The customer account differentiates cash or retail customers from your regular customers. Cash or retail customers have no customer account so must pay for their orders immediately.

If you want to provide your customers with credit, and monitor your business relationship with them you must create a customer account for them. The customer account contains:

- The customer's name, address and a contact's details.

- The currency in which they conduct their business.

- Their credit limit with you.

- Your payment terms and credit reference information.

- Pricing and discount details.

Accounts can be created individually or using the import options.

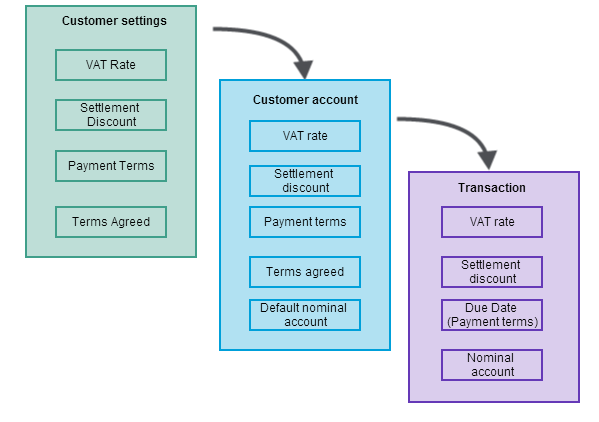

Each account must have a code, name and short name. All other details can either be left blank or are inherited from the customer settings and defaults. You can keep or change them as you create each account.

Some of these defaults also carry through to individual transactions. Again, you can amend them as you enter the details of a transaction.

Are you ready to perform these actions?

Have you completed the necessary set up so that you can perform the tasks listed here?

If you set the defaults for your customer records and invoices you will reduce input errors, ensure consistency and speed up the customer account creation and invoicing processes.

Import, export and update accounts

If you need to add or update a large number of

You can also export accounts to a file in the same format used for an import. This means you can export information and make changes to it using an external tool (such as Excel), and then import your updated information back into Sage 200.

See Import and export customer accounts.

Amending accounts

Any changes you make to an account will only affect transactions that you enter after you've made the changes. For example, if you change the settlement discount details, this doesn't affect the discount details already entered on transactions.

- You can't change the account Code once the account has been saved. If you've entered a code incorrectly and haven't entered any transactions for it, delete the account and recreate it.

Once transactions have been entered for an account:

- You can't change the currency.

- You can't delete the account.

Foreign currency accounts

You can create customer accounts in any currency. To create an account for customer in another currency, just set the currency on the Company tab and the Country Code and VAT details on the Trading tab of the customer's account. All transactions are then recorded in the customer's currency.

When payments are allocated to transactions, any changes in value due to exchange rate fluctuations are dealt with automatically.

Revalue foreign bank accounts

If you want to make sure your outstanding transactions reflect the latest exchange rates, you can revalue the outstanding balance on a customer's account.

Opening Balances

Opening balances represent the financial position of your organisation on the day you start entering live transactions into Sage 200. Whatever date you choose you are likely to have opening balances, whether your organisation is just starting up or changing from another accounting system.

If your

Opening balances are not posted to the nominal accounts or the VAT return. This is because the balance of your Debtors Control, Sales and VAT nominal accounts will be included in your opening balance journal.

You can enter an opening balance for each

See Enter customer opening balances.

Put accounts on hold

You can put accounts on hold when you want to temporarily suspend an account and prevent new transactions being posted to it. This is useful if you need to resolve a query or wait for a payment to be received.

An account can be put on hold at any time. Once on hold, new transactions cannot be entered for the account. Existing transactions can continue to be processed, although you will see a warning to inform you that an account is on hold.

Hide accounts

Once you've stopped trading with a customer, you can give the account a Hidden status.

Hiding an account prevents them being selected in error. The account is removed from the Customer List and all lookup lists. This means the account can't be selected when you're entering or processing transactions, invoices or sales orders.

See Change customer account status (hide or put on hold).

Write off accounts

If the account still has a balance, you can write off the entire debt and set it's balance to zero.

See Write off a customer account.

What if I create an account in error?

As long as no transactions have been posted to the account, you can just delete it. Just Amend the Account and click Delete at the bottom of the screen.

Once transactions have been entered for an account, it can't be deleted. If an account has been created in error, then choose to Hide the account so it can't selected when entering transactions.

See Change customer account status (hide or put on hold).

Customer alerts

You can set up alerts on a

When you set up an alert on the

You can choose to show alerts when entering invoices or credit notes, sales orders and returns, quotations and pro forma invoices, and for customer price enquiries.

Alerts are displayed for these activities in both the Sage 200 desktop and Web Portal (where available).

Alerts are specific to an individual

See Customer alerts.