Reconcile your Creditors Control account

The Creditors Control nominal account represents all the money that you owe your suppliers. Reconciling the balance of this account is something most businesses do regularly.

This nominal account is updated automatically every time you post the following transactions to your supplier's account: Invoice, Credit Note, Payment or Refund.

To reconcile your Creditors Control account, you check that the balance of the account matches the total outstanding value on your supplier accounts, as shown on the Aged Creditors Report.

You can do this for all your transactions or up to a date in the past, such as the end of your previous month.

Tip: Remember the dates you use when running the various reports are the key to reconciling successfully. All reports must be run using the same date range to make sure the same transactions are included.

Reconcile the total balances

-

From the Nominal List, filter the list to only show the balance of your Creditors Control Account.

- Click Refresh to make sure the account balances are up to date.

-

Make a note of the balance. In the example shown, the balance is (-)808.06.

Note: Don't forget the balance of the nominal account will show as a - (minus) because it has a credit balance.

Deferred transactions are those that have been posted to a Future accounting period. These are included on the balance of your supplier accounts but not the nominal accounts.

Tip: If you have a large number of deferred transactions- check you've opened your accounting periods.

To do this:

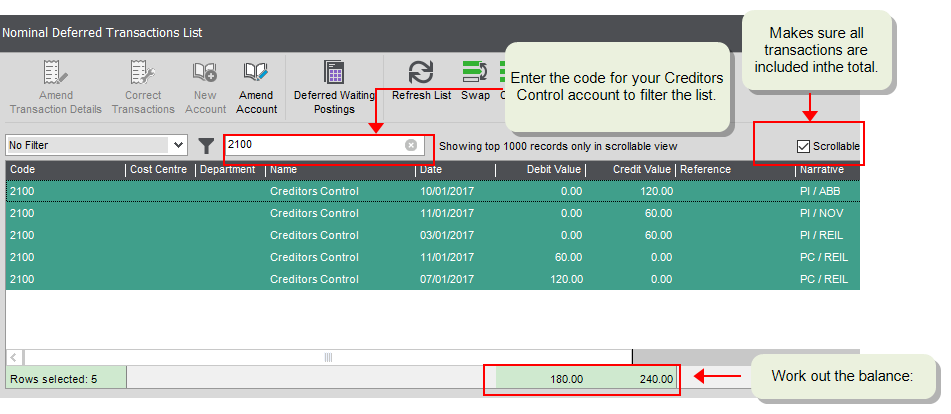

Open: Nominal > Nominal Deferred Transaction List.

- Refresh the list to make sure all transactions are included.

- Filter the list to only show transactions posted to your Creditors Control Account.

- To find the total of these transactions:

-

The total debits and credits are shown at the bottom of the list. Work out the total balance.

-

Add the total balance of the deferred transactions to the balance of your nominal account.

In the example shown:

- The Creditors Control Account has a balance of 808.06.

- The value of deferred transactions posted to the account is 240 - 180 = 60 (Credit minus Debit)

- Add the deferred transactions to the posted account balance and the balance of Creditors Control Account is 868.06.

To do this you run the Aged Creditors report. Make sure you run the report for a date into the future. This is to make sure all transactions are included in the report, in case some have been entered with the wrong date.

To do this:

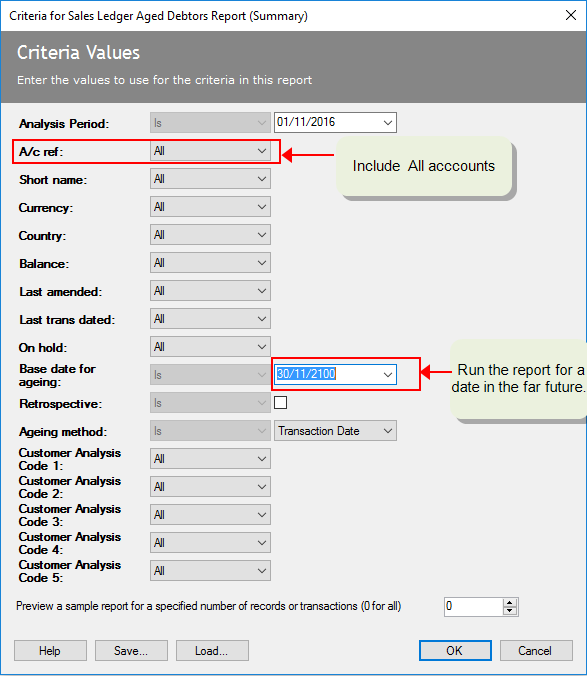

Open: Supplier > Suppliers Reports > Credit Control > Aged Creditors (Summary).

