Cost centres

Managing your funds

Cost centres are used to represent your funds. You append a cost centre to each nominal account that's used to record income and expenses related to a fund. This is likely to be to majority of your income and expense accounts. When you enter transactions you choose the nominal account with correct code and fund.

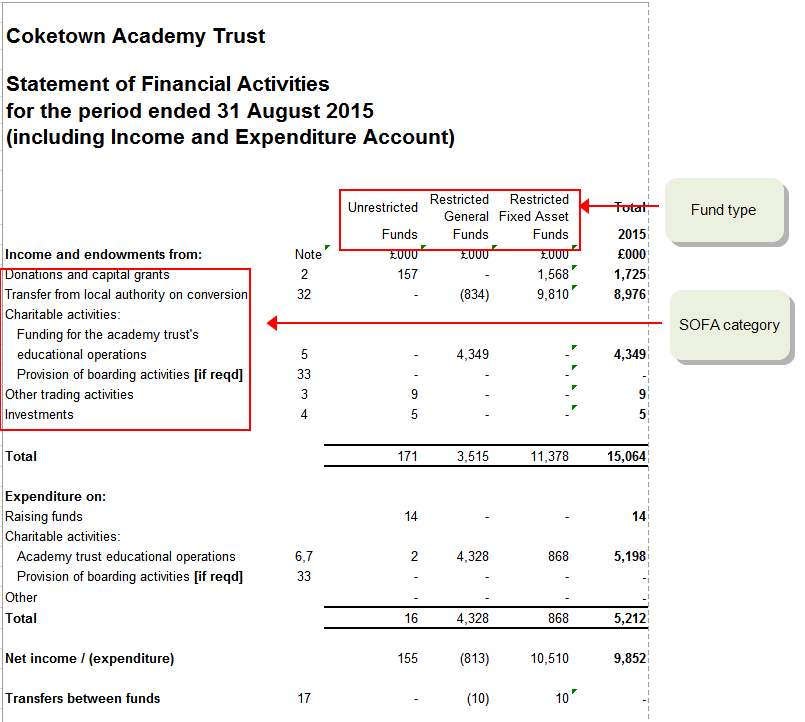

If you're an Academy, you'll also need SOFA categories to determine how your funds are reported on the SOFA report. As you need to record the income and expenditure of your funds on the SOFA report, you need to make sure you set your cost centres and nominal accounts up correctly.

Each figure on the SOFA report comes from the balance all accounts with the same cost centre Fund Type and SOFA category.

Setting up

-

Create your cost centres

Create a cost centre for each of your funds. Make sure you also choose a Fund Type. If you're an academy this determines section of the SOFA report the fund is included on.

-

If you're an academy, create your SOFA categories

If you're an academy, you also need to report on the income and expenditure of your funds on the SOFA report. You can produce the figures required for this from Sage 200.

The SOFA categories are used to determine the section and row that the fund balances are reported on the SOFA report.

If you weren't set to be an academy, then SOFA categories aren't created. You can change this now on the Company Details screen. Once you're set as an academy, the SOFA categories are created for you.

-

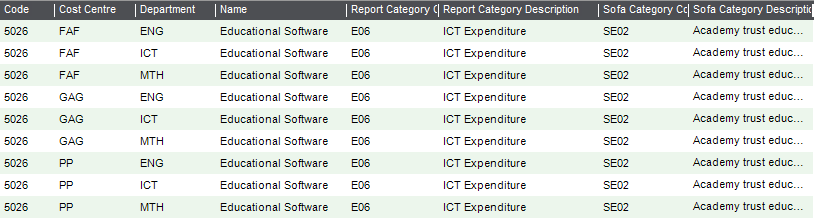

Create your nominal accounts.

You need to add a cost centre to every nominal account code used to record income and expenses for each fund. If you're also using departments, you'll need a nominal account plus cost centre for each department as well.

If you're an academy, don't forget to choose a SOFA category for each account.

Tip: Use the Generate new nominal accounts option, for a quick way yo to create add cost centres and departments to existing account codes.

