Landed costs

Landed costs refer to any costs associated with the shipping, handling and importing of your stock items that you want to include on your purchase orders.

These additional costs are often invoiced separately, by a courier for example and they may span multiple purchase orders.

In Sage 200 you can:

- Choose whether stock items use landed costs by default.

- Charge landed costs as a set amount, or as a percentage of the order line.

- Apply landed costs whenever you use a particular supplier.

If you want to use landed costs in Sage 200, you need to turn this on in the Stock Control Settings. You set defaults for your landed costs on the relevant product groups and these are inherited by the stock items in that group. Landed costs can also be applied when using a specific supplier.

Setting up and entering landed costs

-

To enable landed costs, open the Stock Control Settings, then select Use Landed Costs.

Select the nominal Code to use for landed cost postings.

Switching on landed costs will add a Landed Costs tab to Product Groups.

-

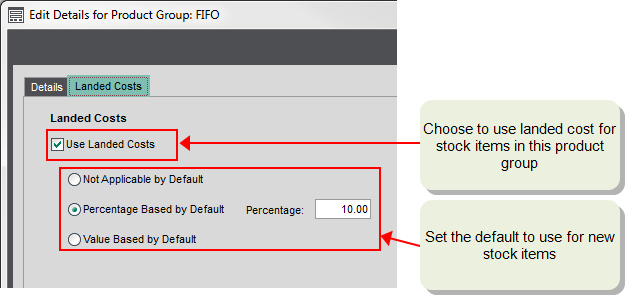

To enable landed costs for the stock product group, open the product group Landed Costs tab, then select Use Landed Costs.

Choose how you want to apply the landed cost as default to new stock items; either not applicable, percentage based, or value based. This just sets the default for the new stock item, and can be changed on the stock item record itself.

Note: If you turn this on after linking stock items to a product group, the existing stock items will remain set to not use landed costs, so you'll need to amend them as required.

-

Set the default landed cost for the stock item on the Landed Costs tab.

-

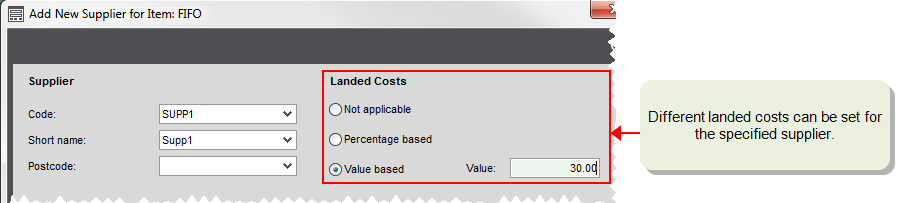

If required, you can set or use different landed costs for the specified supplier of the stock item. To do this you must set a specified supplier on the stock item (Supplier tab). Each time an order is entered for the stock item from this supplier, the supplier's landed cost are used.

