Forecast your cash flow

Find this

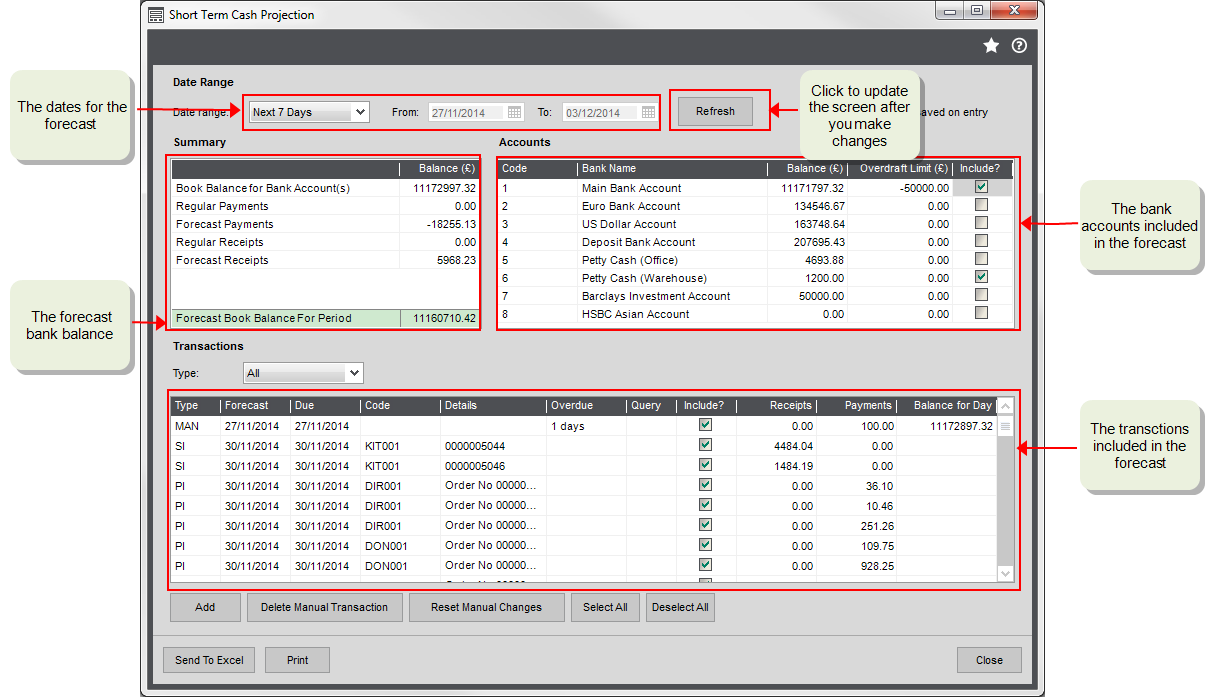

Open: Cash Book > Bank Account Enquiries > Short Term Cash Projection

How to

Use the short term cash projection

- Chose the date range to be covered by the projection.

- Select a date range from the list.

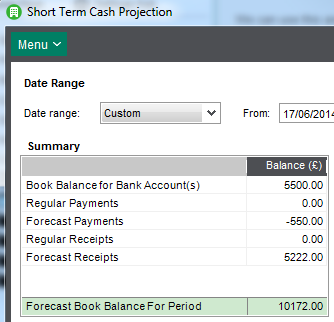

- Select custom from the list and then specify a date range using the calendars.

- Choose the bank accounts you want to include. Click Include? next to those accounts in the Accounts section.

-

Choose the transactions to include. Click Include next to those transactions in the Transactions section.

Use Select All and Deselect All to do this quickly.

- Click Refresh to recalculate with your amendments.

- The forecast totals for the selected bank accounts is shown in the Summary section.

Note: Each time you make an amendment to the projection (for example, include or exclude a bank account or transaction) click Refresh.

Filter the transactions

If you only want to include one type of transaction in your projection, filter the list by transaction Type.

| Transaction Code | Transaction Type | Displayed when |

|

SI |

Sales Invoices |

When the due date of the invoice falls within the date range you specified. |

|

OI |

Opening Balance Invoices |

|

|

SC |

Sales Credit Notes |

When the transaction date of the credit note falls within the specified date range. |

|

OC |

Opening Balance Credit Notes |

|

|

PI |

Purchase Invoices |

When the due date of the invoice falls within the specified date range. |

|

OI |

Opening Balance Invoices |

|

|

PC |

Purchase Credit Notes |

When the transaction date of the credit note falls within the specified date range. |

|

OC |

Opening Balance Credit Notes |

|

|

BRSO |

Standing orders and direct debits |

When the direct debit or standing order is due to be processed in the specified date range. Outstanding direct debits or standing orders are always displayed regardless of the specified date range. These are highlighted yellow if they are overdue. |

|

BRDD |

||

|

BPSO |

||

|

BPDD |

||

| MAN | A manually added temporary transaction. | A transaction you have manually added to the cash projection. |

Add temporary transactions

This temporarily adds details of transactions that haven't been entered into Sage 200 yet.

This helps you make the cash flow projection more accurate.

- In the Transactions section, click Add.

- Add the details of the transaction into the new row that is displayed in the table.

- Select the Include? option for the transaction.

- Repeat steps for each temporary transaction you want to add.

- Click Refresh to recalculate with your amendments.

- To remove a temporary transactions, click Delete Manual Transactions.

- To clear the changes made to the transactions section, click Reset Manual Changes

Print the cashflow projection

Click Print.

This prints a report showing the current forecast details.

Send the cashflow projection to Excel

Click Send to Excel.

This open the current forecast details in an Excel spreadsheet.

Useful info

About cashflow projections

The Short Term Cash Projection enquiry helps you to forecast the amount of cash you will have in your bank accounts on a particular day after your outstanding transactions have been paid.

Sage 200 calculates a forecast bank balance based on the date range and outstanding (unpaid) transactions you've chosen to include.

To create accurate forecasts, you can:

- Choose the date range

- Choose the bank accounts to include

- Choose the transactions to include

- Add transactions that you are expecting but which have not yet been entered into Sage 200.

The forecast bank balance is shown in the Summary section.

How the Summary totals are calculated

The Summary table contains six different summary totals.

| Forecast Totals | How they are calculated |

|

Book Balance for Bank Account(s) |

This is the total of all transactions that have been processed for all bank accounts that you have included. |

|

Regular Payments |

This is the total of the direct debit and standing order payments that you included. Outstanding direct debits or standing orders are always displayed regardless of the date range specified. These are highlighted yellow to indicate that they are overdue. |

|

Forecast Payments |

This is the total of the outstanding purchase invoices and sales credit notes that you have chosen to Include. |

|

Regular Receipts |

This is the total of the direct debit and standing order receipts that you have chosen to Include. Outstanding direct debits or standing orders are always displayed regardless of the date range specified. These are highlighted yellow to indicate that they are overdue. |

|

Forecast Receipts |

This is the total of the outstanding sales invoices and purchase credit notes that you have chosen to Include. |

|

Forecast Book Balance for the Period |

This is the total Book Balance for the included bank accounts, plus or minus the total included payments and receipts. This total is highlighted in yellow if you change the bank accounts or transactions and need to click Refresh to recalculate the cash projection. |