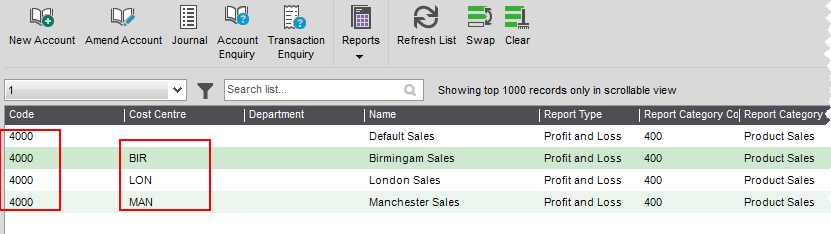

Your accounts might look like this:

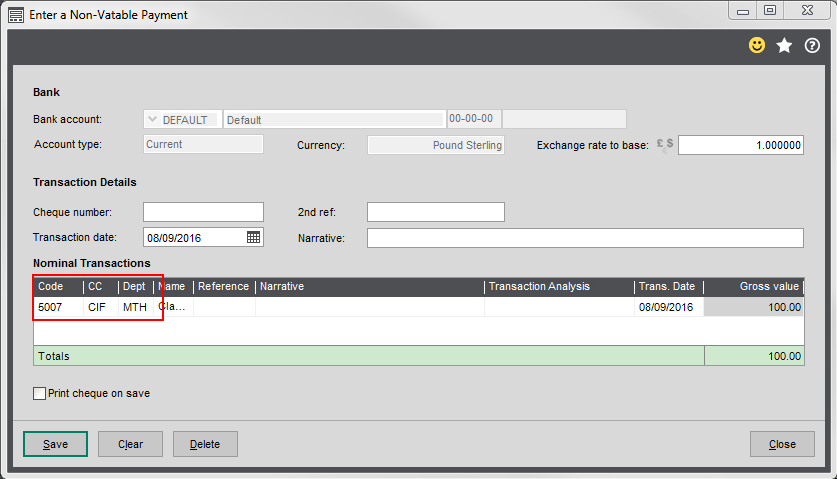

Recording transactions

Once set up, you need to make sure that transactions are posted to nominal account with the correct fund cost centre (and department, if you're using them). When you post transactions directly to your nominal accounts, you can select the nominal account with the correct fund cost centre CC (or CC and Dept combination).

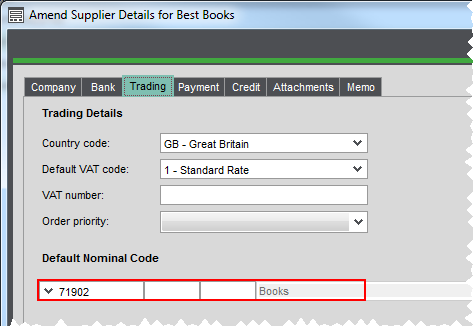

Default nominal accounts on customer and supplier accounts

Specifying a default nominal account on a particular supplier or customer, means that this nominal account is always entered by default on all transactions.

This is useful when the majority transactions for a customer or supplier account are posted to the same nominal account. We recommend that if you do set a default nominal account here, this account doesn't have cost centre or department associated with it. This is to make sure that transactions aren't posted to the wrong fund or department.

If you don't set a default nominal account, you just have to make sure you choose the correct nominal account plus cost centre and department when entering transactions.

Reporting

If you're an academy, you can produce a SOFA report from Sage 200.

You can also produce income and expenditure reports by cost centre so you can track how you're spending your fund:

| Report | Description |

|---|---|

| Profit and Loss (MTD-YTD) by Cost Centre | Shows a total for each cost centre for the period and selected and year to date. |

| Profit and Loss (MTD-YTD Budgets) by Cost Centre | Shows a total for each cost centre for budget and actual figures for the period selected and the year to date. |

| Profit and Loss (MTD - YTD Percentages) by Cost Centre | Shows a total for each cost centre for budget and actual figures for the period selected and the year to date. Includes a percentage column to show the values as a percentage of the subtotal selected to be base value on the layout. |

Year end

As part of the year end process, the remaining balance of any of your funds needs to be transferred to a balance sheet account. This is account specified as the default for Accumulated Fund Profit.

The remaining balance for each fund is transferred to the accumulated fund profit account with the corresponding cost centre. If these accounts don't exist when you run the year end, then Sage 200 creates them for you.

If you're an academy, you must also add the SOFA category for Funds brought forward to each account. This is to make sure your brought forward funds are included on the SOFA report.

-

Create an account for Accumulated Fund Profit. This account should have:

- The same report category that you use for Retained Profit, e.g. BS23 - Reserves.

- If you're an academy, a SOFA category of SX99 - Funds Brought Forward.

- Set this account as the default for Accumulated Fund Profit (Settings > Cash Book / Nominal Ledger > Default Nominal Accounts | Balance Sheet).

