Set up VAT rates

Find this screen

Open: Accounting System Manager > Settings > VAT Rates.

How to

Create a VAT rate

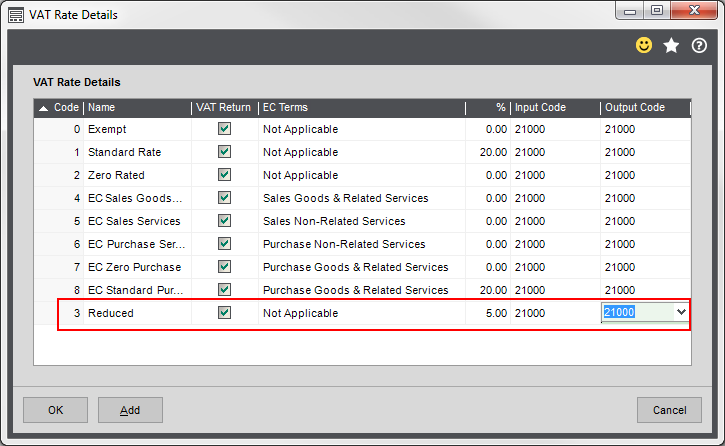

To create a VAT rate:

Open: Accounting System Manager > Settings > VAT Rates.

-

Click Add to add a new row on the table.

-

Enter a unique code and name.

This name appears throughout Sage 200, so make sure that the name adequately describes your new VAT rate.

-

Select the VAT Return box if you want to include the value of VAT accumulated under this code in the VAT Return.

Note: If you don't select this and post vatable transactions to this code, the results are included in the Non-Trading Vatable Transactions report. This report is produced with the VAT Return, but can also be produced as a separate report.

-

Specify how this tax rate is to be treated for processing. Select the appropriate option from the Terms list.

-

Enter the VAT rate %. (0 to 999.99).

-

Select nominal accounts for the Input Code and Output Code, if you don't want to use the defaults. The values for this rate are accumulated in this nominal account.

If you do not enter accounts here, they will use the default nominal accounts you have set for Default VAT Input and Default VAT Output.

If you enter the same nominal account number for both Input Code and Output Code and your company is registered for VAT, the balance of the nominal account will reflect the outstanding net VAT.

Amend a VAT rate

You can change any of the information about the VAT code.

Any changes made will only affect subsequent transactions.

Tip: Remember, changes to the VAT rate % will affect your VAT return.

Add new VAT rate codes after the Brexit transition

This feature is only available from Sage 200 Professional 2020 R2 version onwards. If you're using an older version of Sage 200:

-

VAT rate 16 can be created manually. See Accounting for VAT as a reverse charge when acquiring services from abroad (UK only).

-

VAT rate 18 cannot be created manually, as it uses the term Import Goods ROW Postponed.

We've added some new default VAT rate codes for the UK and Ireland, to reflect how countries will trade after the Brexit transition.

If you import or export goods and services after the Brexit transition ends, you should add these new VAT rates to all your Sage 200 companies.

Open: Accounting System Manager > Settings > VAT Rates.

-

Select Create Import/Export VAT Rates.

-

New VAT rate are added to the list:

-

16 - Purchase Services ROW (Reverse Charge) (used by UK only): Purchase of services from all countries outside the UK that you account for under the reverse charge procedure.

-

18 - Import Goods ROW - Postponed VAT (for UK and Ireland): Purchase of goods from all countries outside the UK (including EU) with VAT charged, using postponed VAT accounting.

-

- If you already have VAT rate codes for 16 and 18, the new code will be highlighted as already in use. You'll need to change the generated Code to a different number. The code number doesn't matter, as it's the Terms setting that affects your VAT return.

-

- Set your Input Code and Output Code for the new rates, if you want to change these from the default nominal accounts (Default VAT Input and Default VAT Output).

- Select OK to save the new VAT rates.

Useful info

About the nominal accounts used for VAT

Sage 200 uses two nominal accounts to record your VAT:

- VAT Input - for the VAT on your purchases.

- VAT Output - for the VAT on your sales.

Any VAT entered on a transaction is automatically posted to these nominal accounts. You specify which nominal accounts to use for these on the Default Nominal Accounts screen.

You may also want to have an additional nominal account to records payments made to HMRC.

