Generate a suggested payments file

How to

Generate a suggested payments file

Before you begin, you must have:

-

Posted all transactions.

-

Updated all pending transactions.

-

Allocated all outstanding payments and credit notes.

-

Dealt with any queried transactions.

Failure to complete these steps may cause imbalances in your accounts.

Invoices that have been allocated are marked as paid and so won't be selected by this process. Making sure that payments you have made are allocated helps to prevent payments being created more than once and your suppliers being overpaid.

Open: Purchase Ledger > Period End Routines > Payment Processing > Generate Suggested Payments.

-

Enter the following:

-

Remittance date: This date is printed on the remittance advices and cheques. The transactions that are included in the file are determined by comparing the Remittance date with the transaction due date.

-

Pay invoices more than: days overdue: Enter the number of days overdue which an invoice must be to qualify for payment.

-

Include all invoices with settlement discounts regardless of their age: Select this to include all invoices with settlement discounts, regardless of their due date. Clear this to pay only invoices that are due.

-

-

To generate the suggested payments file, click OK.

If a suggested payments file has already been generated, choose whether you want to replace the existing file.

If you do not want to replace the file at this point, you can print the existing payment reports in order to view the contents, then decide whether you want to continue to use the existing file or create a new one.

-

Choose whether you want to print the Suggested payments report.

To print the report at a more convenient time choose Period End Routines > Payment Processing > Report Suggested Payments.

Useful info

About generating suggested payments

Use this to create a Suggested payments file. This calculates the total value of the outstanding invoices on a supplier's account and suggests a single payment. Payments are not generated for any supplier accounts on hold, or for any invoices marked as queried.

When the file is created, the payments are checked to ensure they are valid. Any payments that are not valid are shown on the Suggested Payments report along with the reason that they are not valid. Payments are not valid if:

-

The payment exceeds the maximum payment value set on the Supplier Defaults tab in Purchase Ledger settings.

Payments that have exceeded that maximum payment valueIf you find a payment which has exceeded the maximum payment value, you can either:

- Amend the file, using Amend Suggested Payments to reduce the payment value. This is the preferred method.

- Change the maximum payment value in the Purchase Ledger settings Supplier Defaults tab and then generate a new suggested payments file.

You can also identify payments which have exceeded the maximum payment value using the Maximum Payment report.

- The payment currency is different to the bank account used for the payment.

-

The payment amount is more than the balance on the account.

This occurs where there are unallocated payments on the supplier's account.

When you create the suggested payments file, you can choose to:

- Only include invoices more than a specified number of days overdue.

-

Always include invoices with settlement discounts.

Up to this point the suggested payments file has not affected your supplier balances.

Invoices with settlement discounts

About the VAT rules

-

In the UK, VAT on an invoice is only discounted when it is paid within the settlement discount period.

On each invoice, VAT is calculated by default on the full invoice value. If the invoice is paid within the settlement discount period, a VAT adjustment is required, to account for the discounted VAT.

-

In Ireland, VAT is calculated on the full value of the invoice regardless of any settlement discount.

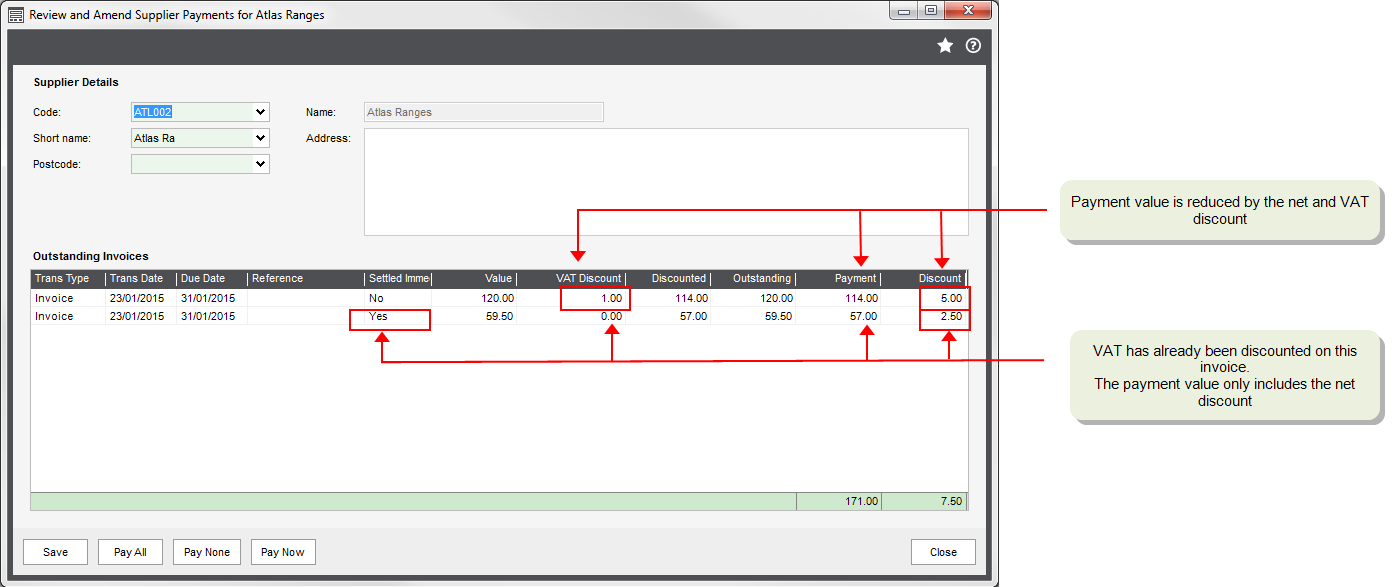

Suggested payments with settlement discounts

When you use payment processing, the net and VAT discounts are automatically included when the suggested payments file is created, as long as:

- The payment falls within the settlement discount period.

- The Settled immediately check box was not selected on the purchase invoice screen. This indicates that the invoice has already been paid and discounts the VAT straight away.

- The invoice has not been part paid.

For example, you have an invoice for £100 with a 5% (£5) settlement discount. If you run the Generate Suggested payments option before the end of the settlement discount period, the suggested payment for this invoice is £114 (£120 - £1 (VAT discount) - £5 (net discount)).