Journal entries are used to post transactions directly to your nominal accounts or to transfer values between nominal accounts. Use journals for transactions that can't be entered using other Sage 200 screens or for making corrections when transactions have been posted to the wrong nominal account.

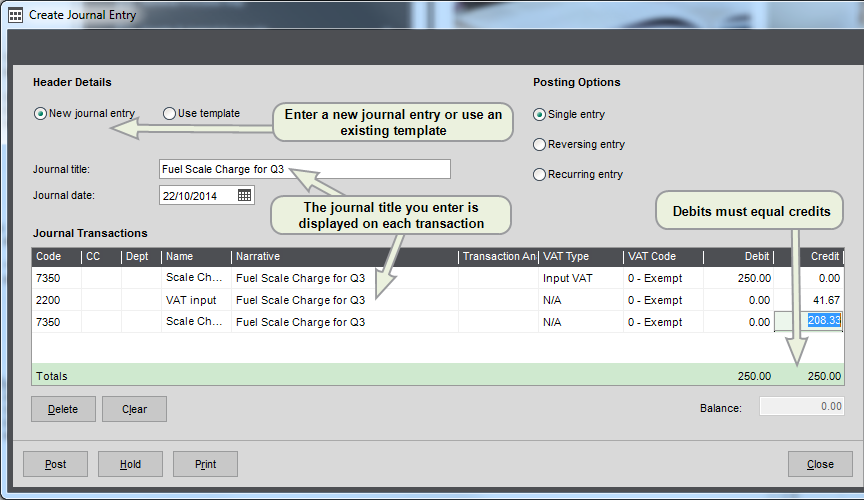

Each journal entry must follow double-entry bookkeeping principles and balance (the debit and credit amounts must equal) before it can be posted.

What you can do with a journal entry

When you create journal entries you can:

- Have Sage 200 automatically reverse it at a later date.

- Set it to recur so that multiple transactions are posted in a single action.

-

Put it on hold so it can be completed and posted later.

You can also examine the details of held journals in the Held Journal report.

Things to remember about journal entries

A journal follows double entry bookkeeping principles so it must balance before it can be posted - the debit and credit postings must be equal.

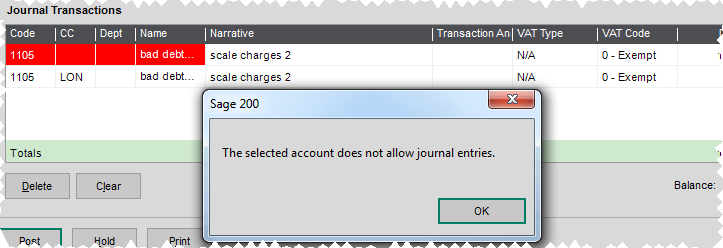

You can only post journal entries to nominal accounts that have the option Allow manual journal entries selected on the nominal account record. If you select a nominal account that does not have this setting selected Sage 200 will highlight the nominal code and stop you from posting the journal.

Journal templates

Journal templates enable you to create a library of reusable journals.

For example, you transfer set amounts between nominal accounts on a regular basis so you create and use a template to hold the details of the nominal accounts posted to and the amounts involved.

Each journal template can be amended or deleted when required. Once you have created the template, you can select it and use its details as the base for a new journal.

You can apply rules to a template that govern how often it can be used, the date from which it may be used and the date after which it can no longer be used. Once the journal exceeds the specified limitations, then it cannot be used again and should be deleted.

There are three types of journal template available to you:

-

Journal templates with no values set.

Useful if you make regular transfers of differing amounts.

-

Journal templates with values set.

Useful if you regularly transfer a set amount.

-

Journal templates with percentages set.

Useful if you want to automatically apportion an amount across several transaction lines, such as distributing an expense across cost centres or departments.

You can restrict how often an individual template is used by specifying a total number of times it can be used or the start and end date of a period during which it can be used.

Taxable journals

You can use taxable journals for special VAT schemes, or to process fuel scale charges.

Note: You should not use a nominal taxable journal to replace the usual invoice, credit note and taxable payment or receipt features.

Only use journals that include VAT for transactions that:

- Can't be entered using any other Sage 200 processes such as an invoices, credit notes, bank payments or receipts.

- Don't affect the bank account.

- Need to be included on the VAT Return.

When posting a journal with VAT, you must make sure the nominal account details contain separate lines for the net, VAT and gross. This makes sure that the journal is included on your VAT Return correctly. In a single journal, you can have several lines representing each of these elements:

- The gross element lines will use the tax type N/A.

- The net element lines will have the tax type input goods or output goods. They represent the value of the entry excluding VAT.

- The tax element lines will have the tax type input tax or output tax. They represent the value of the VAT on the entry. The tax element will almost always be posted to the nominal account used as the VAT control account.

Posting journal entries

You cannot post journal entries to a nominal account that is set to reject manual journal entries (the Allow manual journal entries option on the nominal account record controls this). Sage 200 will highlight any nominal accounts you select that do not allow manual journal entries and you will not be allowed to post the journal entries.

When you create a journal entry the values in the journal must balance when you post the transactions.

When you post a journal the entries immediately affect the account balances provided they are for an open period. If the transactions are for a period that is not yet open then they will not be posted until that period is opened.

When making journal transfers that require analysis by cost centres and/or departments, you can assign a nominal code with a cost centre and/or department code for each transaction line of the journal.

Putting journals on hold

When a journal entry is put on hold its details are saved so that they can be checked or amended before being posted.

You access journal entries that have been put on hold from the Currently Held Journals screen.

This screen lists all the journal entries that have been saved and you can:

- open an individual journal entry to review, make amendments and post the transactions detailed within it.

- delete an individual journal entry or select and delete all the listed journal entries.

- print the details of a single, or all listed journal entries.

Note: It is possible to put a journal entry on hold when the debit and credit values detailed on it do not balance. Remember that Sage 200 will not allow you to post a journal entry in this state so ensure the credits and debits balance when you open a held journal.

Previous year journal entries

If you have closed a financial year, but need to make corrections to update the closed year's financial balances, you can use Previous Year Journals to create transactions in a previous financial year.

Previous year journal values are recorded differently depending on whether journals are posted to Balance Sheet or Profit and Loss accounts. This is because in each financial year the Profit & Loss essentially begins again, but the Balance Sheet carries on. As part of the year end process, the balance of all P & L accounts is transferred to the Accumulated Profit account and the YTD balance is reset to zero.