-

Select the following criteria

| A/C Ref |

All |

|

| Retrospective |

Not ticked

|

| Base Date for Ageing |

A date in the far future such as 01/01/2100 |

-

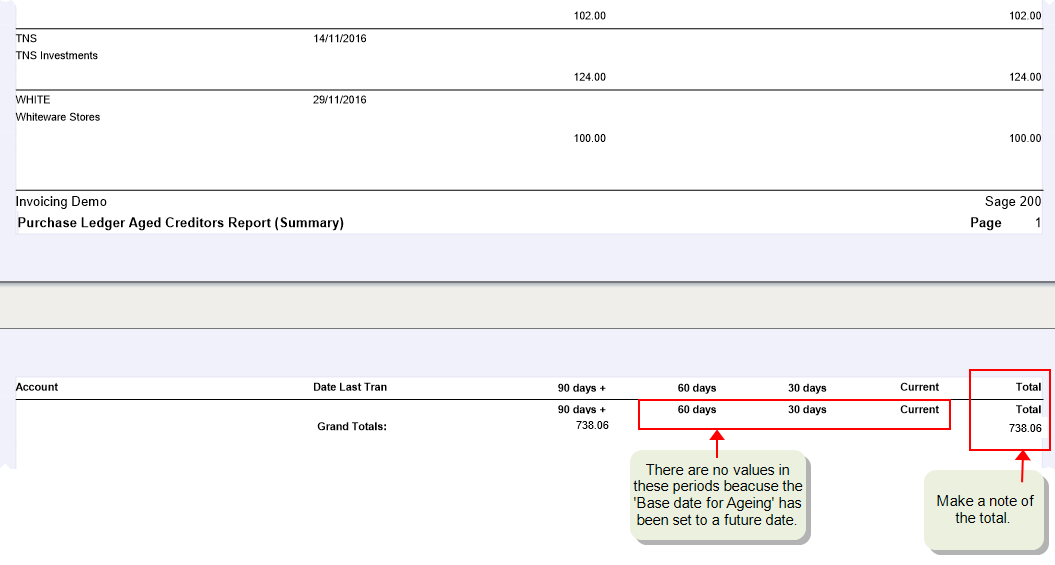

Make a note of the total on the report.

-

Compare the total to the balance of the Creditors Control account.

What if there's a difference?

Differences can be caused by a number of issues, most commonly these are:

- Journals posted directly to the Creditors Control Account.

- Opening balances entered for your supplier accounts.

- Purchase transactions posted to the suspense account.

In the example shown:

Your Creditors Control nominal account balance is £868.06, and your Aged Creditors report total is 738.06, making a difference of £130.

Transactions posted directly to the Creditors Control Account, using the journal entry screens, are not reported on the Aged Creditors report as they're not linked to a supplier account. The value of these journals will need to be added to the Aged Creditors total.

To do this:

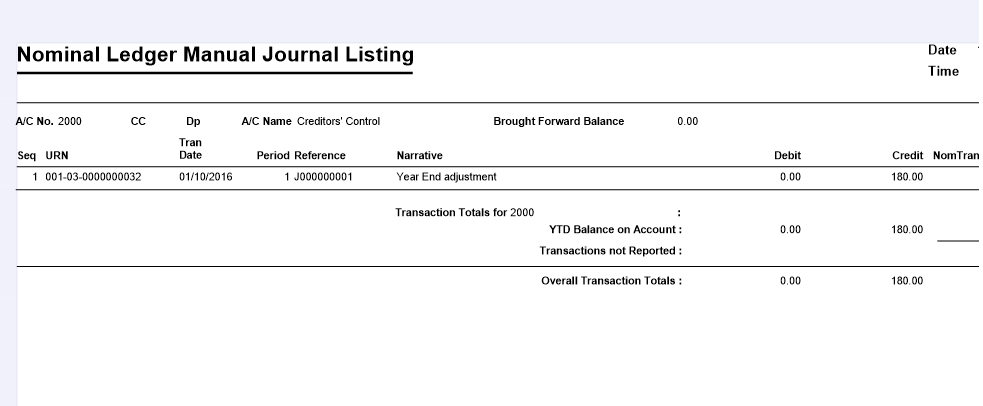

Open: Nominal > Nominal Reports > Account Analysis > Manual Journal Listing.

-

Select the following criteria:

|

Account number or

Account Name

|

Select Is and enter the code or name of your Creditors Control Account. |

| Posting date |

All

|

-

The total Debits and Credits are shown at the bottom of the report. Work out the total balance.

- Add this balance to the total of your Aged Creditorsreport.

In the example shown:

- The total of the Aged Creditors report is 738.06.

- The balance of the Creditors Control Nominal Account is 868.06.

- A single manual journal has been entered for 180.00.

- Add this to the Aged Creditors total 738.06 + 180 = 918.06.

- The difference is now £50. (918.06 - 868.06 = 50)

When you enter an opening balance on a supplier account, it's not posted to your nominal accounts. This is because the value of the Creditors Control nominal account is usually included in your opening balance journal.

