Manage and report on invoices and credit notes

Invoicing List

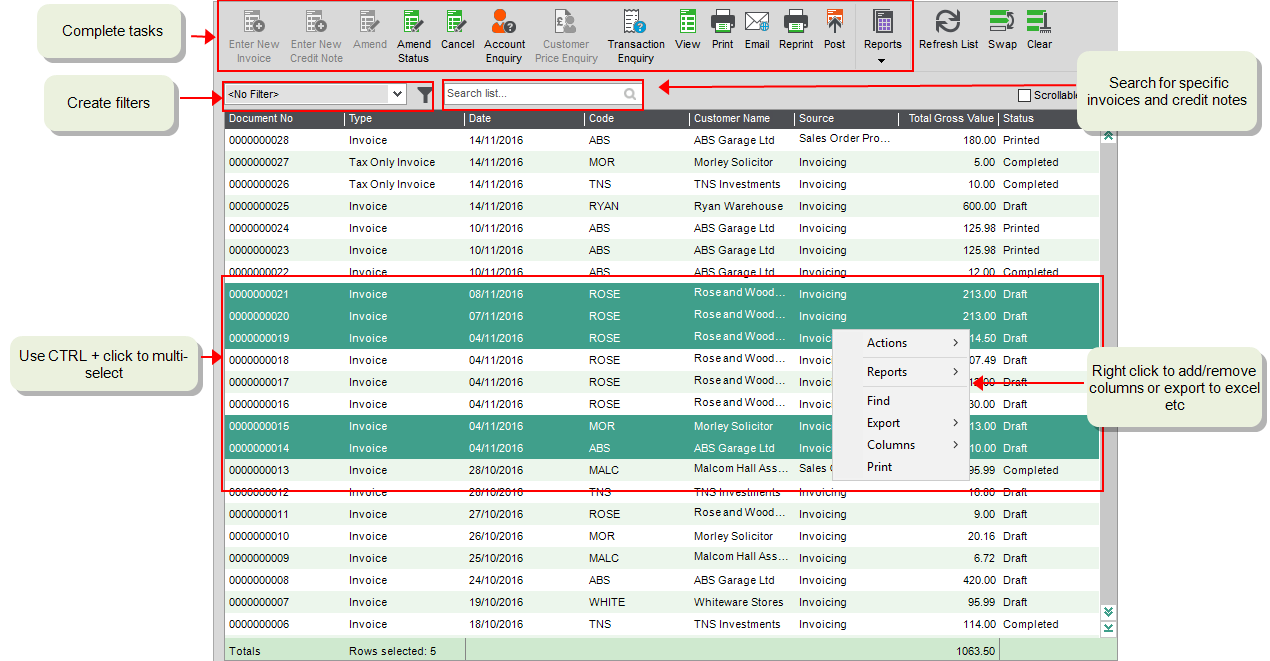

You manage your invoices and credit notes from the Invoicing List.

Open: Invoicing > Invoicing List.

Use the icons at the top of the list to enter, amend, print and post and report on your invoices and credit notes.

All your invoices and credit notes are shown here, including those created from the sales orders and returns. Invoices and credit notes created from the Sales Orders module will always have a status of Completed. You'll only be able to reprint them from here.

You can:

-

Sort the list by clicking on the column headings.

-

Create filters to show the information you need.

-

Add and remove columns to show or hide information. You can add columns such as Net value, VAT value, Date cancelled, Exchange rate, Reason cancelled and so on.

-

Print items in the list or export them to Excel. Right-click in the list and use Print or Export.

-

Process invoices or credit notes individually or in batches. Highlight an invoice or credit note or use Ctrl+click to multi select, then choose the relevant icon from the top of the list. Only the selected items are included to process.

Note: Some tasks, such as Enter or Amend aren't available if you've selected more than one invoice or credit note from the list.

Invoice and credit note status

Each invoice and credit note has a Status which shows each stage of the invoice process:

| Draft |

Saved but not printed. Can be amended or put On Hold. Invoice or credit note number assigned. |

| On Hold | Can't be amended or printed until taken off hold. |

| Printed |

Printed or emailed to a customer. Can't be amended. To make amendments the invoice or credit note must be cancelled and re-entered. |

| Completed |

Customer and nominal accounts have been updated. Stock levels updated. |

| Cancelled | Any lines are removed. |

Using the enquiries and reports

As well as the list, you can use the enquiries and reports to manage and process your invoices. The Invoicing list, enquiries and workspaces give you a quick way to view information about your invoices and credit notes. The reports provide a printed record.

Check the details of invoices and credit notes

-

Use the View option to see details of individual invoices and credit notes.

Open: Invoicing List > View.

Here you can:

-

See what was included on the invoice or credit note.

-

Check the profit per line and per invoice or credit note.

-

Check the nominal accounts the invoice or credit note was posted to, both per line and the total per nominal account per invoice.

-

Check the analysis codes per line and per invoice or credit note.

