Departments

Using departments

Departments are codes that you can add to profit and loss nominal accounts, to help keep track of your income and expenses.

Each nominal account has the same code but with different departments.

Each of John's branch offices has two departments, Sales and Administration. As he also wants to record income and expenses by department, he creates two department codes, ADM and SAL. He also applies these to his profit and loss nominal accounts.

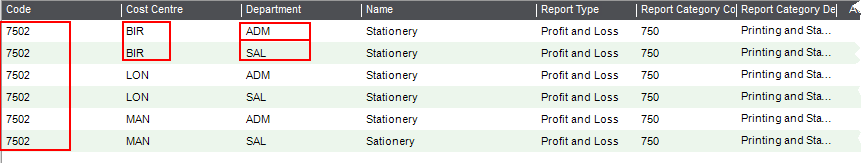

His nominal accounts for stationery purchases are shown below:

| Nominal Account Code | Cost Centre | Dept |

|---|---|---|

| 7502 | LON | ADM |

| 7502 | LON | SAL |

| 7502 | MAN | ADM |

| 7502 | MAN | SAL |

| 7502 | BIR | ADM |

| 7502 | BIR | SAL |

Departments are additional codes that you can add to profit and loss nominal accounts, to help keep track of your income and expenses in a particular area.

For example:

- A primary school might set up a department for each year, from Nursery to Year 6.

- A secondary school might set up a department for each teaching subject area, such as English, Mathematics and Art.

Each nominal account has the same code but with different departments.

-

First you'll need to create a department code for each area. A standard set of departments has been created for you that represents the main areas in most schools, such as Maths and English for Secondary schools or Year 1, Year 2 for Primary.

To change or add new departments:

Open: Settings > Cash Book / Nominal Ledger > Departments

-

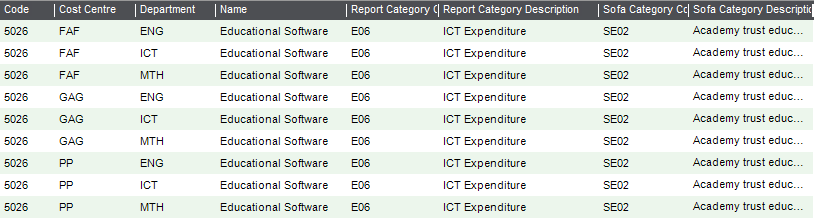

For each nominal account code used to record income and expense, you'll need a nominal account plus cost centre plus department. The majority of our income and expense accounts will also have a cost centre, so your nominal accounts will look something like this:

- When you record transactions, you choose the nominal account with required cost centre and department.

- When you run your financial reports, you can group your balances to show income and expenditure by cost centre (fund) and by department.

Applying departments to transactions

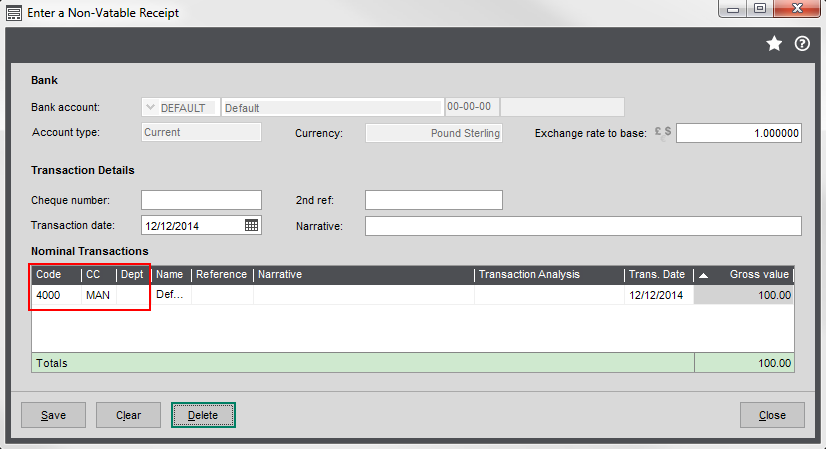

Once set up, you need to make sure that transactions are posted to nominal account with the correct cost centre and department combination. When you post transactions directly to your nominal accounts, such as a cash sale, you can select the nominal account with the correct CC or CC/ Dept combination.