As long as all your VAT nominal accounts have the same report category, you net VAT liability will be report on your Balance Sheet, so there's no need to journal between accounts.

If you only want to use a single nominal account for your VAT, then you can enter the same nominal account for both VAT Input and VAT Output.

Default VAT rates

We have set up a number of VAT rate codes for you.

| Country | Code | Name | Comments |

|---|---|---|---|

| UK and Ireland (ROI) | 0 | Exempt |

|

| UK and Ireland (ROI) | 1 | Standard Rate |

|

| UK and Ireland (ROI) | 2 | Zero Rated |

|

| Ireland (ROI) and Northern Ireland only | 4 |

EC Sales Goods |

|

| Ireland (ROI) only | 5 |

EC Sales Services |

|

| Ireland (ROI) only | 6 |

EC Purchase Services |

|

| Ireland (ROI) and Northern Ireland only | 7 |

EC Zero Purchase |

|

| Ireland (ROI) and Northern Ireland only | 8 |

EC Standard Purchase |

|

|

UK only |

16 | Purchase Services ROW (Reverse Charge) |

For the UK:

Note - information

This VAT code is only created by default in Sage 200 Professional 2020 R2 version onwards. |

|

UK and Ireland (ROI) |

18 | Import Goods ROW - Postponed VAT |

For Great Britain (England, Scotland, Wales):

For Northern Ireland:

For Ireland:

Note - information

This VAT code is only created by default in Sage 200 Professional 2020 R2 version onwards. |

Note:

We advise that you do not amend the general details of these tax rates. The only fields you should update on these rates are:

- %

- Input Acc. No

- Output Acc. No

You can create your own VAT rates if you need new ones.

For examples of VAT rates, and to determine which rates to use, see:

When to create a new VAT rate

You may find that you need additional VAT rates to the defaults we've supplied.

Depending on what you but and sell you may need to create a VAT rate for reduced rate items and non-vatable items.

You'll need this if you deal with any goods or services that attract reduced rate VAT such as home energy. This is currently 5%.

To set this up, create a new rate with the following details:

- Code - Enter a number.

- Name - Reduced rate.

- VAT return - Select this as reduced rate VAT items need to be included on the VAT returns.

- Terms - Not Applicable

- % - 5

- Input / Output code - This is defaults to the nominal accounts specified for VAT in the Default Nominal Accounts.

This is generally used for services that are outside the scope of UK VAT.

Note: If you've previously used Sage 50 Accounts, this equivalent to the T9 tax code.

To set this up, create a new rate with the following details:

- Code - Enter a number.

- Name - Non- vatable or something meaningful to you.

- VAT return - Don't select this, as this rate items don't need to be included on a VAT return.

- Terms - Not Applicable

- % - 0

- Input / Output code - This is defaults to the nominal accounts specified for VAT in the Default Nominal Accounts.

Applying Term codes to your VAT rates

VAT rates have a Term indicator which controls how the rate is treated for processing.

Select the appropriate term according to your business.

UK

Select Reverse charge sales (Mobiles) when you are trading in specified electronic devices (such as mobile telephones and computer chips) in the UK with another UK business and the value of your trade exceeds £5000 for a UK VAT registered customer.

These two tax rates have not been set up for you. If you add them:

- Set the sales tax rate at your local VAT rate (20%).

- Set the purchase tax rate at your local VAT rate (20%).

-

Select Purchase Non-Related Services for the purchase of services from all countries outside the UK that you account for under the reverse charge procedure.

Ireland or Northern Ireland

-

Select Sales Goods & Related Services if you are selling goods to EU customers (outside your country) and there are associated service costs such as freight charges.

Values are included in the total on box 8 on the UK VAT Return.

- Select Sales Non-Related Services if you are selling services that are not related to any supply of goods, to EU customers (outside your country). For example, legal services.

-

Select Purchase Goods & Related Services if you are acquiring goods from EU suppliers (outside your country) that have associated service costs such as freight charges.

Values are included in the total in boxes 7 and 9 on your UK VAT Return.

- Select Purchase Non Related Services if you are purchasing services that are not related to any supply of goods, from EU suppliers (outside your country). For example, legal services.

For more information, see Trading in EU countries.

