a group of nominal accounts.

If required, you can also use combined budgets to set anticipated budgets. Here you would provide a total budget for the selected nominal accounts that is more than total budgets entered for the accounts. This a good way of recording a budget that you don't want to fully allocate yet.

For example, you might have an annual budget of £800 for materials but only want to allocate £600 to the budget owner at the beginning of the year.

You can set a combined nominal budget for the current year and up to 5 future years.

You have a single budget for your utility bills, but post your gas and electric bills to separate nominal accounts. To track the total budget for energy:

- Create a combined nominal budget for Energy.

- Set individual nominal account budgets for Gas and Electricity.

| Budget Name | Nominal account | Budget Amount | Allocated Amount | Unallocated Amount |

|---|---|---|---|---|

| Energy | 108000 | |||

| 7200 -Electricity | 4800 | |||

| 7201 -Gas | 6000 | |||

| 10800 | 10800 |

How to set up combined nominal budgets

For your next steps, see How to report on your budgets.