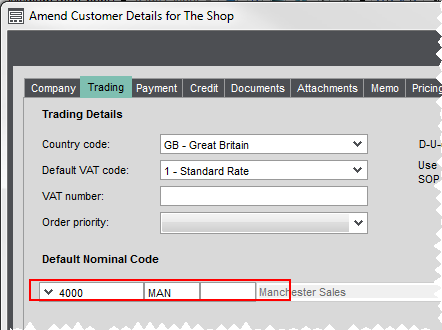

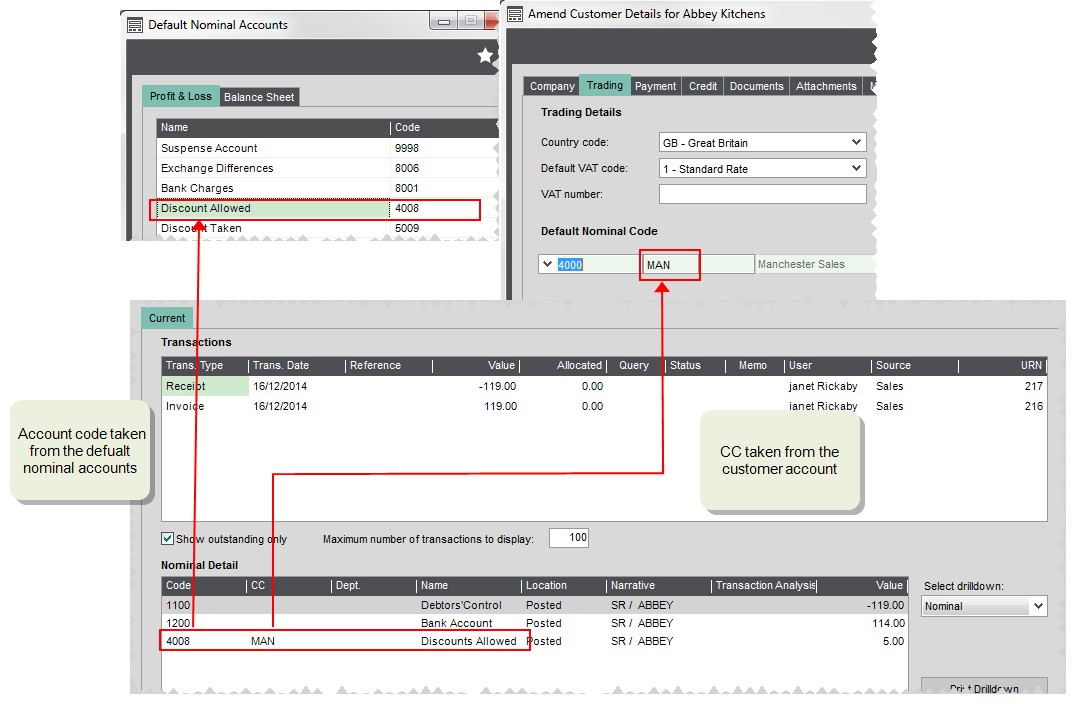

For sales and purchase transactions for customer and supplier accounts, you can specify the nominal account you want to use for particular customer or supplier on their account. When you enter transactions, this nominal account is automatically selected. To make sure sales and purchases are assigned to the correct nominal account, you can select a nominal account with a CC or CC / Dept combination. For example, a customer of your Manchester office, would have their default nominal account as 4000 MAN.

Once you have set a nominal account with a CC or CC / Dept, as the default nominal account on a customer or supplier account, Sage 200 uses this when posting transactions automatically. When Sage 200 posts a transaction to a profit and loss nominal account, it posts to the account code associated with the default nominal account and the CC/ Dept associated with the customer or supplier account. A settlement discount for a customer with a default nominal account of 4000 MAN, would post to a Discounts Allowed nominal account, 4008 MAN.

Once set up, you need to make sure that transactions are posted to nominal account with the correct department. When you post transactions directly to your nominal accounts, you can select the nominal account with the correct department.

Default nominal accounts on customer and supplier accounts

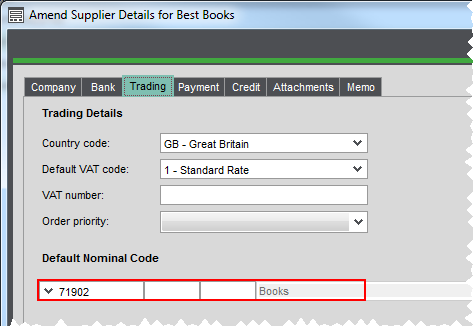

Specifying a default nominal account on a particular supplier or customer, means that this nominal account is always entered by default on all transactions.

This is useful when the majority transactions for a customer or supplier account are posted to the same nominal account. We recommend that if you do set a default nominal account here, this account doesn't have cost centre or department associated with it. This is to make sure that transactions aren't posted to the wrong fund or department.

If you don't set a default nominal account, you just have to make sure you choose the correct nominal account plus cost centre and department when entering transactions.