-

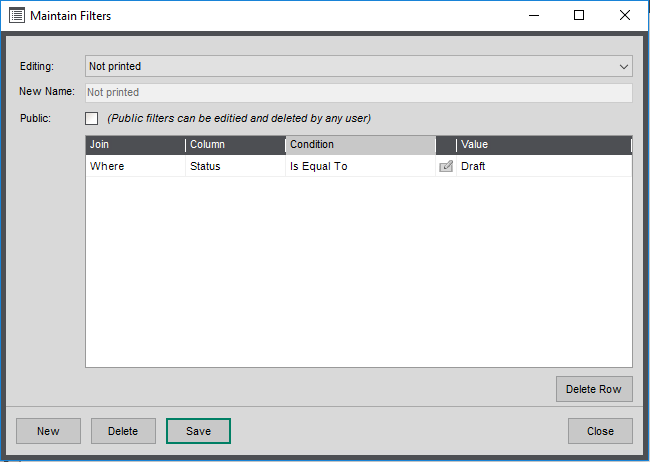

See invoices and credit notes that are not printed

-

Sort the Invoicing list by the Status column. Invoices and credit notes with a status of Draft have not been printed.

-

You can create a filter for the Status column, so the list only shows unprinted invoices and credit notes. You could then send Export the list to Excel. Click the filter icon

to create a new filter.

to create a new filter.

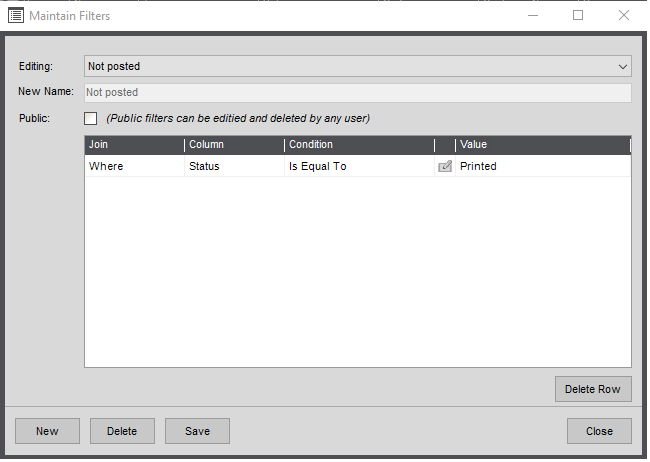

See invoices and credit notes that are printed (emailed) and not posted

Invoices which have been emailed also have a status of Printed.

-

Sort the Invoicing list by the Status column. Invoices and credit notes with a status of Printed have not been posted.

-

You can create a filter for the Status column, so the list only shows these invoices and credit notes. You could then Export the list to Excel. Click the filter icon

to create a new filter.

to create a new filter.

Check the price of stock item per customer

Use this to find the price the customer pays for a selected stock item. This works out the price based on the quantity entered and includes any discounts.

Open: Invoicing List > Customer Price Enquiry.

-

Select the customer account.

-

Select the stock item.

-

Enter the a Quantity.

-

The price of the item is shown in the selling prices section. You can see the selling price and the price after any discounts are applied.

Note: If the customer uses foreign currency, the price and discounts shown will be converted using the current exchange rate set in Sage 200.

Check the profitability of your invoices

When entering invoices, the profit you have made on each invoice and invoice line is calculated. You can check this on the View Invoice screen and via the invoice profitability reports.

Open: Invoicing List > View - select View Line Profit Line or Invoice Profit.

Open: Invoicing List > Reports > Invoice Profitability (Detailed).

Open: Invoicing List > Reports > Invoice Profitability (Summary).

See Invoice profit.

Check your cancelled invoices and credit notes

-

Sort the Invoicing list by the Status column. You can also add a column to show the reason for the cancellation. Right-click on the list and select Columns > Reason Cancelled.

-

You can create a filter for the Status column, so the list only shows cancelled invoices and credit notes. You could then send Export the list to Excel. Click the filter icon

to create a new filter.

to create a new filter. -

Use the Cancelled Invoices Report. This shows a list of cancelled invoices or credit notes and the reason for the cancellation.

Open: Invoicing List > Reports > Cancelled Invoices.

See Cancel invoices and credit notes.

See what your customers have bought (and what they paid)

-

Use the Items sold per customer reports to see a list of the stock items sold per customer.

Open: Invoicing List > Reports > Items sold per customer (Detailed).

Open: Invoicing List > Reports > Items sold per customer (Summary)

-

To see free text and charge lines per customer, as well as stock items, use the Sales Invoice and Credit Line Enquiry workspace.

Open: Workspaces > Invoicing > Sales Invoice and Credit Line Enquiry.

-

Sort the list by Item Code, Name or Description to see all lines for the same thing.

-

Add the Customer Name or Code columns to see all items per customer. Right-click on any column heading and select Add Column to the Right or Add Column to the Left. Choose the column(s) to add.

-

Select a line and click Details in the lower panel, to see details of the invoice or credit note.

-

Delete invoices and credit notes

You can remove invoices and credit that you've finished with from Sage 200. Once invoices or credit notes have been updated and posted to the customer's account, and you no long need to print a physical copy, then you can consider whether to delete them. Deleting completed and cancelled invoices and credit notes helps you manage your data and reduces the items shown on the Invoicing list and included in reports. How often you do this depends on your organisation's requirements.

You can only delete invoices and credit notes with a status of Cancelled and Completed.