Reconcile VAT transactions

Before you produce your final VAT Return, we recommend you reconcile your VAT transactions. This helps you to identify transactions that have been posted incorrectly.

To reconcile your VAT Return, you must check the transactions included in the VAT Return against Vatable transactions in the Sales, Purchase and Nominal Ledgers.

To reconcile your VAT transactions

- Print the following reports. These should be for the same date range as the VAT period:

VAT Return Transactions - Codes Included in the VAT Return.

Open: Period End Routines > VAT Analysis | Current Period Return.

This report should also be titled Report Only - records not adjusted. This means the final VAT Return has not been produced.

The information for this report is taken from the central VAT file. It shows the total net input and output for each VAT code.

Vatable Transactions from the Sales Ledger and Purchase Ledger.

Open: Sales Ledger > Reports > Vatable Transactions.

Open: Purchase Ledger > Reports > Vatable Transactions.

The information for this report is taken from the Sales Ledger and Purchase Ledger.

Non-trading Vatable Transactions report in the Nominal Ledger.

Open: Nominal Ledger > Reports > Account Analysis > Non-trading Vatable Transactions.

The information for this report is taken from a central file used for storing Nominal and Cash Book Vatable transactions.

-

To reconcile your VAT Return:

- Check the net output and input totals, and the VAT input and output totals, for each VAT code, from the VAT Return Transactions report.

-

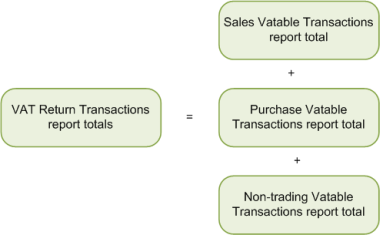

Compare these to the combined total of the Sales and Purchase Vatable Transactions reports, and the Nominal Ledger Non-trading Vatable Transactions report.

The totals for the individual Vatable Transactions reports added together, should equal the input and output totals on your VAT Return Transactions report.

Why might the totals not match?- The Vatable Transactions reports may have been generated with a different date range to the VAT period.

-

The Vatable Transactions reports print details of all Vatable transactions. Some of these transactions may have been entered using a VAT code that was not set to appear on the VAT Return.

You can see these transactions on the VAT Return transactions - Codes Not Included in the VAT Return report. This is printed with the VAT Return.

- The VAT Return reports include transactions dated before the start of the VAT period covered by the VAT Return, but were entered after the previous VAT Return was generated. These transactions will not be included in the Vatable Transactions reports.

If you are unable to match the difference in totals based on these criteria, then we advise you to check the individual transactions manually until you locate the difference. Use the account and transaction reference to help you to find your transactions on the report.

Sage is providing this article for organisations to use for general guidance. Sage works hard to ensure the information is correct at the time of publication and strives to keep all supplied information up-to-date and accurate, but makes no representations or warranties of any kind—express or implied—about the ongoing accuracy, reliability, suitability, or completeness of the information provided.

The information contained within this article is not intended to be a substitute for professional advice. Sage assumes no responsibility for any action taken on the basis of the article. Any reliance you place on the information contained within the article is at your own risk. In using the article, you agree that Sage is not liable for any loss or damage whatsoever, including without limitation, any direct, indirect, consequential or incidental loss or damage, arising out of, or in connection with, the use of this information.