Purchase of goods from abroad using postponed VAT accounting

Postponed VAT accounting allows businesses that import goods to account for import VAT on their VAT return, rather than paying import VAT on or soon after the time that the goods arrive at the border.

From 1 January 2021, if your business is registered for VAT in the UK or Ireland, you'll be able to account for import VAT on your VAT Return for goods you import into:

-

Great Britain (England, Scotland and Wales) from anywhere outside the UK (including EU members).

-

Northern Ireland from outside the UK and EU. You will not change how you account for VAT for movement of goods from the EU.

-

Ireland from non-EU countries.

For more information:

Set up this VAT rate

-

If you're using Sage 200 Professional 2020 R2 onwards, a VAT rate Import Goods ROW - Postponed VAT will be set up for you in any new companies that you set up. If you have an existing company that doesn't include this VAT rate, you can set it up by selecting Create Import/Export VAT Rates. See Add new VAT rate codes after the Brexit transition.

-

If you're using a version of Sage 200 Professional before 2020 R2, you'll need to manually set up this VAT rate.

To set up a VAT rate for postponed VAT accounting:

-

Create a VAT rate, with Terms set to Import Goods ROW Postponed.

Code

Name

VAT Return

Terms

%

Enter a unique code. Enter a unique name. Select the VAT Return box. Select Import Goods ROW Postponed. Enter your local tax rate (20% UK, 23% Ireland).

- Specify Input Code and Output Code nominal accounts, if you want to override the Default VAT Input and Default VAT Output tax nominal accounts in the company's default nominal accounts.

-

Affects UK VAT Return boxes: 1, 4, 7.

Affects Irish VAT Return boxes: T1, T2, PA1.

Reverse charge VAT

Reverse charge VAT is a term that covers the following scenarios:

-

Accounting for VAT as a reverse charge on services supplied to a UK business from abroad.

-

Accounting for VAT as a reverse charge on goods or services supplied to an Irish or Northern Irish business from an EU business.

- Accounting for VAT as a domestic reverse charge to prevent fraud in trade between businesses within the UK centres. This is known as carousel fraud or missing trader intra community (MTIC) fraud.

- Accounting for VAT for the Construction Industry Scheme (CIS) in the UK.

You set up VAT rates differently for each of these scenarios.

For more information on each type of reverse charge VAT, see:

- Accounting for VAT as a reverse charge when acquiring goods and services from EU suppliers (Ireland and Northern Ireland).

- Accounting for VAT as a reverse charge when acquiring services from abroad (UK only).

- Domestic reverse charge VAT rates for preventing carousel fraud in the UK.

- Reverse charge VAT rates for the CIS (UK only).

Accounting for VAT as a reverse charge when acquiring services from abroad (UK only)

This information describes accounting for reverse charge VAT in the UK for services from overseas suppliers.

See HMRC: Paying VAT on imports, acquisitions and purchases from abroad (opens in a new tab).

When you buy services from suppliers in other countries, you may have to account for the VAT yourself using the reverse charge procedure (also known as tax shift).

Set up this VAT rate

-

If you're using Sage 200 Professional 2020 R2 onwards, a VAT rate Purchase Services ROW (Reverse Charge) will be set up for you in any new companies that you set up. If you have an existing company that doesn't have this VAT rate, you can set it up by selecting Create Import/Export VAT Rates. See Add new VAT rate codes after the Brexit transition.

-

If you're using a version of Sage 200 Professional before 2020 R2, you'll need to manually set up this VAT rate.

To set up a VAT rate for this reverse charge:

-

Create a VAT rate, with Terms set to Purchase Non-Related Services.

Code

Name

VAT Return

Terms

%

Enter a unique code. Enter a unique name. Select the VAT Return box. Select Purchase Non-Related Services. Enter your local tax rate (20%).

- Specify Input Code and Output Code nominal accounts, if you want to override the Default VAT Input and Default VAT Output tax nominal accounts in the company's default nominal accounts.

- Set up the supplier's account details with the relevant country code and their VAT registration number and default VAT rate.

-

Apply the VAT rate you have set up to appropriate suppliers (outside the UK).

-

Purchase Non-Related Services: On the UK VAT Return, the value of the VAT appears in both boxes 1 and 4, and the value of the goods in boxes 6 and 7.

The reverse charge VAT on your own VAT Return effectively charges you VAT on the goods.

