As part of your day-to-day credit control activities you will:

- Monitor the level of all debt and that of single customers.

- Remind customers of outstanding invoices.

- Sanction customers who fail to pay outstanding invoices.

- Deal with bad customer debt.

The following reports and features can help you stay abreast of customer debt and take appropriate action when needed. Use these tools and actions as part of your own credit control business processes.

Monitoring your customer debt

A number of reports and enquiry screens can help you monitor when transactions are due and when they pass their expected payment date.

Open: Customers > Customer Reports > Credit Control.

Aged Debt reports

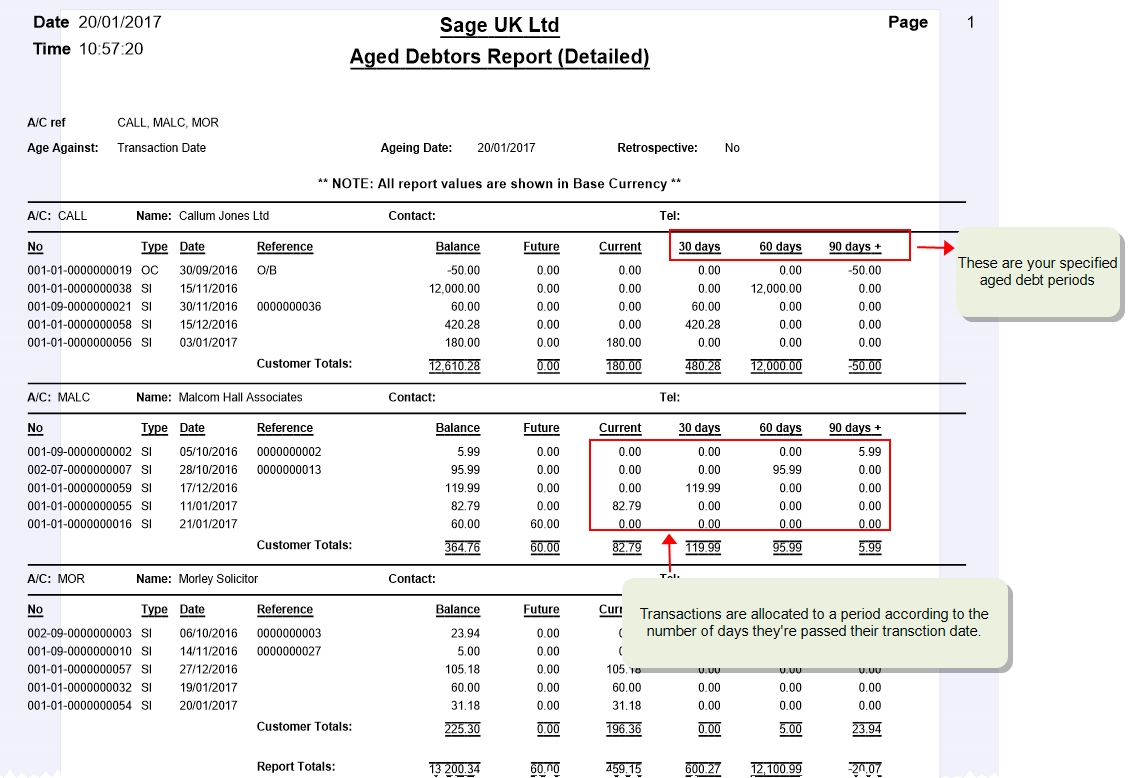

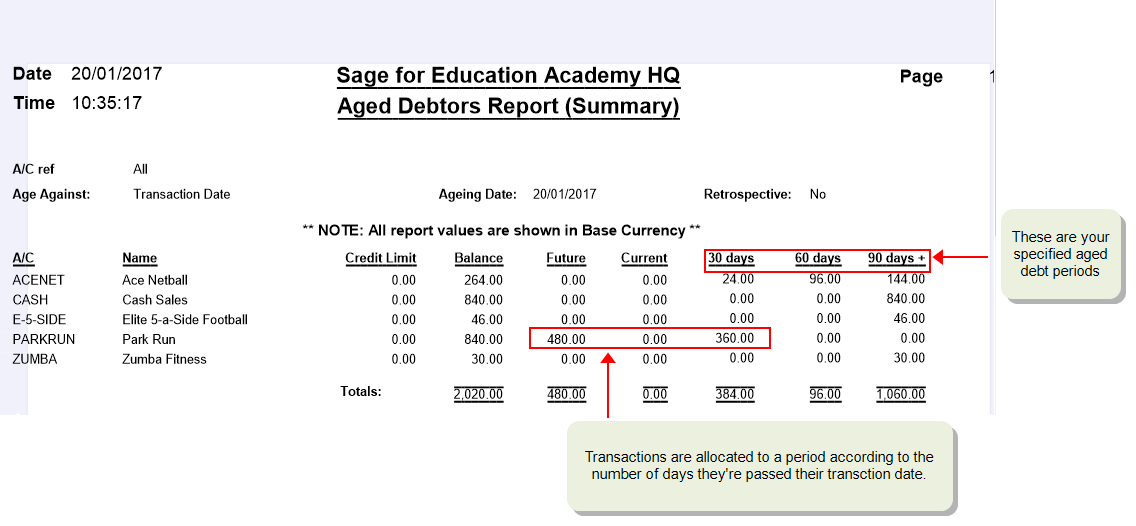

On the Aged Debt reports you can see the age of your customer's invoices in relation to your aged debt periods. The reports are divided into columns which reflect your aged debt periods.

- The Summary report shows the total value of all transactions in each ageing period.

- The Detailed report shows the details of every outstanding transaction.

