Standard cost variances

What do you do if you're using the Standard costing method on your stock items and the cost on the invoice received from your supplier is different to the standard cost price you've set on the stock item?

This might happen if you've changed supplier or the price has changed and the price on your stock item hasn't been updated. Most of the time these prices differences are likely to be for small amounts - pence rather than pounds!

Why does it matter?

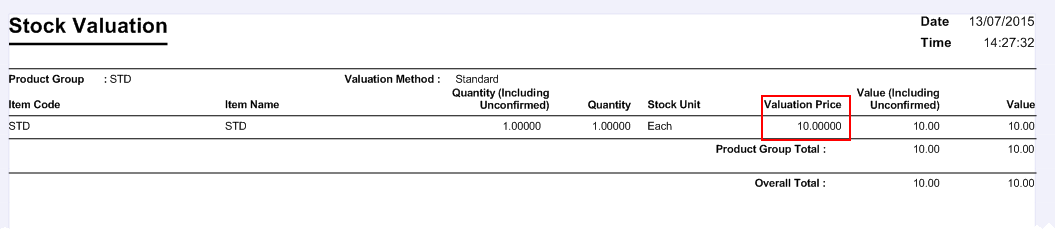

You usually use the Standard costing method for a stock item when you don't expect the cost price to fluctuate. The cost price is set on the stock record and Sage 200 uses this to calculate the value of your stock on the stock valuation report.

When you enter the details of the invoice received from your supplier into Sage 200, the amount that you've paid is posted to the nominal account specified on the invoice. If this is different to the standard price set on the stock item, the value of your stock on the valuation report will be different to the nominal account balance. So you'll need to enter adjustments to account for the difference.

There are two ways that you can do this:

- Enter your own manual adjustment transactions. You might do this as part of your month or year end process.

- Use Sage 200 to post any adjustments for you.

Adjust your variances

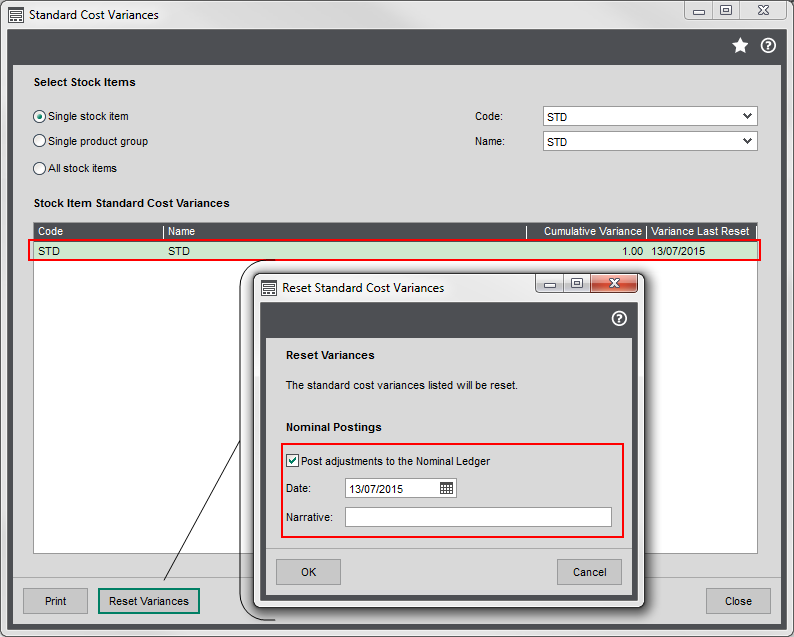

Sage 200 always stores any differences between the cost price set on the stock record and the price entered on the purchase invoice. You can see these difference on the Standard cost variances screen.

The standard cost variances screen shows the cumulative value of all the occasions when the purchase price for a stock item has been different to the standard cost price stored on the stock record. You can use this value to update your accounts manually, or you can choose to post this value to the standard cost variances nominal account.

Enter your own manual adjustments

If you're going to enter your own adjustments, you can use the Standard cost variances screen to:

- See the total value of differences between the purchase price and the standard cost price for each item.

- Reset the variances so that the next time you need to make any adjustments, only the new differences are reported.

- Print a list of all the variances each time for your records.

Use Sage 200 to post adjustments

If you want Sage 200 to post a transaction to account for the differences:

- Specify which nominal account the cost variance will be posted to. You do this in the POP settings.

- Choose to post a nominal adjustment when your rest the variances on the Standard cost variances screen.

This moves the value of the price difference from the nominal account specified on the stock item to you standard cost variances nominal account.

You have a stock item which has a standard cost price of £10. You buy the item from your supplier who charges you £11.

When you record the invoice for the purchase, £11 is posted to the nominal account specified on the invoice. This defaults to the account set on the stock item. The balance of this account is now £11.

The stock valuation report shows the item value as £10, making a variance of £1.

This is shown on the standard cost variances screen.

If you choose to post this to your nominal accounts, the following values are posted:

| Nominal account | Debit | Credit |

|---|---|---|

| Specified on the stock item | 1.00 | |

| Standard cost variances | 1.00 |

What's next

Open: Settings > Purchase Orders > POP settings | Order Entry.

Open: Purchase Orders > Adjustments > Standard Cost Variances.