If you haven't entered an opening balance journal, then your Aged Creditorsreport won't match the balance of the Creditors Control nominal account. The same applies if you have entered an opening balance journal but haven't entered opening balances for the supplier accounts.

Add the value of any opening balances to the balance of the Creditors Control account.

To do this:

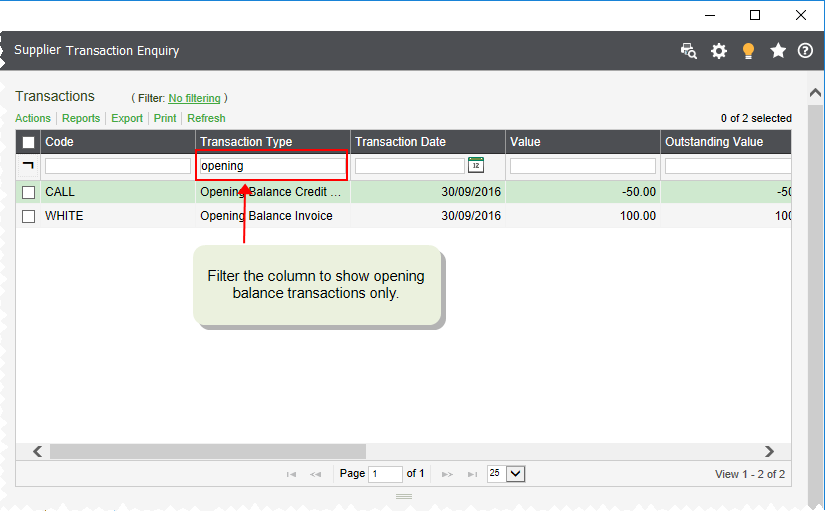

Check the Supplier Transaction workspace for any opening balance invoices or credit notes.

Open: suppliers > Supplier Enquiries > Supplier Transaction Enquiry.

- Enter Opening Balance to the quick filter for the Transaction Type column. This will filter the transactions to only show opening balances.

-

Total up the opening balance transactions. Don't forget to take the credit notes away from the invoices.

- Add this balance to the total of your Creditors Control account.

In the example shown:

- The balance of the Creditors Control Nominal Account is 868.06.

- After adding the value of any journals, the balance of the Aged Creditors report is now £918.06 (738.06 + 180 = 918.06).

- Two opening balances have been entered; an invoice for £100 and a credit note for £50.

- The total of the opening balance transactions is 100 - 50 =50.

- Add the total to the Creditors Control account 868.06 +50 = 918.06. This now matches the Aged Creditors report.

Transactions are automatically posted to the Creditors Control account. To do this, Sage 200 uses the account specified in the Default Nominal Accounts. If you entered transactions before specifying , they will have been posted to the suspense account.

To check this:

Nominal List > Reports > Transaction Listing.

-

On the report criteria, set the following

|

Account number or

Account Name

|

Select Is and enter the code or name of your Suspense Account |

| Source |

Purchases

|

-

If there any transactions on the report, they value of each one will need to be posted to the Creditors control account. To do this, you'll need to move the value from the suspense account using a journal. Make sure the journal to do this is entered for the same posting date. This is to make sure that the value is reported in the correct period. Otherwise your Aged Creditors report may not match again in the future.

Use the Verify Data option to make sure there are no errors in your data and your nominal account balances are correct.

This checks to make sure that:

- The balance on each nominal account agrees with the total of the transactions posted to each account.

- Previous years figures balance for all accounts.

If any errors are found they are corrected and shown in the Error Log. Any imbalances in your nominal accounts are posted to the suspense account.

Before you start

Before your run the verify data option, you must:

- Make sure you've backed up your data.

- Make sure all other users are logged off. A list of all logged users is displayed when you start.

To verify your nominal data

Open: Period End Routines > Verify Data > Financials

-

Choose Nominal from the Module drop-down list.

-

Click OK.

-

Any errors and fixes are reported on the Error Log.

Reconcile retrospectively

Sometimes you'll want to check what the balances are for data in the past such as the end of the previous month. This is also very straight forward. Again the key thing is to make sure that you use the same date.

Use the Transaction Listing report to find total value of current transactions posted to the Debtors Control Account up the end of a specific period.

To do this:

Open: Nominal > Reports > Account Analysis > Transaction Listing.

-

Enter the following criteria.

| Account number or Account Number |

Select Is and enter the code or name of your Aged Creditors Control account |

|

| Transaction Date |

Select To and enter the date of the end of the period. |

|

- Make a note of the total balance.