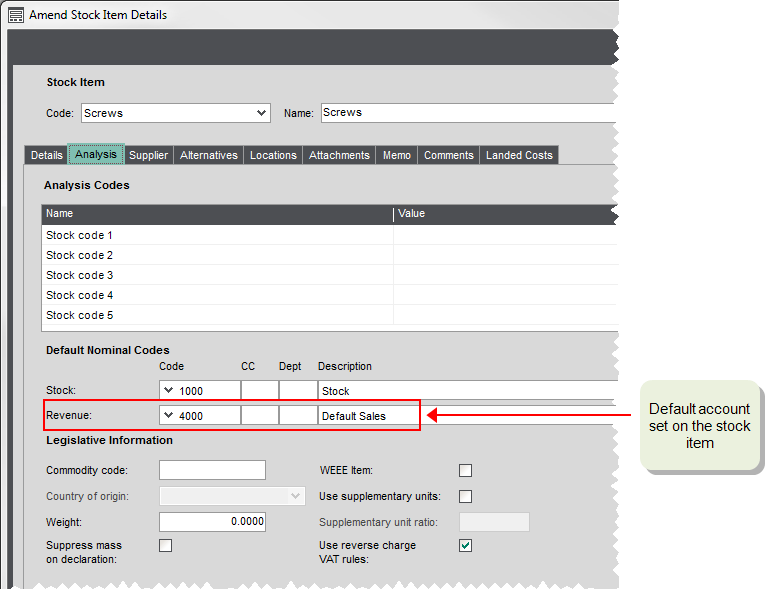

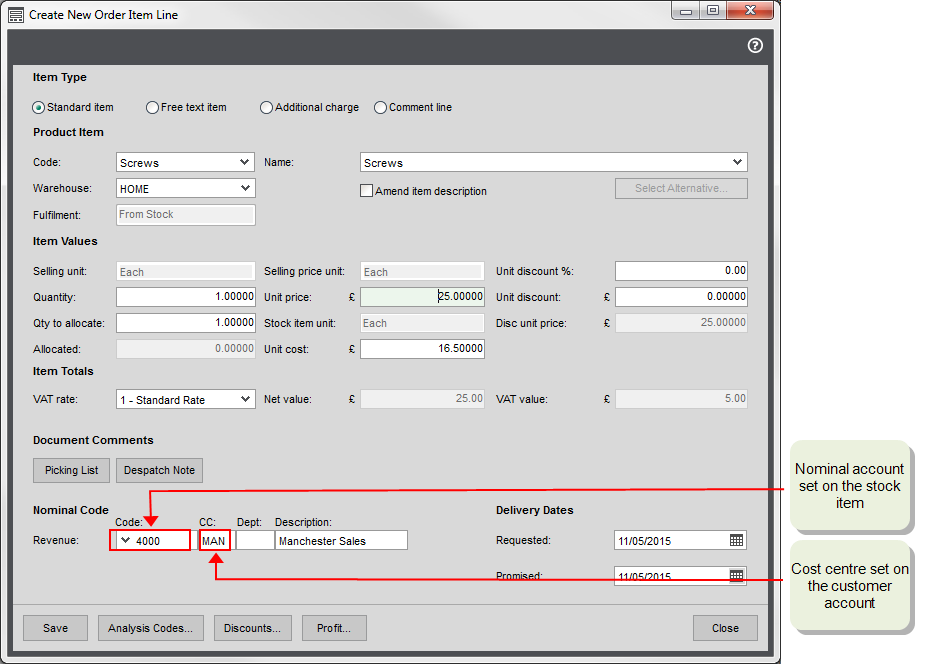

Cost centres and departments with stock

When choosing the nominal account to use by default on invoice and order lines, Sage 200 looks at the default nominal account assigned to the stock item and the cost centre and/ or department (if used) set on the customer or supplier account. For example, if you've set a default nominal account of 4000 MAN on a customer account and a default nominal account of 4001 of a stock item, your 4001 MAN is entered on the invoice or order line, by default.

Note: When using cost centres and departments with your customer and supplier accounts, you must make sure that you create nominal accounts with all the required cost centre and department combinations. If a nominal account doesn't exist, then the line value is posted to the suspense account.

John has a business that sells some goods and some services. He wants to make sure that he records these sales separately in his nominal accounts. Ho also uses cost centres with his nominal accounts to record sales for each of his branch offices. To do this, he has a default Sales nominal account of 4000 and a nominal account for services 4001. He then sets up additional nominal accounts for Sales and Services for each cost centre London LON, Birmingham BIR, and Manchester MAN.

To make sure his sales are recorded correctly for each branch, each customer account is set to the default sales nominal account with their branch cost centre. So a customer of the Manchester office would have a default nominal account 4000 MAN.

To make sure his products and services sales are recorded correctly, his product groups use different default Revenue accounts depending one whether they are Stock(4000) or Service (4001) type groups. These default nominal accounts are then inherited by stock items in the group. As John doesn't want to use further separate nominal accounts, he keeps these defaults for his stock items.

When he enters an order for a stock item for a customer in the Manchester office, the nominal account used on the order line defaults to a combination of the nominal account from the item and the cost centre from the customer in this case 4000 MAN. In the same way an order line for a service item defaults to the 4001 MAN nominal account.

In this example, if John hasn't created the 4000 MAN or 4001 MAN nominal accounts, the order line value will post to the suspense account.

Note: The same rules apply to purchases. A purchase order line will post by default to the Stock nominal account set on the item with the cost centre and/or department set on the supplier account.

Importing departments

If you need to add a number of departments, it might be quicker for you to import them into Sage 200.