-

Create additional accounts with the same code, for each of your cost centres. A quick way to do this is to use the Generate Accounts screen. (Nominal > Create and Amend Accounts > Generate New Nominal Accounts)

See an exampleAccount Code Cost Centre Fund Type Report Category Report category Type SOFA Category 3300 CIF Restricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 EFA Restricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 FAF Restricted Fixed Asset BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 GAG Unrestricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 RES Restricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 SEN Restricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward 3300 UN Unrestricted BS23 - Reserves Balance Sheet SX 99 - Funds Brought Forward

About cost centres

You can use cost centres to segment parts of your business so that you can monitor income and expenses from individual areas in your company. You append a cost centre to profit and loss nominal accounts. Each nominal account has the same Code but different cost centres. For example, if you have several branch offices and you want to be able to produce a P & L for each office as well as one for the whole business, you could create a cost centre for each branch office. You then make sure that every profit and loss nominal account also using an account with the cost centre for each branch.

When you enter transactions, these are posted to the nominal account associated with this cost centre. When you produce your P & L, it reports the total of all accounts with the same code.

Tip: As all these nominal accounts are reporting the same thing, they should also have the same Report Category.

John is setting up Sage 200 within his company. His company is comprised of three branches. He wants to produce a P & L for each branch, as well as his the company as a whole, so he creates three cost centres to represent this. These are:

- London - LON

- Manchester - MAN

- Birmingham - BIR

To make sure the value of each transaction is recorded correctly, John creates a set of profit and loss nominal accounts for each cost centre.

His nominal accounts for his sales are as follows:

| Nominal Account Code | Cost Centre |

|---|---|

| 4000 | LON |

| 4000 | MAN |

| 4000 | BIR |

| 4001 | LON |

| 4001 | MAN |

| 4001 | BIR |

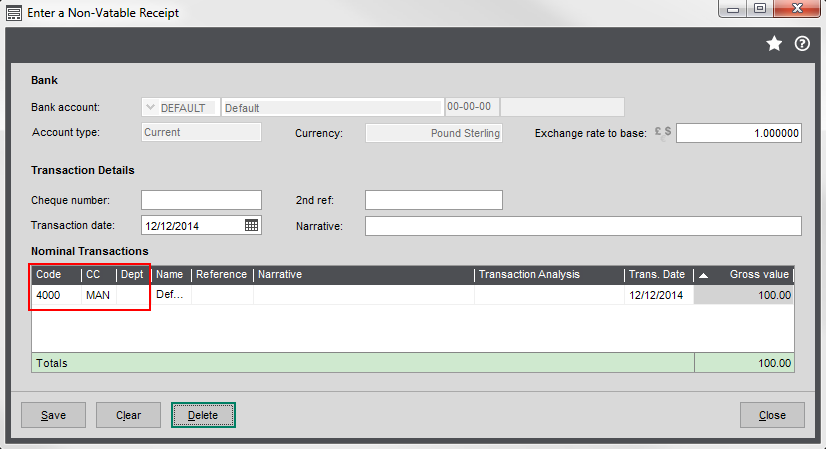

Applying cost centres to transactions

Once set up, you need to make sure that transactions are posted to nominal account with the correct cost centre (and department, if you're using them). When you post transactions directly to your nominal accounts, you can select the nominal account with the correct CC (or CC and Dept combination).

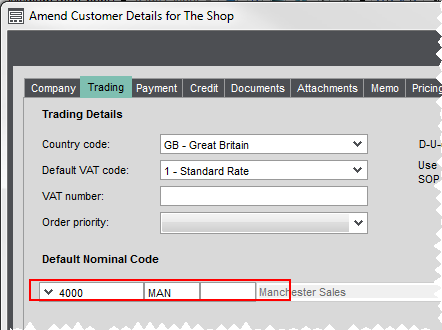

For sales and purchase transactions for customer and supplier accounts, you can specify the nominal account you want to use for particular customer or supplier on their account. When you enter transactions, this nominal account is automatically selected.

To make sure sales and purchases are assigned to the correct nominal account, you can select a nominal account with a CC (or CC and Dept combination). For example, a customer of your Manchester office, would have their default nominal account as 4000 MAN.