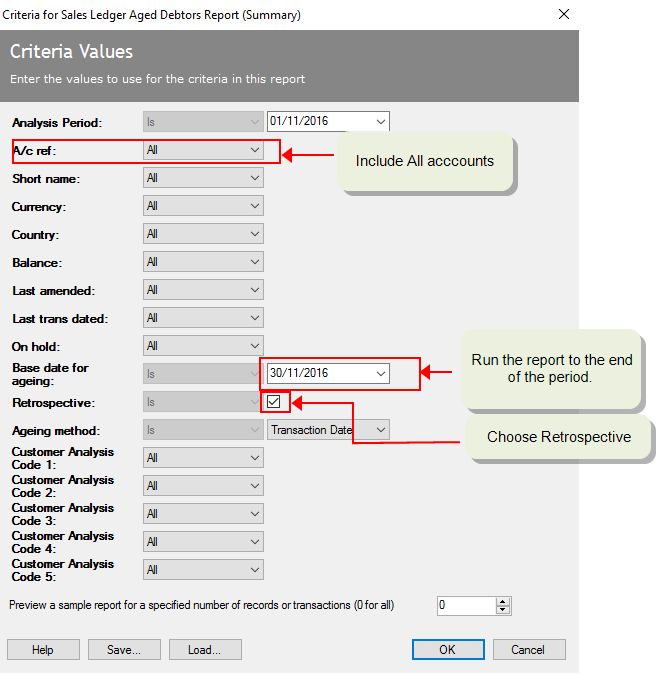

To do this you run the Aged Creditors report. Make sure you run it for the same date as the Transaction Listing report and select Retrospective

To do this:

Open: suppliers > Supplier Reports > Payments Control > Aged Creditors (Summary).

-

Select the following criteria

| A/C Ref |

All |

|

| Retrospective |

Ticked

|

| Base Date for Ageing |

The date of the end of the period |

- Check the total on the report and

- Compare to the total of the Debtors Control Account for the same period.

What if there's a difference?

Differences between the balance of these reports can be caused by a number of issues.

- Check that you're running the reports for the same dates.

- Follow the steps above to check for:

- Deferred transactions.

- Opening balances.

- Journals posted to the Creditors Control Account.

- Purchase transactions posted to the suspense account.

- The nominal account balance is correct.

To check why there's a difference when comparing the balances for a specific period, consider the following:

When running a retrospective Aged Creditors report, the date that paymentswere allocated to invoices can also create differences.

This occurs when the date a payment is allocated is before the date of the payment, and the Aged Creditors report is run for a date between the allocation date and the payment date. This is because:

-

Aged Creditors report:

As the invoice has been allocated in the period the report is being run for, the invoice doesn't have outstanding balance so is not included on the balance of the report.

-

Creditors Control Account:

As the invoice has been posted in the period the report is being run for, the invoice is included in the balance of the account. The payment is not included as it's transaction date is in the following period, hence creating the difference.

How to find the differences:

For example

- An invoice for £60 is entered for the 26/10.

- The payment is received and entered for 02/11.

- The payment is allocated to the invoice with an allocation date of 30/10.

- The Aged Creditors report is run retrospectively with the Base date For Ageing as 31/10. The balance is 0 because the invoice has been allocated.

- The Nominal Transaction Listing report is run for Aged Creditors up to 31/10. The balance is £60 because the invoice has been posted in that period, but not the payment.

If you use foreign currency, any currency adjustments create differences in the same way as the allocation date. This is because currency adjustments are posted according to their allocation date and not their transaction date.

The difference occurs when the date a receipt is allocated is before the date of the payment, and the Aged Creditors report is run for a date between the allocation date and the receipt date. This is because:

-

Aged Creditors report:

As the payment and the invoice have been allocated to each other in the period the report has been run for, neither the invoice or payment have an outstanding balance.

-

Creditors Control Account:

The invoice and the currency adjustment are included. This is because the currency adjustment's transaction date is the same as the allocation date and in the period the report is being run for. The payment is not included as it's transaction date is in the following period, therefore creating the difference.

To find your currency adjustments:

Open: Nominal > Reports > Account Analysis > Transaction Listing.

-

Enter the following criteria.

| Account number or Account Number |

Select Is and enter the code or name of your Exchange Differences account |

|

| Transaction Date |

Select To and enter the date of the end of the period. |

|

- Make a note of the adjustment transactions.

For example:

- An invoice for $60 (£33.33) is entered for the 26/10. The exchange rate is 1.5.

- The payment is received and entered for 02/11. The exchange rate is 1.4

- The payment is allocated to the invoice with an allocation date of 30/10. A currency adjustment for £2.38 is also created and dated 30/10.

- The Aged Aged Creditors report is run retrospectively with the Base date For Ageing as 31/10. The balance is 0 because the invoice has been allocated.

- The Nominal Transaction Listing report is run for Creditors Control Account up to 31/10. The balance is £35.71 because the invoice and the currency adjustment have been posted in that period, but not the payment.