-

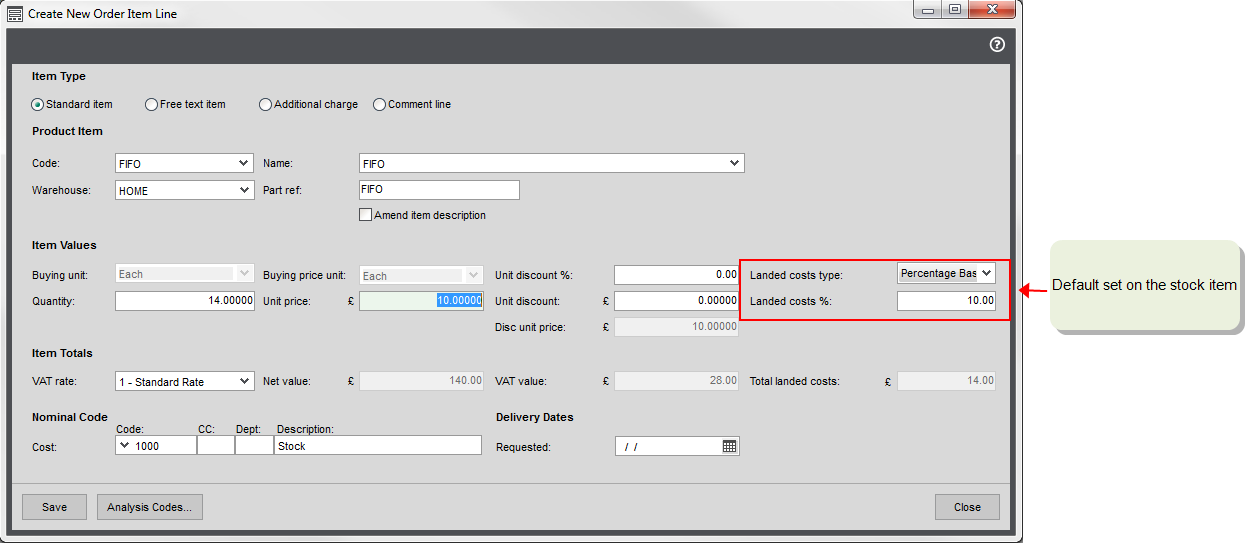

Enter a purchase order for the item. The default landed costs are added automatically. This can be changed as required.

Note: The landed costs are not included in the total value of the purchase order.

How landed costs are posted

Landed costs are included in the cost price of a stock item.

- When the item is recorded as received:

- The cost price of the item is updated. This is the cost price of the item on the order plus the landed costs value.

- For stock items that use the Standard costing method, a standard cost variance is calculated when the cost price of the item on the purchase order plus the landed cost value, is different to the standard cost price specified on the stock item.

- When the purchase order invoice is recorded:

- The cost price of the item plus the landed cost is posted the Stock nominal account specified for the stock item.

- The landed cost value is posted to the nominal account specified in the Stock Control Settings.

Example

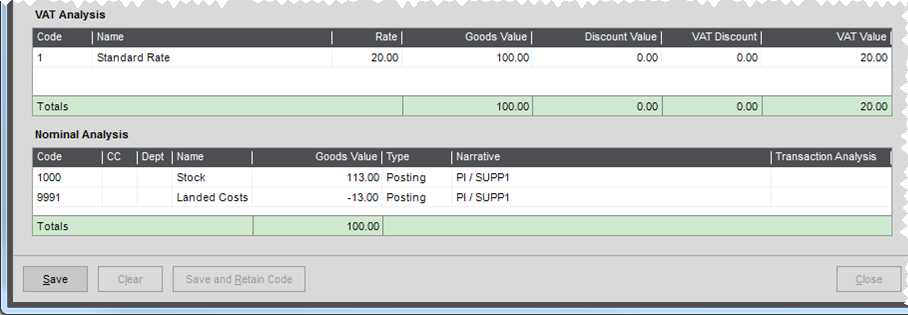

The nominal account for landed costs is set as 9991 (Landed Costs).

A stock item has a unit price of £100, and it has a standard charge of £13 which is set as its landed cost value.

A purchase order is created for the item. The net goods value is £100, the VAT value is £20, and the landed cost is £13. The nominal code 1000 (Stock) is used for the order.

The item is received and the purchase invoice is posted.

- £113 is posted to the account 1000 (Stock), which is the cost price of the item (£100) plus the landed cost (£13).

- -£13 is posted to the account 9991 (Landed Costs), which is the landed cost value (£13).

- £20 is posted to the account 2200 (Default VAT Input).

- -£120 is posted to the account 2000 (Creditor's Control).

What do you want to do?

Open: Settings > Stock Control > Stock Control Settings

Open: Settings > Stock Control > Product Groups.

Open: Stock Control > Stock Records > Enter New Stock Item | Landed Costs, or

Open: Stock Control > Stock Records > Amend Stock Item Details | Landed Costs