Note: No nominal postings for VAT are made as the VAT element of the transaction is notional; it is self-cancelling.

-

Domestic reverse charge VAT rates for preventing carousel fraud in the UK

This information describes how you set up rates to apply reverse charge VAT to prevent carousel fraud in the UK.

See HMRC: Domestic reverse charge procedure (VAT Notice 735) (opens in a new tab).

When you are trading in specified electronic devices (such as mobile telephones and computer chips) in the UK with another UK business and the value of your trade exceeds £5000 for a UK VAT registered customer, you should set up VAT rates to prevent carousel fraud. These VAT rates have not been set up for you.

Set up this VAT rate

To set up a reverse charge VAT rate for carousel fraud:

-

Create two VAT rates, with Terms set to Reverse charge sales (Mobiles) and Reverse charge purchases (Mobiles).

Code

Name

VAT Return

Terms

%

Enter a unique code. Enter a unique name. Select the VAT Return box. Select Reverse charge sales (Mobiles). Enter your local tax rate (20%).

Enter a unique code. Enter a unique name. Select the VAT Return box. Select Reverse charge purchases (Mobiles). Enter your local tax rate (20%).

- Specify Input Code and Output Code nominal accounts, if you want to override the Default VAT Input and Default VAT Output tax nominal accounts in the company's default nominal accounts.

- Ensure that appropriate product groups in Stock Control have Use reverse charge VAT rules enabled. These product groups should be used for all stock items that fall under the reverse charge VAT rules for preventing carousel fraud.

- For each relevant stock item, enable Use reverse charge VAT rules on the stock item Analysis tab.

- Open SOP Settings, go the Invoice Printing tab, then select Apply domestic reverse charge VAT rules when printing invoice.

Reverse charge VAT rates for the CIS (UK only)

As of March 2021, those working in the UK's construction industry might have to handle and pay VAT in a different way following the introduction of the new VAT reverse charge system for the Construction Industry Scheme (CIS).

For supplies of certain specified construction services, the customer will be liable to account to HMRC for the VAT for these purchases instead of the supplier. The reverse charge will include goods, where those goods are supplied with the specified services.

- For full compliance with the CIS, you will need to use a third-party CIS module for Sage 200.

- CIS is only applicable for companies in the UK, and not Ireland.

- The start date for this change to the CIS has been delayed to March 2021 (from October 2020).

For more information, see:

- CIS reverse charge - common questions.

- HMRC: VAT - reverse charge for building and construction services (opens in a new tab).

Set up this VAT rate

If you buy or sell construction services that are affected by the CIS, you should set up reverse charge VAT rates for the CIS.

These VAT rates have not been set up for you. To set them up:

-

Set the VAT rate Terms to CIS Reverse charge sales or CIS Reverse charge purchases.

Typically you might set up four VAT rates, for sales at 5% and 20%, and purchases at 5% and 20%.

Code

Name

VAT Return

Terms

%

Enter a unique code. Enter a unique name. Select the VAT Return box. Select CIS Reverse charge sales. Enter your local tax rate, for example 5% or 20%.

Enter a unique code. Enter a unique name. Select the VAT Return box. Select CIS Reverse charge purchases. Enter your local tax rate, for example 5% or 20%.

- Specify Input Code and Output Code nominal accounts, if you want to override the Default VAT Input and Default VAT Output tax nominal accounts in the company's default nominal accounts.

What happens when I use a CIS reverse charge VAT rate?

-

The tax rates are used for accumulating values for the CIS reverse charges on the VAT Return.

- CIS Reverse charge sales affects box 6 of the UK VAT return, and has no effect on the Irish VAT return.

- CIS Reverse charge purchases affects boxes 1, 4, 7 of the UK VAT return, and T1 and T2 of the Irish VAT return.

-

When you print invoices and credit notes that contain items using the CIS reverse charge VAT rates, a message will added to the footer of the document to indicate that a reverse charge is applicable. The HMRC recommends that this text is included on invoices and credit notes that are eligible for CIS reverse charge VAT.

You can select the message to display on the Invoice Printing tab in Invoicing Settings or SOP Settings. See Invoice printing.

-

When you enter a sales order, invoice, or a bill, the items cannot contain a combination of VAT rates used for CIS reverse charges with any other VAT rate above 0% (zero).