You can use landscape or portrait versions of these reports.

Use the report criteria to control which customers are included in each report.

Yes. Select In from the A/c ref drop-down. Then check all the accounts you want to include.

This sets the date that the report will include transactions up to.

Yes, just select Retrospective. This means that the report will only include transactions that were overdue up the date specified.

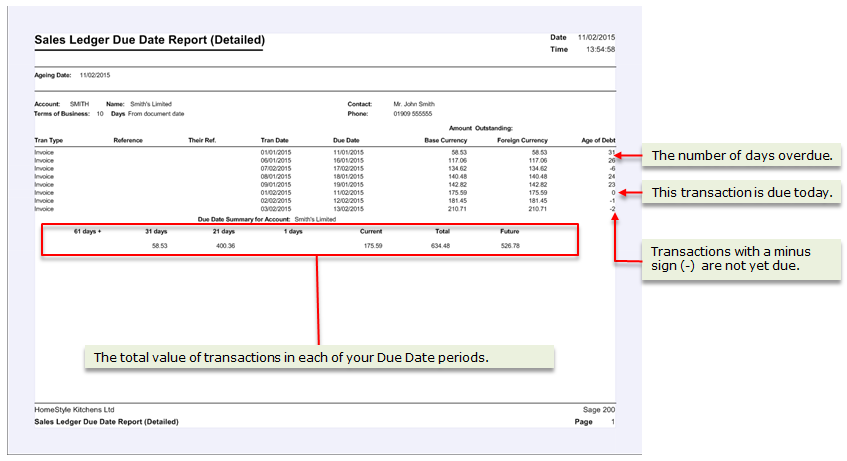

This shows how much your customers owe you based on the number of days each transaction is past its due date.

The Due date on an invoice is calculated using the Payment terms set on each customer account.

The report also shows the total amount owed per due date period. These are set in the Customer settings and can be different to the periods used for your Aged debt reports.

- The summary report shows the total value of all transactions in each due date period and those not yet due.

- The detail report shows how many days each invoice is past its due date as well as the total value of all transactions per due date period.