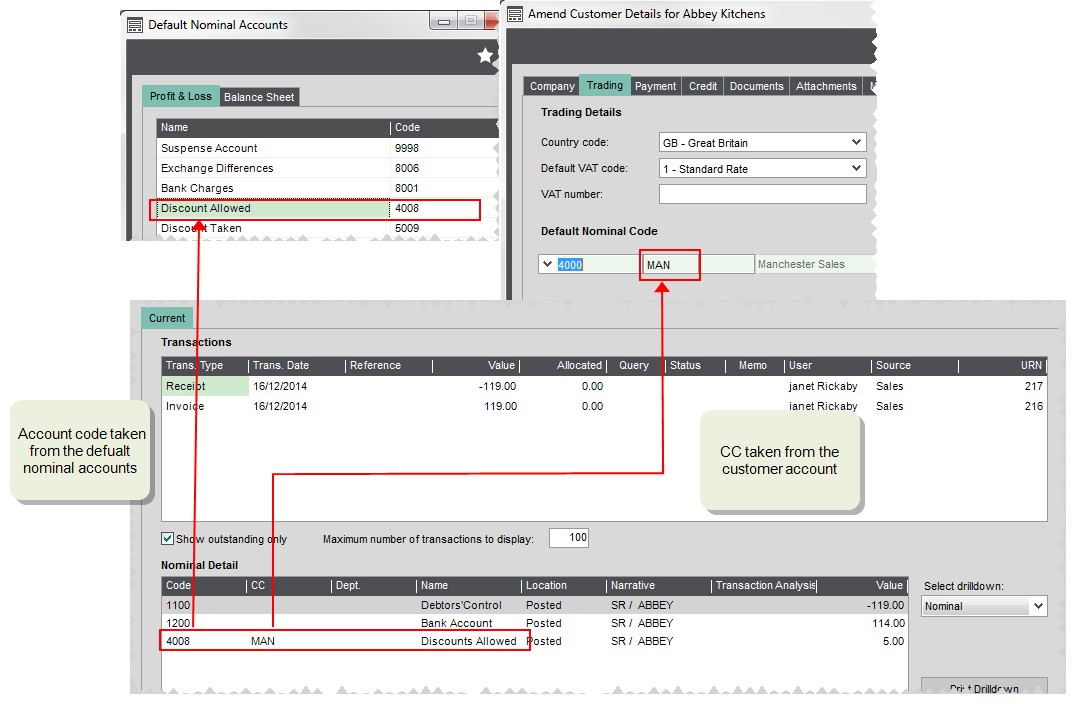

Once you have set a nominal account with a CC or CC / Dept, as the default nominal account on a customer or supplier account, Sage 200 uses this when posting transactions automatically. When Sage 200 posts a transaction to a profit and loss nominal account, it posts to the account code associated with the default nominal account and the CC/ Dept associated with the customer or supplier account. A settlement discount for a customer with a default nominal account of 4000 MAN, would post to a Discounts Allowed nominal account, 4008 MAN.

