Cancel sales invoices and credit notes

You can cancel an invoice or credit note as long as it has not been posted.

Once cancelled both the order and the despatch notes can be amended, before printing the new invoice. The new invoice is assigned the next available invoice number.

Details of the cancelled sales invoice remain stored in Sage 200. A cancelled sales invoice is removed from Sage 200 if you delete archived sales orders and returns.

You can also cancel credit notes when dealing with a sales return.

When the invoice is cancelled:

- The associated despatches are marked not invoiced.

- The associated order can be amended.

- The associated despatch can be amended.

To cancel a sales invoice or credit note

Open: Sales Order Processing > Order Processing > Cancel Invoice.

- Select the invoice or credit note from those displayed and click Cancel Document.

- Accept or amend the displayed date.

- Enter a reason for the cancellation and click OK.

Check when orders have been cancelled

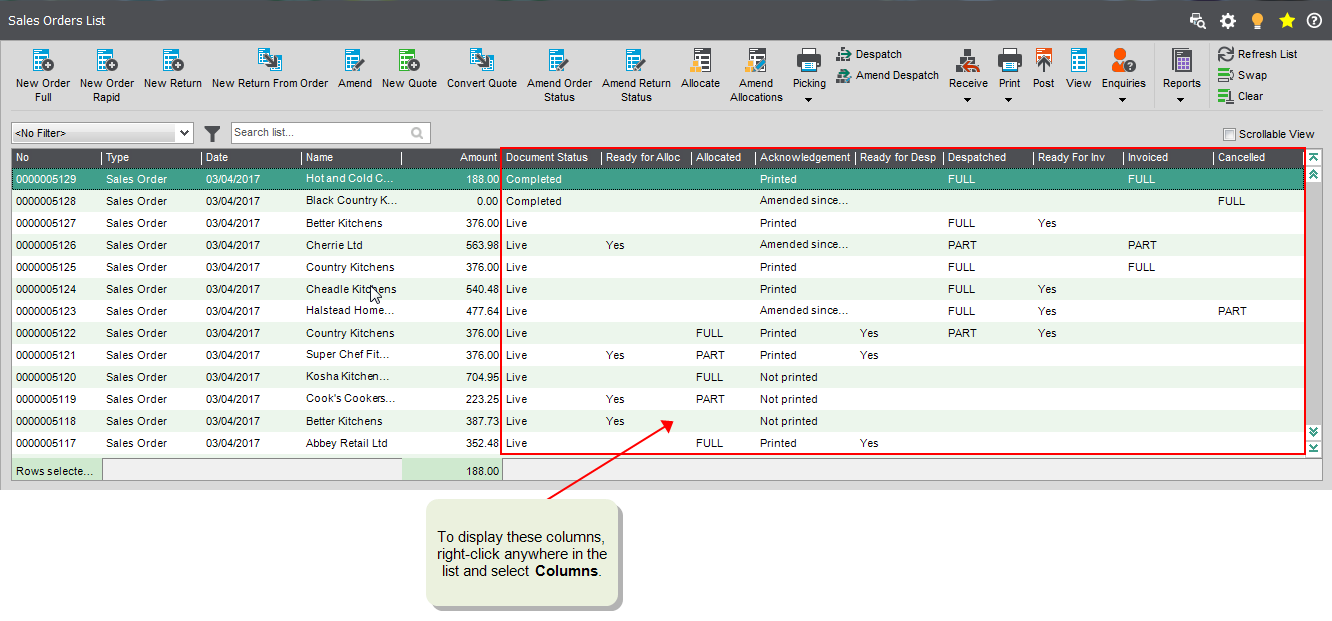

You can see when orders have been cancelled from the Sales Orders List.

Open: Sales Order Processing > Sales Orders List.

-

The Cancelled column shows:

- Part: Only some of the items in the order have been cancelled, but not all of the items. For example, an order may only be Part cancelled if some items have already been despatched, or if you have deleted items but haven't yet cancelled the order.

- Full: All items in the order have been cancelled.

Open: Sales Order Processing > Sales Orders List.

- Right-click anywhere in the list.

-

Select Columns > Cancelled.