If you try to use this combination of VAT rates, you'll see the warning: This document can't contain items that use this combination of VAT rates. The VAT rates for CIS can't be used in combination with any other VAT rate that is above 0% (zero).

- If you have customer accounts that are set up to use consolidated billing, separate invoices will be produced to group orders that use CIS reverse charge VAT rates and any other VAT rate that is above 0% (zero).

Tip: For customers or suppliers in the CIS, it's a good idea to set their account to use a CIS VAT rate by default. To do this, set the Default VAT code on their account Trading tab.

Low Value Import Scheme

Imports into Great Britain from outside the UK not exceeding £135 in value will be subject to new VAT rules.

If you are processing under the Low Value Import Scheme, you should create a new VAT rate.

See the following articles:

For further guidance, see HMRC: Changes to VAT treatment of overseas goods sold to customers from 1 January 2021 (opens in a new tab).

Notional VAT effects on order and invoice totals

Notional VAT is tax that should be declared on invoices, but is not payable, nor can be claimed back.

Notional VAT rates use these Terms:

- Purchase Goods & Related Services.

- Purchase Non-Related Services.

-

Import Goods ROW - Postponed VAT.

- Reverse Charge Purchases (Mobiles).

- Reverse Charge Sales (Mobiles).

- CIS Reverse Charge Sales.

- CIS Reverse Charge Purchases.

When you use notional VAT rates on orders and invoices, this will affect the VAT, Gross, and order/invoice Total as follows:

-

Sales invoices and purchase invoices (entered directly)

For sales invoices that you enter to the Sales Ledger, and purchase invoices that you enter to the Purchase Ledger, the notional VAT values are not included in the Invoice total.

- The VAT value you enter will not include VAT for notional VAT rates.

-

The Invoice total value will not include VAT values that are for notional tax rates.

Note: The invoice document will show the VAT analysis with the actual VAT value.

- For example, you enter a sales invoice that has a Goods Value of £100, and a VAT value of £20 for a notional VAT rate of 20%. The Invoice total will be £100 rather than £120, as the total doesn't include the £20 VAT for the VAT rate.

-

Sales orders and purchase orders

For sales orders and purchase orders, the notional VAT values are not included in the order's Gross total.

- The VAT total value will include all VAT totals, including notional VAT rates.

-

The Gross total value will not include values that are for notional VAT rates.

-

For example, you enter a purchase order for an item that has a Goods value of £100, and a VAT value of £20 for a notional VAT rate of 20%. In the order's Totals you will see a Net value of £100, a VAT value of £20, but a Gross value of £100 rather than £120. As the VAT rate is notional, it is not included in the order's Gross value.

-

Purchase invoices recorded from purchase orders

For purchase invoices that you record for a purchase order, the notional VAT values are includes in the Invoice total.

- The VAT value total should include the order's VAT value for notional VAT rates, so VAT value on the invoice may be different (higher) than what you see on the corresponding purchase order.

-

The Invoice total displayed will also include the notional VAT value, so this may also be different to the total value of the corresponding purchase order. However, this Invoice total amount is not posted to Sage 200, the actual value posted will not include VAT for the notional VAT rates.

Note: The invoice document will show the VAT analysis with the actual VAT value.

- For example, if we record an invoice for an order with a Goods value of £100, and a VAT value of £20 for a notional VAT rate of 20%. In the invoice's totals, you would enter a Goods value of £100, and a VAT value of £20 (rather than £0, which is displayed on the order). This will result in an Invoice total of £120. However, when you continue to post and save the invoice, the Invoice total will be £100, as it does not include the notional VAT amount.

Sage is providing this article for organisations to use for general guidance. Sage works hard to ensure the information is correct at the time of publication and strives to keep all supplied information up-to-date and accurate, but makes no representations or warranties of any kind—express or implied—about the ongoing accuracy, reliability, suitability, or completeness of the information provided.

The information contained within this article is not intended to be a substitute for professional advice. Sage assumes no responsibility for any action taken on the basis of the article. Any reliance you place on the information contained within the article is at your own risk. In using the article, you agree that Sage is not liable for any loss or damage whatsoever, including without limitation, any direct, indirect, consequential or incidental loss or damage, arising out of, or in connection with, the use of this information.