Enquiring on a customer's transactions

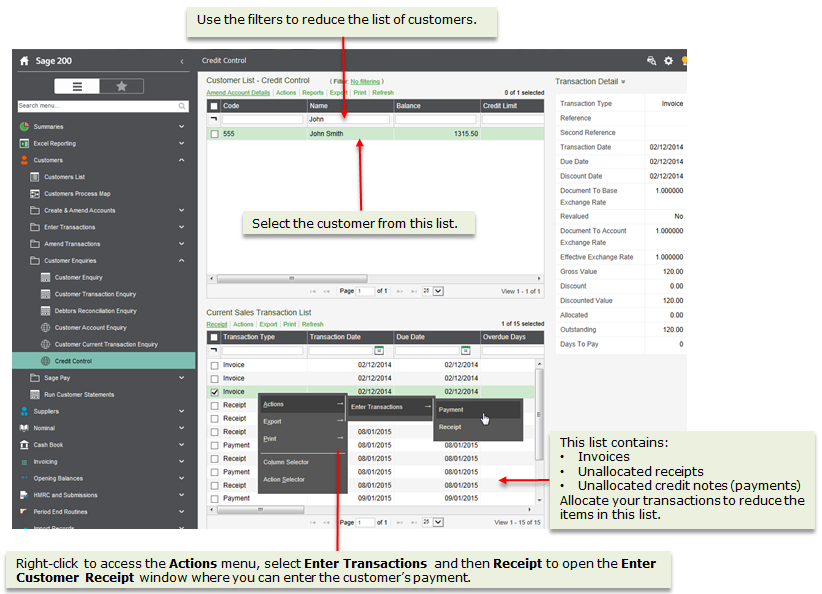

Use the Credit Control Enquiry Workspace to check your customer's outstanding transactions in real time. This is a quicker way to check individual customer accounts than running a report. This is an excellent way to view customer transaction information when you are speaking with them on the phone.

Open: Workspaces > Sales Ledger > Credit Control

From here, you can check the details of the customer account and outstanding transactions. For example:

The top list shows a list of customers with outstanding balances.

To quickly find a customer. enter the Code or Name in the quick filter at the top of a column.

Select a customer from the top list. The details of all outstanding transactions are shown in the bottom list.

Select a customer from the top list. The customer account and contact details are shown on the right panel.

For detailed contact information, select Contact details use using the drop-down  .

.

If an invoice has been part paid, you can see the receipt that was allocated to it.

- Select the customer and then the invoice from the bottom list.

- The details of the invoice are shown in the right panel.

- To see who allocated the transaction, select Allocation details using the drop-down

.

. - To see details of the allocated receipt, select Allocation History using the drop-down

.

.

- Select Actions just above the bottom list.

- Choose whether to enter a Receipt or Refund (payment).

Monitoring payment trends

With the Time Taken to Pay Sales Invoices report you can examine the average time it takes a customer to pay their invoices.

Run this regularly and you will spot when the average time a customer takes to pay their invoices starts increasing. While an increased average payment time is not a positive indicator of a problem it could provide an early warning for you to monitor the customer before an oversight becomes a trend.

Motivating your customers to pay

Some customers will take action to pay outstanding invoices when presented with documentation from you detailing the number and value of unpaid invoices.

This could be as simple as a statement listing the outstanding invoices or, for a more formal approach, a debtor letter.

Customer statements

You can generate statements at any time and define the period of time to be covered on them.

Each statement details:

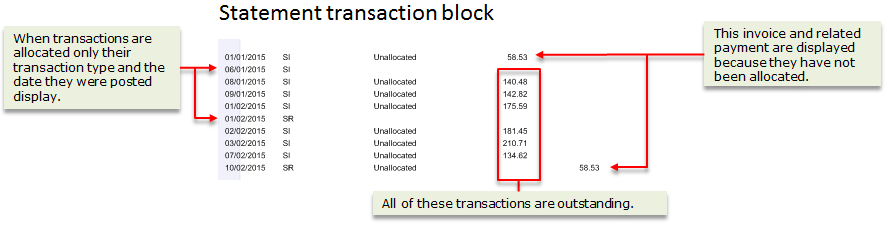

-

Outstanding invoices - the date the transaction was posted and its amount.

Invoices that have been paid but not yet allocated to a receipt are also listed.

- Unallocated receipts and credit notes - the date they were posted and the amount.

- Allocated transactions - the date on which the transaction was posted and its transaction type, but no amount details.

Before generating a statement if you allocate all transactions you will reduce the number of transactions detailed on the statement. That way, the statement will provide a clear picture of the number, and value, of outstanding invoices.

You can also set up Sage 200 to:

-

Print or email statements. This depends on the layout chosen on the customer's account.

- Choose which transactions are included on a statement. This is set in the Customer Settings.

- Choose how transactions are aged. This is set on the customer settings.

Debtor letters

When you generate a debtor letter Sage 200 automatically selects which template to use based on the due date period in which the oldest outstanding transaction falls. The details of all other outstanding transactions are also added to the letter so that the customer can clearly see what is owed.

Before generating debtor letters allocate any outstanding transactions.

Sanctioning non-paying customers

When a customer's debt remains unpaid you may need to take punitive actions. Within Sage 200 you can:

- Reduce the customer's credit limit.

- Reduce or remove the payment terms for future purchases.

- Put their account on hold.

You could tie any or all of these actions to the production of your debtor letters and amend the text of the debtor letter to warn the customer of the impending sanction.

When all else fails

When it becomes clear that a customer cannot or will not pay their outstanding invoices you need to take appropriate actions.

See Dealing with customer bad debt.