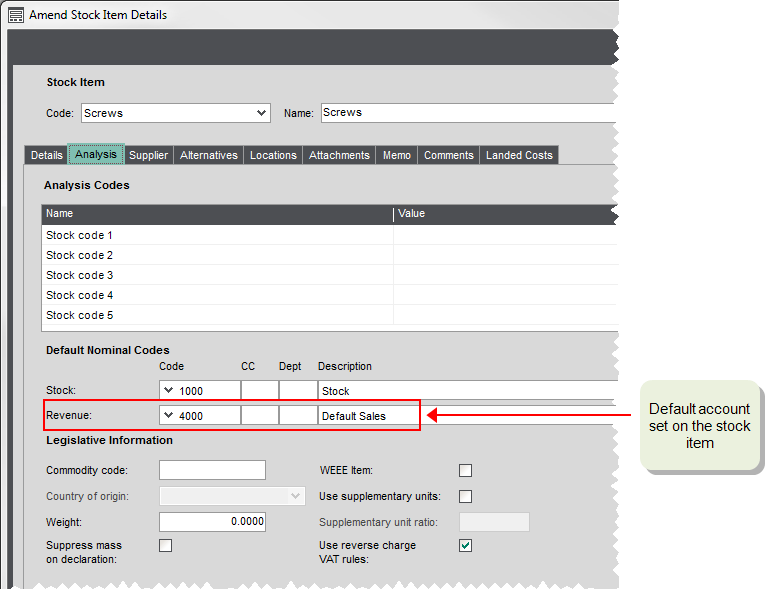

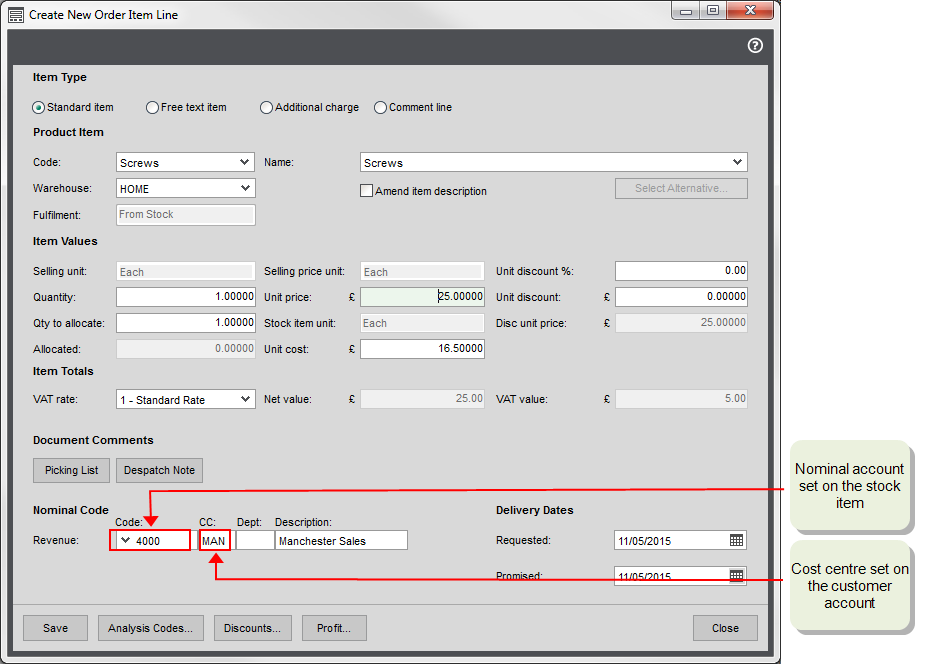

Cost centres and departments with stock items

When choosing the nominal account to use by default on invoice and order lines, Sage 200 looks at the default nominal account assigned to the stock item and the cost centre and/ or department (if used) set on the customer or supplier account. For example, if you've set a default nominal account of 4000 MAN on a customer account and a default nominal account of 4001 of a stock item, your 4001 MAN is entered on the invoice or order line, by default.

Note: When using cost centres and departments with your customer and supplier accounts, you must make sure that you create nominal accounts with all the required cost centre and department combinations. If a nominal account doesn't exist, then the line value is posted to the suspense account.

John has a business that sells some goods and some services. He wants to make sure that he records these sales separately in his nominal accounts. Ho also uses cost centres with his nominal accounts to record sales for each of his branch offices. To do this, he has a default Sales nominal account of 4000 and a nominal account for services 4001. He then sets up additional nominal accounts for Sales and Services for each cost centre London LON, Birmingham BIR, and Manchester MAN.

To make sure his sales are recorded correctly for each branch, each customer account is set to the default sales nominal account with their branch cost centre. So a customer of the Manchester office would have a default nominal account 4000 MAN.

To make sure his products and services sales are recorded correctly, his product groups use different default Revenue accounts depending one whether they are Stock(4000) or Service (4001) type groups. These default nominal accounts are then inherited by stock items in the group. As John doesn't want to use further separate nominal accounts, he keeps these defaults for his stock items.

When he enters an order for a stock item for a customer in the Manchester office, the nominal account used on the order line defaults to a combination of the nominal account from the item and the cost centre from the customer in this case 4000 MAN. In the same way an order line for a service item defaults to the 4001 MAN nominal account.

In this example, if John hasn't created the 4000 MAN or 4001 MAN nominal accounts, the order line value will post to the suspense account.

Note: The same rules apply to purchases. A purchase order line will post by default to the Stock nominal account set on the item with the cost centre and/or department set on the supplier account.

What do you want to do?

- Add and edit cost centres

- Add or edit SOFA categories

- Generate nominal accounts for existing cost centres and departments

- Create nominal accounts for a new cost centre or department

Sage is providing this article for organisations to use for general guidance. Sage works hard to ensure the information is correct at the time of publication and strives to keep all supplied information up-to-date and accurate, but makes no representations or warranties of any kind—express or implied—about the ongoing accuracy, reliability, suitability, or completeness of the information provided.

The information contained within this article is not intended to be a substitute for professional advice. Sage assumes no responsibility for any action taken on the basis of the article. Any reliance you place on the information contained within the article is at your own risk. In using the article, you agree that Sage is not liable for any loss or damage whatsoever, including without limitation, any direct, indirect, consequential or incidental loss or damage, arising out of, or in connection with, the use of this information.